Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Halcyon Lines is considering the purchase of a new bulk carrier for $8.7 million. The forecasted revenues are $5.7 million a year and operating

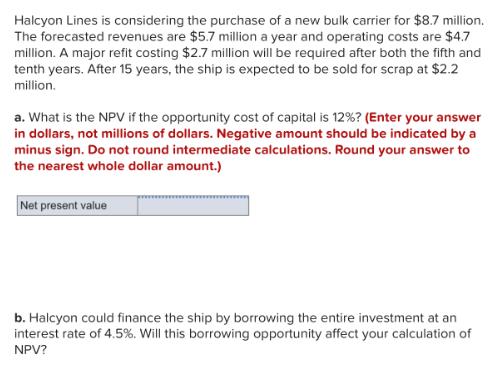

Halcyon Lines is considering the purchase of a new bulk carrier for $8.7 million. The forecasted revenues are $5.7 million a year and operating costs are $4.7 million. A major refit costing $2.7 million will be required after both the fifth and tenth years. After 15 years, the ship is expected to be sold for scrap at $2.2 million. a. What is the NPV if the opportunity cost of capital is 12%? (Enter your answer in dollars, not millions of dollars. Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) Net present value b. Halcyon could finance the ship by borrowing the entire investment at an interest rate of 4.5%. Will this borrowing opportunity affect your calculation of NPV?

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the NPV we need to discount the future cash flows at the opportunity cost of capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started