Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hamilton, Inc obtained 100% of Tommy Company's common stock on January, 2015, by issuing 20,000 shares of $4 par value common stock. Hamilton shares

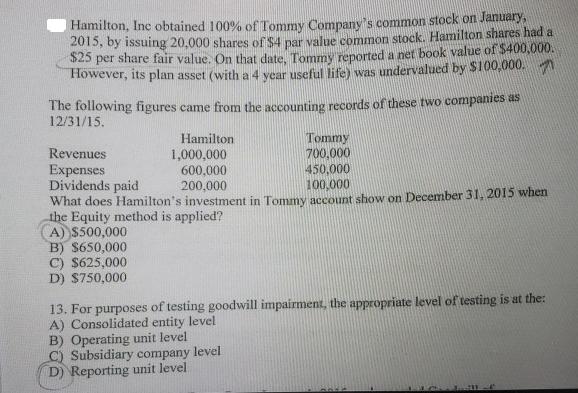

Hamilton, Inc obtained 100% of Tommy Company's common stock on January, 2015, by issuing 20,000 shares of $4 par value common stock. Hamilton shares had a $25 per share fair value. On that date, Tommy reported a net book value of $400,000. However, its plan asset (with a 4 year useful life) was undervalued by $100,000. The following figures came from the accounting records of these two companies as 12/31/15. Hamilton 1,000,000 Tommy 700,000 600,000 450,000 200,000 100,000 What does Hamilton's investment in Tommy account show on December 31, 2015 when the Equity method is applied? A) $500,000 B) $650,000 C) $625,000 D) $750,000 Revenues Expenses Dividends paid 13. For purposes of testing goodwill impairment, the appropriate level of testing is at the: A) Consolidated entity level B) Operating unit level C) Subsidiary company level D) Reporting unit level

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below SOLUTION To determine the value of Hamiltons investment in Tommy Company using the equity method we need to calculate the equity income for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started