Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hall, Incorporated manufactures two components, Standard and Ultra, that are designed for the same function, but are made of different metals for operational performance

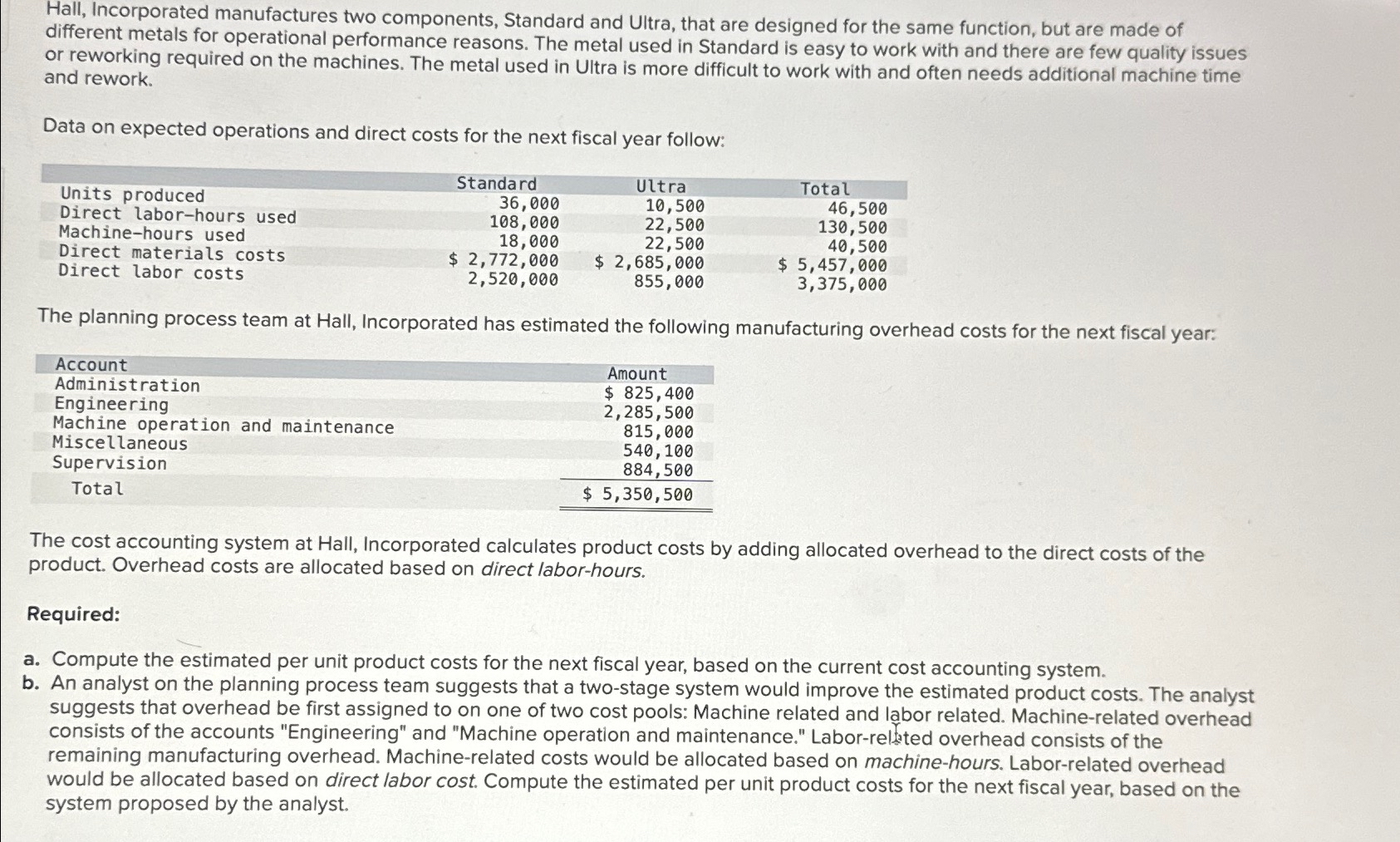

Hall, Incorporated manufactures two components, Standard and Ultra, that are designed for the same function, but are made of different metals for operational performance reasons. The metal used in Standard is easy to work with and there are few quality issues or reworking required on the machines. The metal used in Ultra is more difficult to work with and often needs additional machine time and rework. Data on expected operations and direct costs for the next fiscal year follow: Units produced Direct labor-hours used Machine-hours used Direct materials costs Direct labor costs Standard 36,000 108,000 18,000 Ultra 10,500 22,500 22,500 Total 46,500 130,500 40,500 $ 2,772,000 2,520,000 $ 2,685,000 855,000 $ 5,457,000 3,375,000 The planning process team at Hall, Incorporated has estimated the following manufacturing overhead costs for the next fiscal year: Account Amount Administration Engineering $ 825,400 2,285,500 Machine operation and maintenance Miscellaneous Supervision Total 815,000 540,100 884,500 $ 5,350,500 The cost accounting system at Hall, Incorporated calculates product costs by adding allocated overhead to the direct costs of the product. Overhead costs are allocated based on direct labor-hours. Required: a. Compute the estimated per unit product costs for the next fiscal year, based on the current cost accounting system. b. An analyst on the planning process team suggests that a two-stage system would improve the estimated product costs. The analyst suggests that overhead be first assigned to on one of two cost pools: Machine related and labor related. Machine-related overhead consists of the accounts "Engineering" and "Machine operation and maintenance." Labor-related overhead consists of the remaining manufacturing overhead. Machine-related costs would be allocated based on machine-hours. Labor-related overhead would be allocated based on direct labor cost. Compute the estimated per unit product costs for the next fiscal year, based on the system proposed by the analyst.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started