Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hannah is a Tax Senior working for the prestigious tax advisers Arden Taxation UK Ltd . Hannah is going to have a meeting

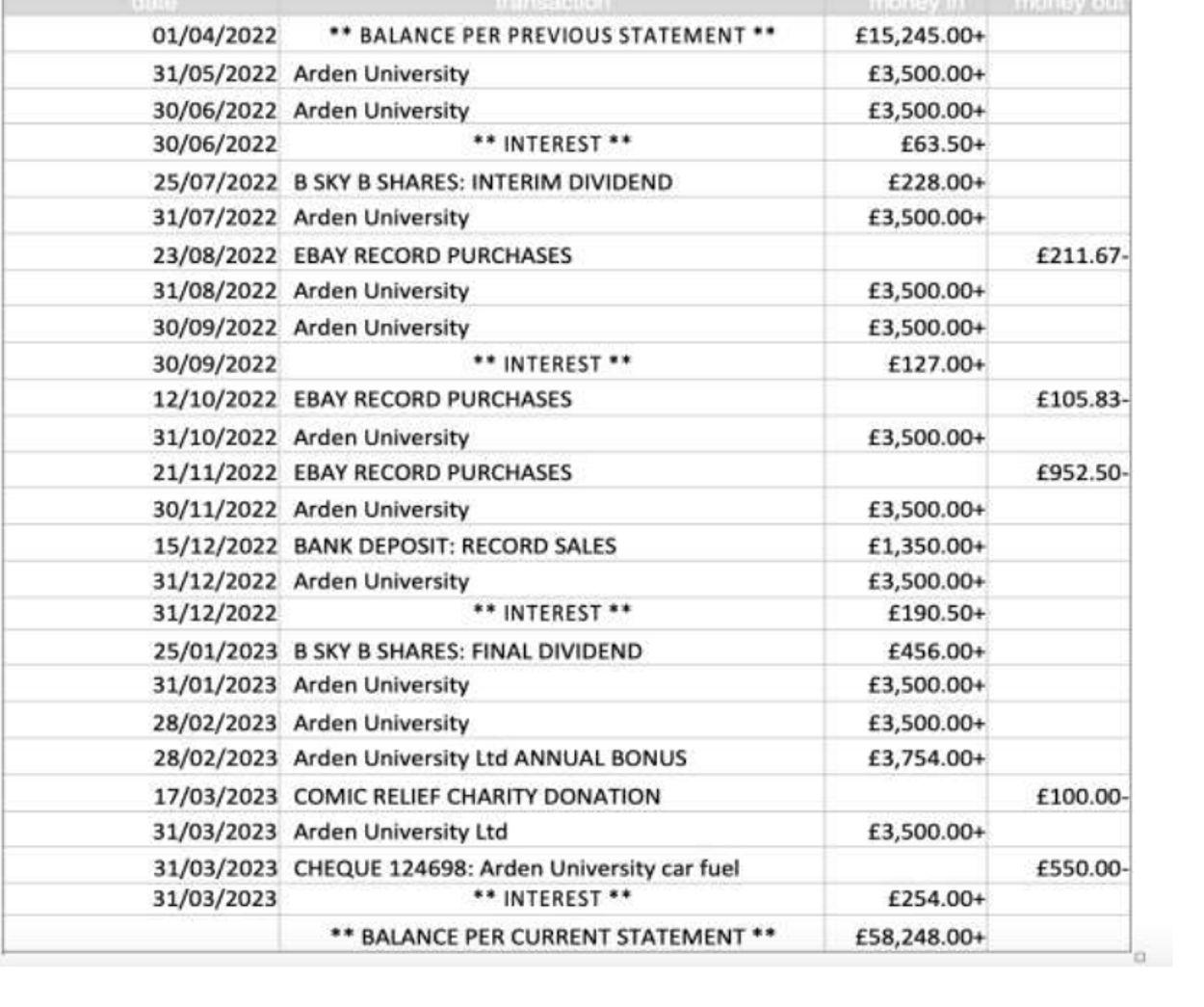

Hannah is a Tax Senior working for the prestigious tax advisers Arden Taxation UK Ltd Hannah is going to have a meeting with one of its clients, Jonathan Matteo. She knows that he is now working as an associate lecturer at Arden University, and he is going to ask Hannahs tax advice.Jonathan sent in advance the following documents for Hannah to analyse before the meeting: The letter from Arden University with the terms and conditions of the contract The bank statement covering April to March Letter from Jonathan Matteo from Arden University February Dear Jonathan, We have great pleasure in offering you the fulltime post as Associate Lecturer at the School of Finance at Arden University commencing on May Your remuneration package from your date of commencement will include a salary of per annum, the full use of a diesel Ford car which the company purchased in January for CO emissions gkm list price The company will pay also pay for of all fuel costs, a mobile phone value capped at and computer for your home use value capped at You will also be part of the companys bonus scheme through which a bonus which will be paid in February. Finally, I understand from our HR department that you would like to contribute of your basic salary to our HMRC registered company pension scheme, this will be matched by a contribution by Arden University. We look forward to welcoming you to our team. Yours sincerely Mr Enrico Director of the SchoolBank Statement EXHIBIT B Bank Statement BANKIN bank.coukMr Jonathan Current Account Account Number Available Balance Sort Code Account Balance Overdraft limit Question Jonathan took the company car offered by Arden University and contributed towards the cost of fuel. In addition, Jonathan took full advantage of the other benefits offered and chose a mobile phone retail price of and laptop retail price Required: What is the total benefit in kind which will appear on Jonathans PD for in respect of these benefits? marks Taking into consideration pensions and benefits, what is Jonathans total employment income for the tax year assuming his bonus has not had PAYE deducted marks Page of Arden University reserves all rights of copyright and all other intellectual property rights in the learning materials and this publication. No part of any of the learning materials or this publication may be reproduced, shared including in private social media groups stored in a retrieval system or transmitted in any form or means, including without limitation electronic, mechanical, photocopying, recording or otherwise, without the prior written consent of Arden University. To find out more about the use and distribution of programme materials please see the Arden Student Terms and Conditions. Jonathan would like you to explain in full any tax advantage he would get from increasing his pension contributions and if there is a cap on the amount he can contribute? marks In Jonathan made a few bulk EBay purchases of vinyl records which he sold in December for a small profit. He is worried because at a party one of his friends said he thought Jonathan would have to pay tax on any profit he makes. Required: Making reference to two Badges of Trade explain the comment made by Jonathan's friend and challenge why it may not be correct. marks Jonathan would like to know if he is deemed to be carrying on a trade with his vinyl record sales, what will happen if the trade makes a loss in how will the loss be treated for tax purposes and will how will he get relief for any losses? marks Jonathan owns shares in B Sky B which have paid two dividends during the year. Jonathan would like you to briefly explain how dividends are taxed in the UK and why they are treated differently from other forms of income. marks Using Jonathans donation to Comic Relief as an example, explain to Jonathan how he will receive tax relief for this gift aid donation and the benefit to the charity Comic Relief. marks Jonathan tells you he has paid tax through PAYE and asks you to calculate any additional income tax he must pay for Required: Using all the information included in the documents provided, and any points already discussed, calculate the additional income tax payable for marksYour calculations should be on the basis that you determined that Jonathan was not carrying on trade with his vinyl EBay sales. What is the deadline for Jonathan to electronically file his personal tax return and before what date must he pay any additional tax due? markstable BALANCE PER PREVIOUS STATEMENT

01/04/2022 ** BALANCE PER PREVIOUS STATEMENT ** 15,245.00+ 31/05/2022 Arden University 3,500.00+ 30/06/2022 Arden University 3,500.00+ 30/06/2022 ** INTEREST ** 63.50+ 25/07/2022 B SKY B SHARES: INTERIM DIVIDEND 228.00+ 31/07/2022 Arden University 3,500.00+ 23/08/2022 EBAY RECORD PURCHASES 211.67- 31/08/2022 Arden University 3,500.00+ 30/09/2022 Arden University 3,500.00+ 30/09/2022 INTEREST ** 127.00+ 12/10/2022 EBAY RECORD PURCHASES 105.83- 31/10/2022 Arden University 3,500.00+ 21/11/2022 EBAY RECORD PURCHASES 952.50- 30/11/2022 Arden University 3,500.00+ 15/12/2022 BANK DEPOSIT: RECORD SALES 1,350.00+ 31/12/2022 Arden University 3,500.00+ 31/12/2022 ** INTEREST 190.50+ 25/01/2023 B SKY B SHARES: FINAL DIVIDEND 456.00+ 31/01/2023 Arden University 3,500.00+ 28/02/2023 Arden University 3,500.00+ 28/02/2023 Arden University Ltd ANNUAL BONUS 3,754.00+ 17/03/2023 COMIC RELIEF CHARITY DONATION 100.00- 31/03/2023 Arden University Ltd 3,500.00+ 31/03/2023 CHEQUE 124698: Arden University car fuel 550.00- 31/03/2023 ** INTEREST ** 254.00+ ** BALANCE PER CURRENT STATEMENT** 58,248.00+

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the answers to Jonathans questions 11 Benefit in kind on company car and other benefits Company car The taxable benefit is calculated as 20 o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started