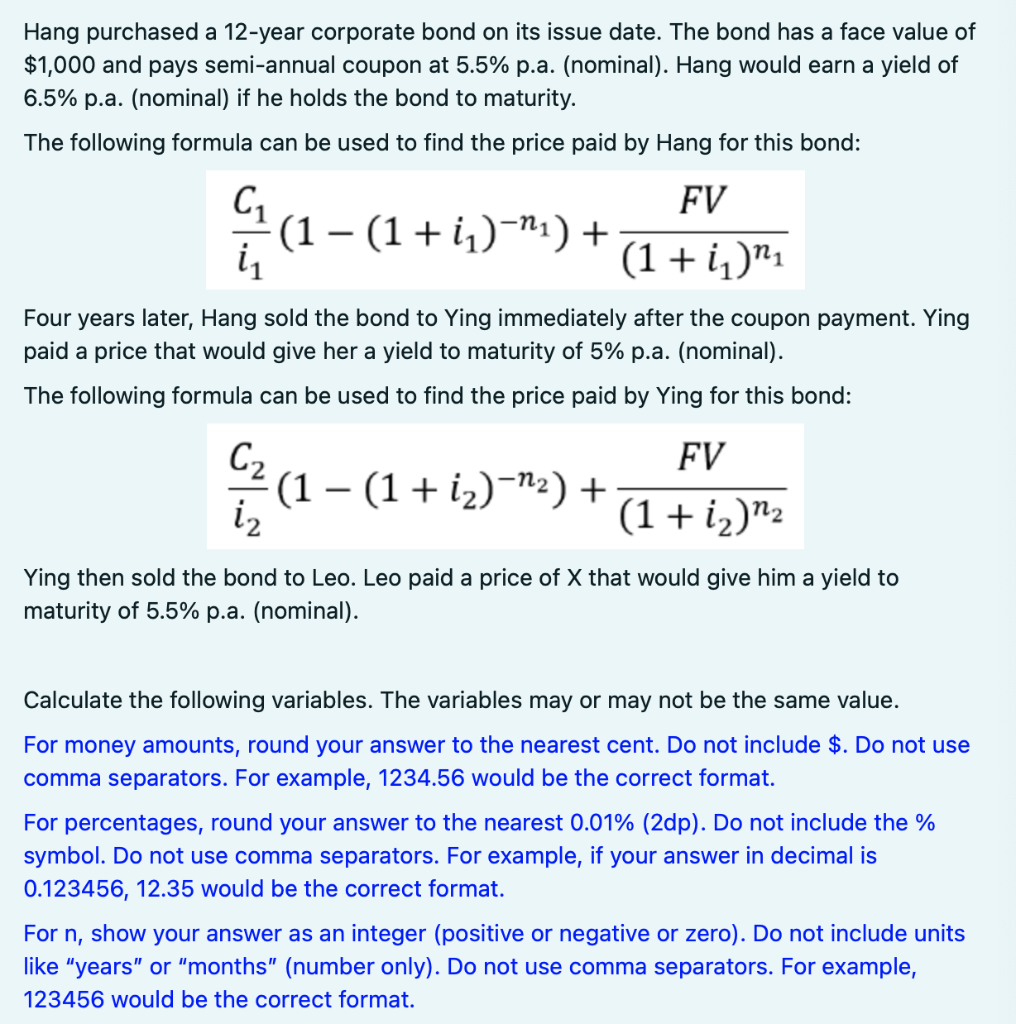

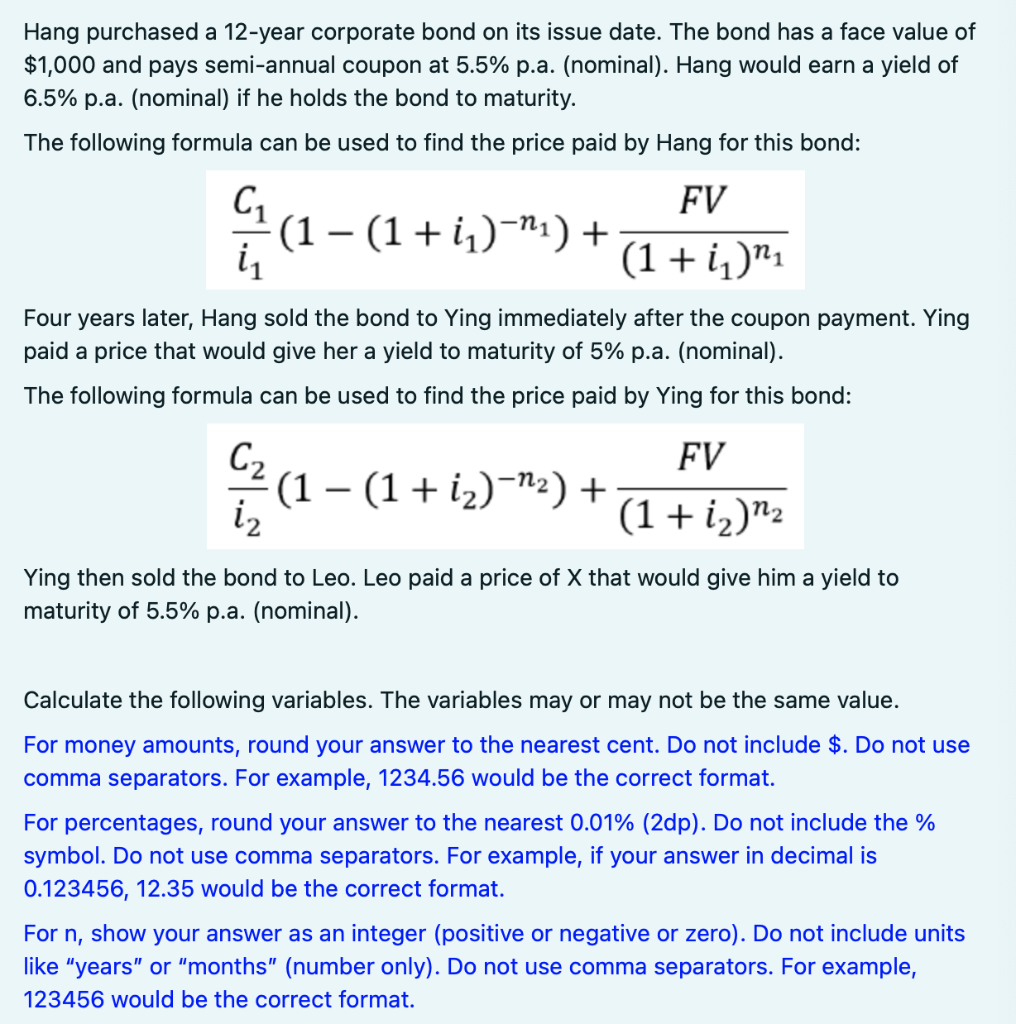

Hang purchased a 12-year corporate bond on its issue date. The bond has a face value of $1,000 and pays semi-annual coupon at 5.5% p.a. (nominal). Hang would earn a yield of 6.5% p.a. (nominal) if he holds the bond to maturity. The following formula can be used to find the price paid by Hang for this bond: FV (1 - (1 + i)-ni + (1 + i])"1 Four years later, Hang sold the bond to Ying immediately after the coupon payment. Ying paid a price that would give her a yield to maturity of 5% p.a. (nominal). The following formula can be used to find the price paid by Ying for this bond: (1- (1 (1 + iz)-n2) + FV (1 + i)^2 Ying then sold the bond to Leo. Leo paid a price of X that would give him a yield to maturity of 5.5% p.a. (nominal). Calculate the following variables. The variables may or may not be the same value. For money amounts, round your answer to the nearest cent. Do not include $. Do not use comma separators. For example, 1234.56 would be the correct format. For percentages, round your answer to the nearest 0.01% (2dp). Do not include the % symbol. Do not use comma separators. For example, if your answer in decimal is 0.123456, 12.35 would be the correct format. For n, show your answer as an integer (positive or negative or zero). Do not include units like "years" or "months" (number only). Do not use comma separators. For example, 123456 would be the correct format. Hang purchased a 12-year corporate bond on its issue date. The bond has a face value of $1,000 and pays semi-annual coupon at 5.5% p.a. (nominal). Hang would earn a yield of 6.5% p.a. (nominal) if he holds the bond to maturity. The following formula can be used to find the price paid by Hang for this bond: FV (1 - (1 + i)-ni + (1 + i])"1 Four years later, Hang sold the bond to Ying immediately after the coupon payment. Ying paid a price that would give her a yield to maturity of 5% p.a. (nominal). The following formula can be used to find the price paid by Ying for this bond: (1- (1 (1 + iz)-n2) + FV (1 + i)^2 Ying then sold the bond to Leo. Leo paid a price of X that would give him a yield to maturity of 5.5% p.a. (nominal). Calculate the following variables. The variables may or may not be the same value. For money amounts, round your answer to the nearest cent. Do not include $. Do not use comma separators. For example, 1234.56 would be the correct format. For percentages, round your answer to the nearest 0.01% (2dp). Do not include the % symbol. Do not use comma separators. For example, if your answer in decimal is 0.123456, 12.35 would be the correct format. For n, show your answer as an integer (positive or negative or zero). Do not include units like "years" or "months" (number only). Do not use comma separators. For example, 123456 would be the correct format