Answered step by step

Verified Expert Solution

Question

1 Approved Answer

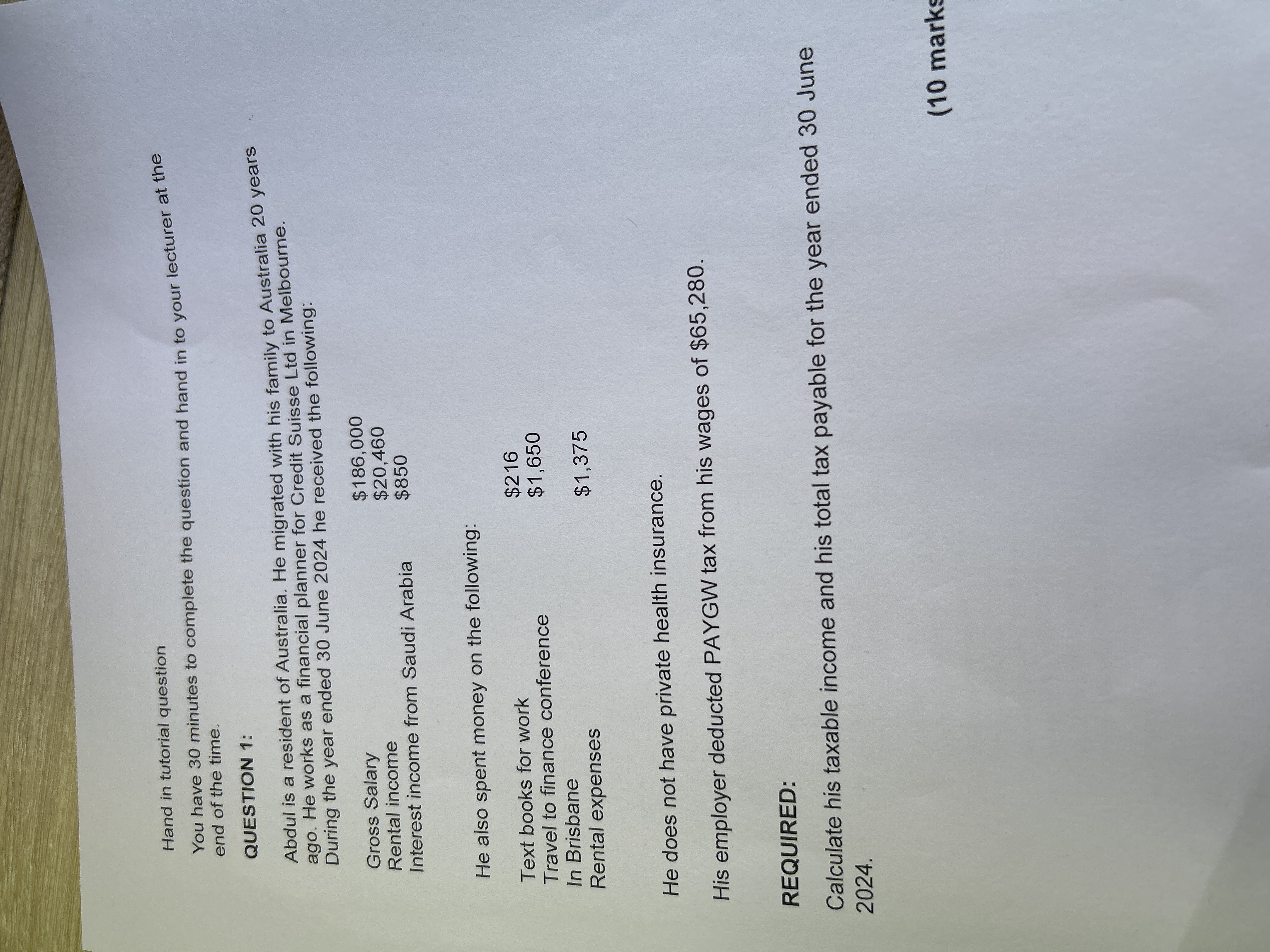

Hand in tutorial question You have 30 minutes to complete the question and hand in to your lecturer at the end of the time.

Hand in tutorial question You have 30 minutes to complete the question and hand in to your lecturer at the end of the time. QUESTION 1: Abdul is a resident of Australia. He migrated with his family to Australia 20 years ago. He works as a financial planner for Credit Suisse Ltd in Melbourne. During the year ended 30 June 2024 he received the following: Gross Salary Rental income $186,000 $20,460 Interest income from Saudi Arabia $850 He also spent money on the following: Text books for work Travel to finance conference In Brisbane Rental expenses $216 $1,650 $1,375 He does not have private health insurance. His employer deducted PAYGW tax from his wages of $65,280. REQUIRED: Calculate his taxable income and his total tax payable for the year ended 30 June 2024. (10 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Abduls taxable income and total tax payable we need to consider his sources of income d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started