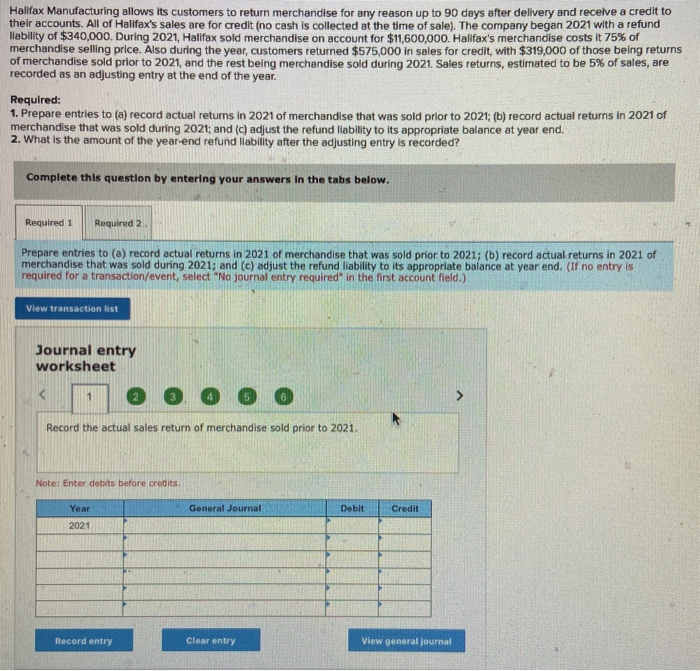

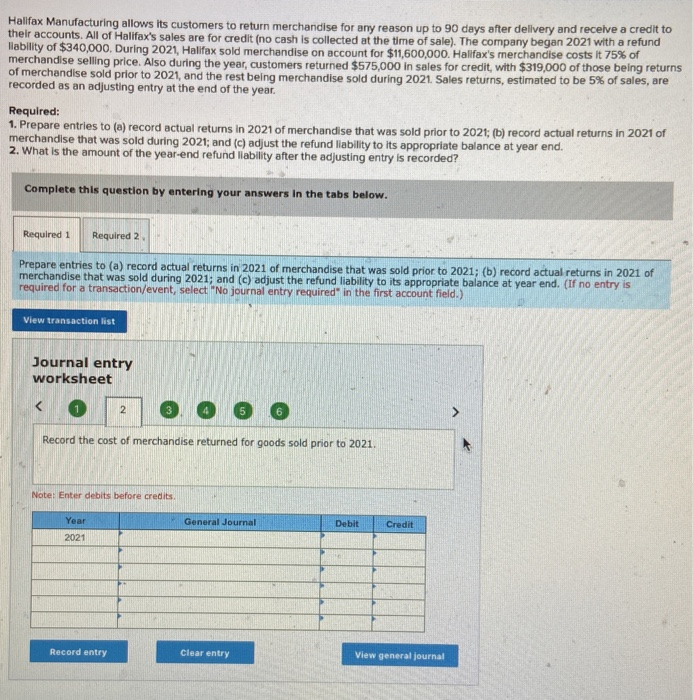

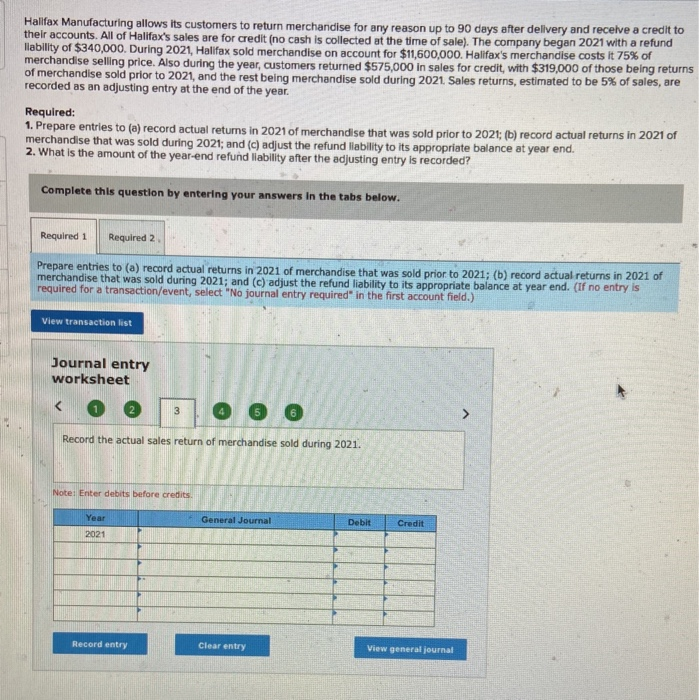

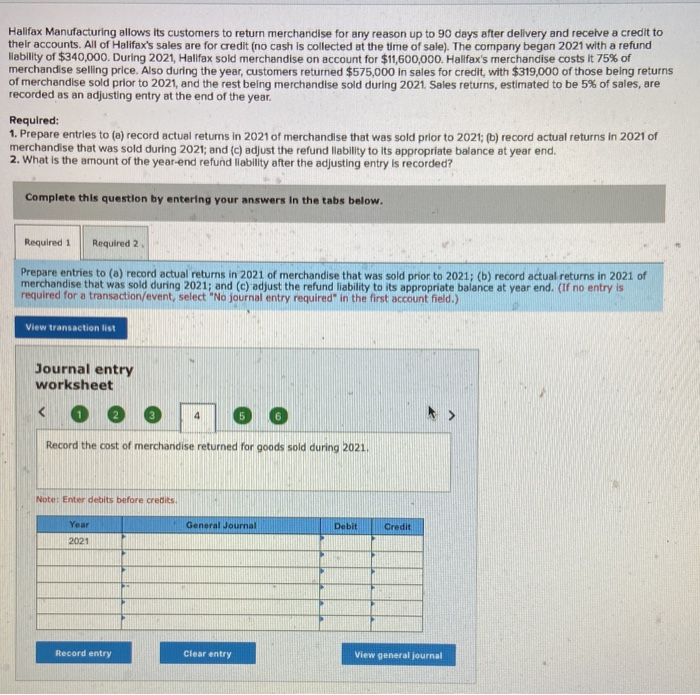

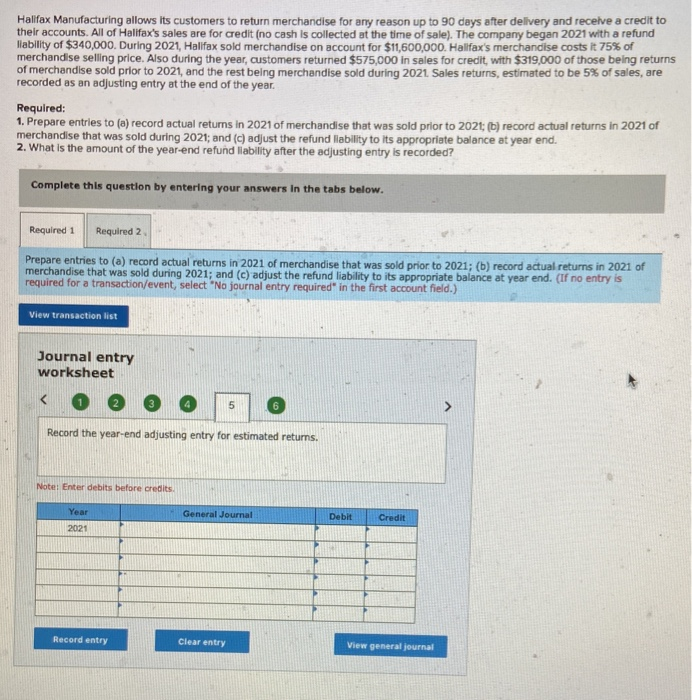

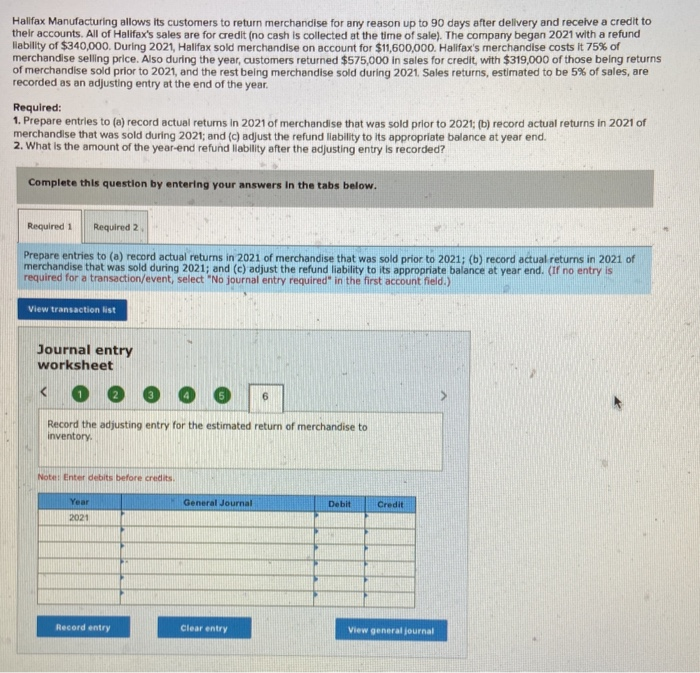

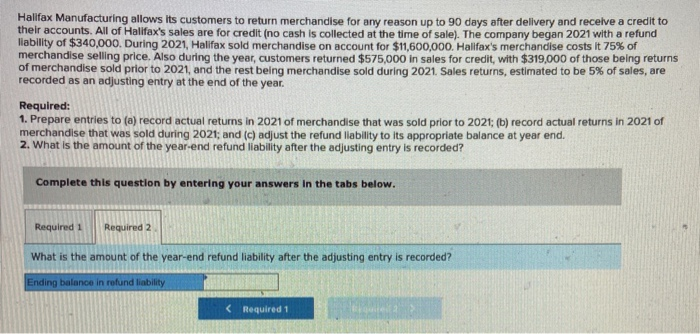

Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after dellvery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2021 with a refund Hability of $340,000. During 2021, Halifax sold merchandise on account for $11,600,000. Halifax's merchandise costs it 75% of merchandise selling price. Also during the year, customers returned $575.000 in sales for credit with $319,000 of those being returns of merchandise sold prior to 2021, and the rest being merchandise sold during 2021. Sales returns, estimated to be 5% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual returns in 2021 of merchandise that was sold prior to 2021; (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare entries to (a) record actual returns in 2021 of merchandise that was sold prior to 2021; (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 6. O o Record the actual sales return of merchandise sold prior to 2021. Note: Enter debits before credits. Year General Journal Debit Credit 2021 Record entry Clear entry View general Journal Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of salel. The company began 2021 with a refund Tiability of $340,000. During 2021, Halifax sold merchandise on account for $11.600.000. Halifax's merchandise costs It 75% of merchandise selling price. Also during the year, customers returned $575,000 in sales for credit with $319,000 of those being returns of merchandise sold prior to 2021, and the rest being merchandise sold during 2021. Sales returns, estimated to be 5% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual returns in 2021 of merchandise that was sold prior to 2021: (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare entries to (a) record actual returns in 2021 of merchandise that was sold prior to 2021; (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 0 2 0 0 6 0 Record the cost of merchandise returned for goods sold prior to 2021. Note: Enter debits before credits Year General Journal Debit Credit 2021 Record entry Clear entry View general journal Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after dellvery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2021 with a refund Mability of $340,000. During 2021, Halifax sold merchandise on account for $11,600,000. Halifax's merchandise costs It 75% of merchandise selling price. Also during the year, customers returned $575,000 in sales for credit, with $319,000 of those being returns of merchandise sold prior to 2021, and the rest being merchandise sold during 2021. Sales returns, estimated to be 5% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual retums in 2021 of merchandise that was sold prior to 2021: (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare entries to (a) record actual returns in 2021 of merchandise that was sold prior to 2021: (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 Record the cost of merchandise returned for goods sold during 2021. Note: Enter debits before credits General Journal Debit Credit 2021 Record entry Clear entry View general journal Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2021 with a refund lability of $340,000. During 2021, Halifax sold merchandise on account for $11,600,000. Halifax's merchandise costs it 75% of merchandise selling price. Also during the year, customers returned $575,000 in sales for credit with $319,000 of those being returns of merchandise sold prior to 2021, and the rest being merchandise sold during 2021 Sales returns, estimated to be 5% of sales, are recorded as an adjusting entry at the end of the year Required: 1. Prepare entries to (a) record actual returns in 2021 of merchandise that was sold prior to 2021; (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare entries to (a) record actual returns in 2021 of merchandise that was sold prior to 2021; (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 05 Record the year-end adjusting entry for estimated returns. Note: Enter debits before credits Year General Journal it Credit Record entry Clear entry View general journal Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2021 with a refund liability of $340,000. During 2021, Halifax sold merchandise on account for $11.600.000. Halifax's merchandise costs it 75% of merchandise selling price. Also during the year, customers returned $575.000 in sales for credit with $319,000 of those being returns of merchandise sold prior to 2021, and the rest being merchandise sold during 2021. Sales returns, estimated to be 5% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual returns in 2021 of merchandise that was sold prior to 2021: (b) record actual returns in 2021 of merchandise that was sold during 2021; and (c) adjust the refund liability to its appropriate balance at year end. 2. What is the amount of the year-end refund liability after the adjusting entry is recorded? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the amount of the year-end refund liability after the adjusting entry is recorded? Ending balance in refund liability