Answered step by step

Verified Expert Solution

Question

1 Approved Answer

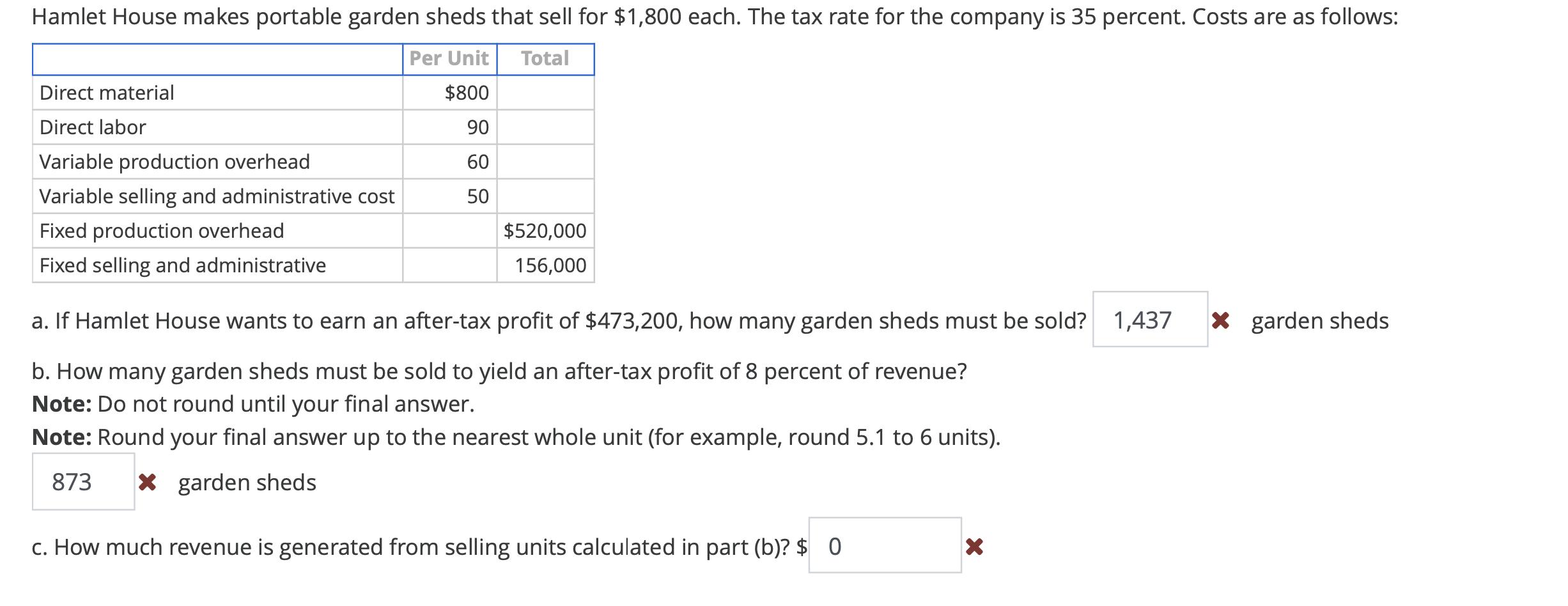

Hamlet House makes portable garden sheds that sell for $1,800 each. The tax rate for the company is 35 percent. Costs are as follows:

Hamlet House makes portable garden sheds that sell for $1,800 each. The tax rate for the company is 35 percent. Costs are as follows: Per Unit Total Direct material $800 Direct labor 90 Variable production overhead 60 Variable selling and administrative cost 50 Fixed production overhead Fixed selling and administrative $520,000 156,000 a. If Hamlet House wants to earn an after-tax profit of $473,200, how many garden sheds must be sold? 1,437 b. How many garden sheds must be sold to yield an after-tax profit of 8 percent of revenue? Note: Do not round until your final answer. Note: Round your final answer up to the nearest whole unit (for example, round 5.1 to 6 units). 873 garden sheds c. How much revenue is generated from selling units calculated in part (b)? $ 0 garden sheds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Given information Selling price per garden shed 1800 Tax rate 35 Aftertax profit target 47320...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started