Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Halyard plc is studying the viability of a proposed new division which is due to commence operations on 1 July 2019. This new project

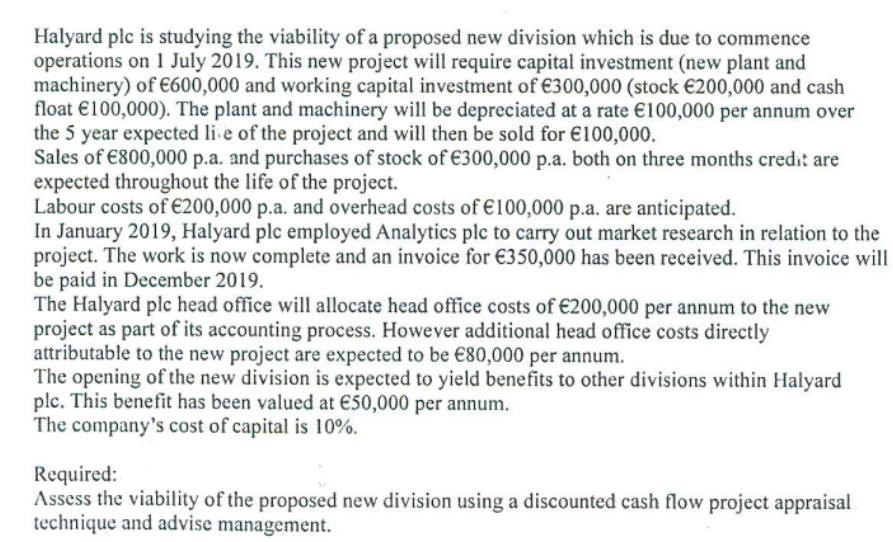

Halyard plc is studying the viability of a proposed new division which is due to commence operations on 1 July 2019. This new project will require capital investment (new plant and machinery) of 600,000 and working capital investment of 300,000 (stock 200,000 and cash float 100,000). The plant and machinery will be depreciated at a rate 100,000 per annum over the 5 year expected live of the project and will then be sold for 100,000. Sales of 800,000 p.a. and purchases of stock of 300,000 p.a. both on three months credit are expected throughout the life of the project. Labour costs of 200,000 p.a. and overhead costs of 100,000 p.a. are anticipated. In January 2019, Halyard plc employed Analytics plc to carry out market research in relation to the project. The work is now complete and an invoice for 350,000 has been received. This invoice will be paid in December 2019. The Halyard plc head office will allocate head office costs of 200,000 per annum to the new project as part of its accounting process. However additional head office costs directly attributable to the new project are expected to be 80,000 per annum. The opening of the new division is expected to yield benefits to other divisions within Halyard plc. This benefit has been valued at 50,000 per annum. The company's cost of capital is 10%. Required: Assess the viability of the proposed new division using a discounted cash flow project appraisal technique and advise management.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The viability of the proposed new division can be assessed using a discounted cash flow project appr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started