Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hand written please not using excel Q4: You are trying to estimate a beta for Jett. The regression beta over the last 5 years is

hand written please not using excel

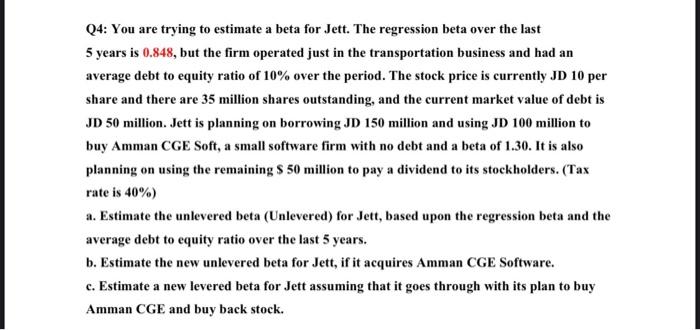

Q4: You are trying to estimate a beta for Jett. The regression beta over the last 5 years is 0.848, but the firm operated just in the transportation business and had an average debt to equity ratio of 10% over the period. The stock price is currently JD 10 per share and there are 35 million shares outstanding, and the current market value of debt is JD 50 million. Jett is planning on borrowing JD 150 million and using JD 100 million to buy Amman CGE Soft, a small software firm with no debt and a beta of 1.30. It is also planning on using the remaining S 50 million to pay a dividend to its stockholders. (Tax rate is 40%) a. Estimate the unlevered beta (Unlevered) for Jett, based upon the regression beta and the average debt to equity ratio over the last 5 years. b. Estimate the new unlevered beta for Jett, if it acquires Amman CGE Software. c. Estimate a new levered beta for Jett assuming that it goes through with its plan to buy Amman CGE and buy back stock Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started