Answered step by step

Verified Expert Solution

Question

1 Approved Answer

* handwriting QUESTION 4 (20 MARKS) Semarak Enterprises is considering a new three-year expansion project and is looking closely at investing in a new machine.

*handwriting

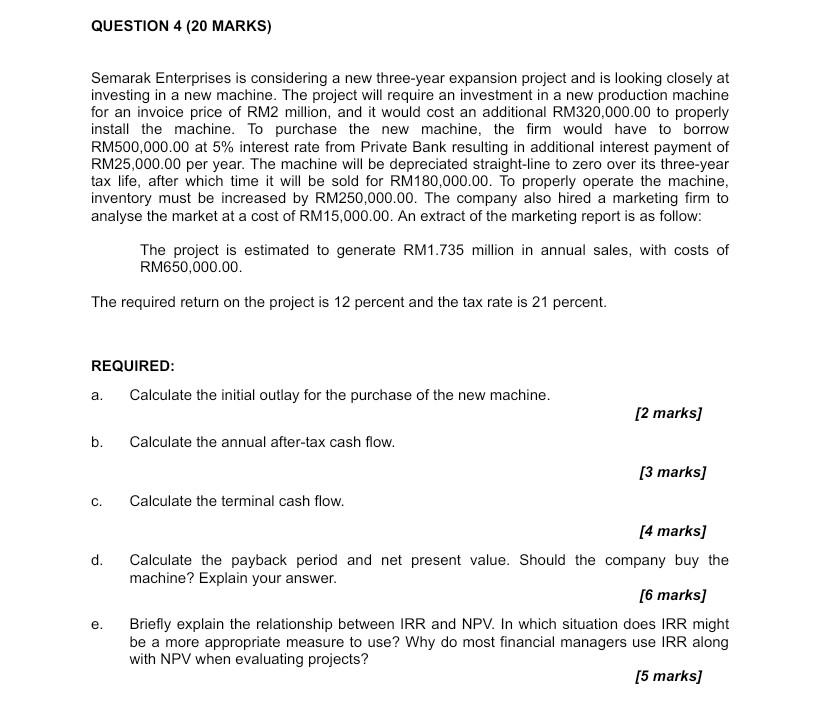

QUESTION 4 (20 MARKS) Semarak Enterprises is considering a new three-year expansion project and is looking closely at investing in a new machine. The project will require an investment in a new production machine for an invoice price of RM2 million, and it would cost an additional RM320,000.00 to properly install the machine. To purchase the new machine, the firm would have to borrow RM500,000.00 at 5% interest rate from Private Bank resulting in additional interest payment of RM25,000.00 per year. The machine will be depreciated straight-line to zero over its three-year tax life, after which time it will be sold for RM180,000.00. To properly operate the machine, inventory must be increased by RM250,000.00. The company also hired a marketing firm to analyse the market at a cost of RM15,000.00. An extract of the marketing report is as follow: The project is estimated to generate RM1.735 million in annual sales, with costs of RM650,000.00 The required return on the project is 12 percent and the tax rate is 21 percent. REQUIRED: Calculate the initial outlay for the purchase of the new machine. a. [2 marks] b. Calculate the annual after-tax cash flow. c. d. [3 marks] Calculate the terminal cash flow. [4 marks] Calculate the payback period and net present value. Should the company buy the machine? Explain your answer. [6 marks] Briefly explain the relationship between IRR and NPV. In which situation does IRR might be a more appropriate measure to use? Why do most financial managers use IRR along with NPV when evaluating projects? [5 marks] eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started