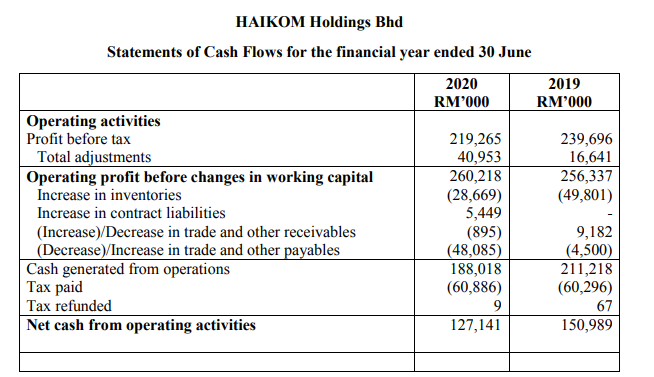

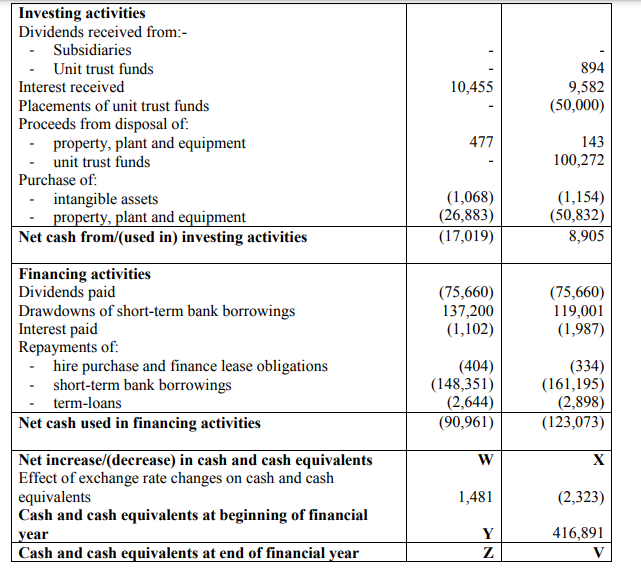

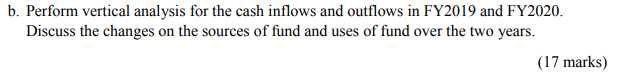

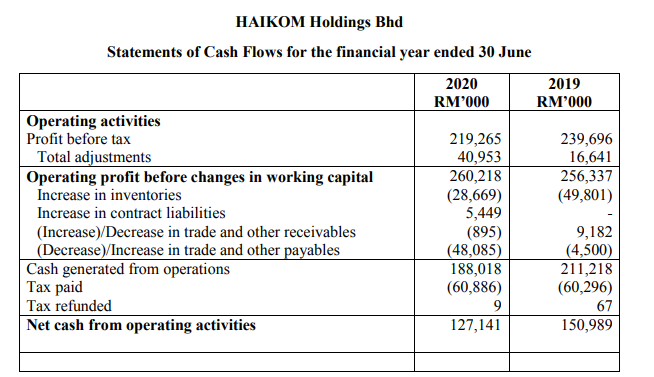

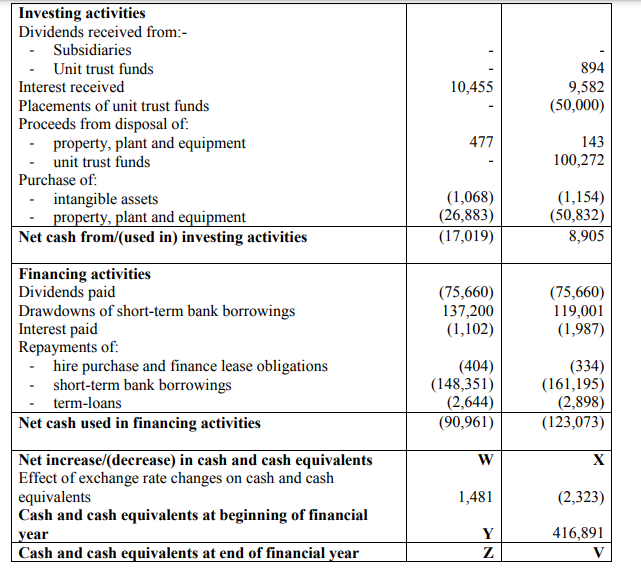

HAIKOM Holdings Bhd Statements of Cash Flows for the financial year ended 30 June 2020 2019 RM'000 RM'000 Operating activities Profit before tax 219,265 239,696 Total adjustments 40,953 16,641 Operating profit before changes in working capital 260,218 256,337 Increase in inventories (28,669) (49,801) Increase in contract liabilities 5,449 (Increase)/Decrease in trade and other receivables (895) 9,182 (Decrease)/Increase in trade and other payables (48,085) (4,500) Cash generated from operations 188,018 211,218 Tax paid (60,886) (60,296) Tax refunded 9 67 Net cash from operating activities 127,141 150,989 10,455 894 9,582 (50,000) Investing activities Dividends received from:- Subsidiaries Unit trust funds Interest received Placements of unit trust funds Proceeds from disposal of: property, plant and equipment - unit trust funds Purchase of intangible assets property, plant and equipment Net cash from/(used in) investing activities 477 143 100,272 (1,068) (26,883) (17,019) (1,154) (50,832) 8,905 (75,660) 137,200 (1,102) (75,660) 119,001 (1,987) Financing activities Dividends paid Drawdowns of short-term bank borrowings Interest paid Repayments of hire purchase and finance lease obligations short-term bank borrowings term-loans Net cash used in financing activities (404) (148,351) (2,644) (90,961) (334) (161,195) (2,898) (123,073) W X Net increase/(decrease) in cash and cash equivalents Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents at beginning of financial 1,481 (2,323) year 416,891 Y z Cash and cash equivalents at end of financial year b. Perform vertical analysis for the cash inflows and outflows in FY2019 and FY2020. Discuss the changes on the sources of fund and uses of fund over the two years. (17 marks) HAIKOM Holdings Bhd Statements of Cash Flows for the financial year ended 30 June 2020 2019 RM'000 RM'000 Operating activities Profit before tax 219,265 239,696 Total adjustments 40,953 16,641 Operating profit before changes in working capital 260,218 256,337 Increase in inventories (28,669) (49,801) Increase in contract liabilities 5,449 (Increase)/Decrease in trade and other receivables (895) 9,182 (Decrease)/Increase in trade and other payables (48,085) (4,500) Cash generated from operations 188,018 211,218 Tax paid (60,886) (60,296) Tax refunded 9 67 Net cash from operating activities 127,141 150,989 10,455 894 9,582 (50,000) Investing activities Dividends received from:- Subsidiaries Unit trust funds Interest received Placements of unit trust funds Proceeds from disposal of: property, plant and equipment - unit trust funds Purchase of intangible assets property, plant and equipment Net cash from/(used in) investing activities 477 143 100,272 (1,068) (26,883) (17,019) (1,154) (50,832) 8,905 (75,660) 137,200 (1,102) (75,660) 119,001 (1,987) Financing activities Dividends paid Drawdowns of short-term bank borrowings Interest paid Repayments of hire purchase and finance lease obligations short-term bank borrowings term-loans Net cash used in financing activities (404) (148,351) (2,644) (90,961) (334) (161,195) (2,898) (123,073) W X Net increase/(decrease) in cash and cash equivalents Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents at beginning of financial 1,481 (2,323) year 416,891 Y z Cash and cash equivalents at end of financial year b. Perform vertical analysis for the cash inflows and outflows in FY2019 and FY2020. Discuss the changes on the sources of fund and uses of fund over the two years. (17 marks)