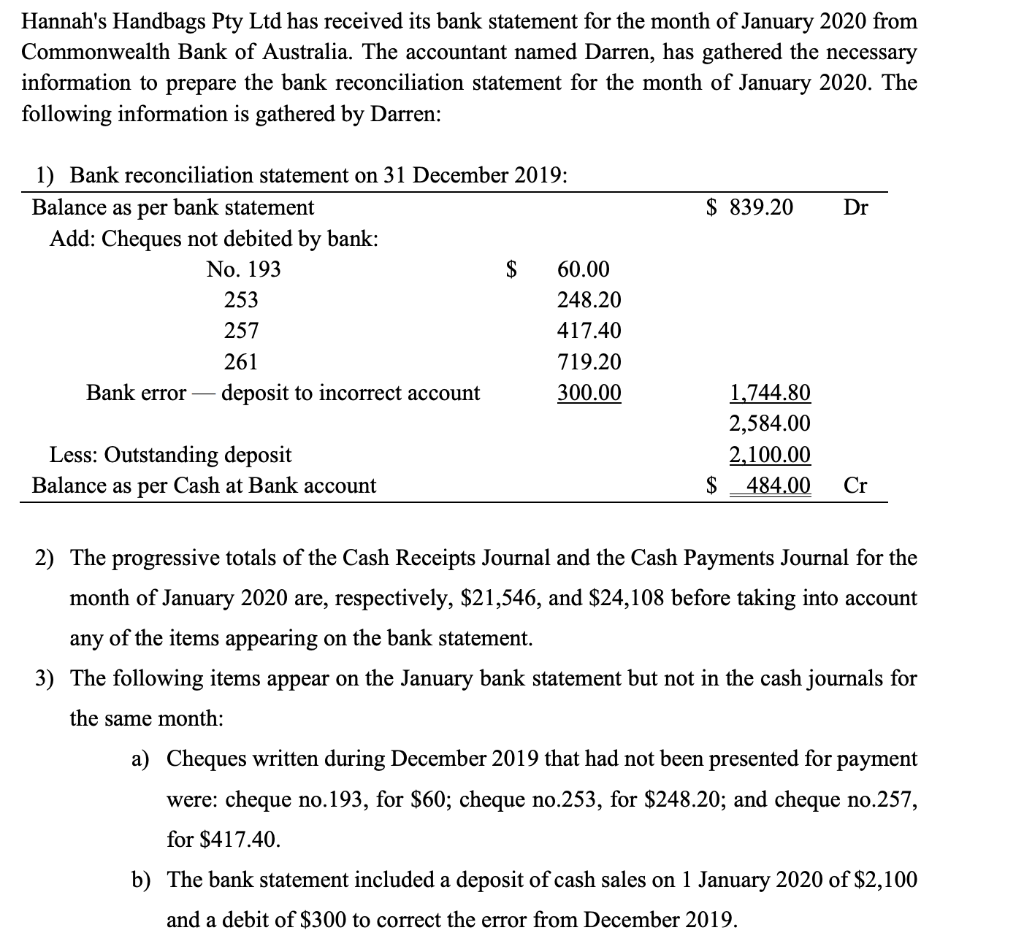

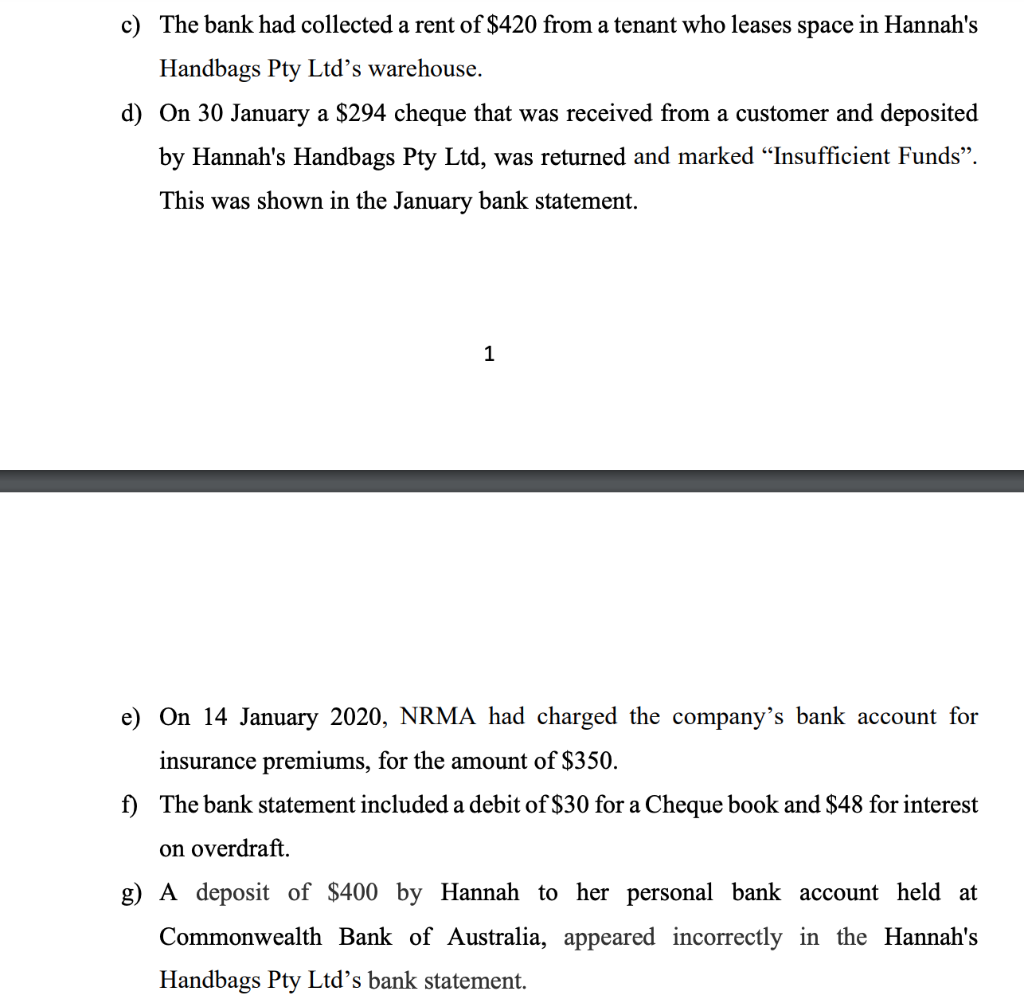

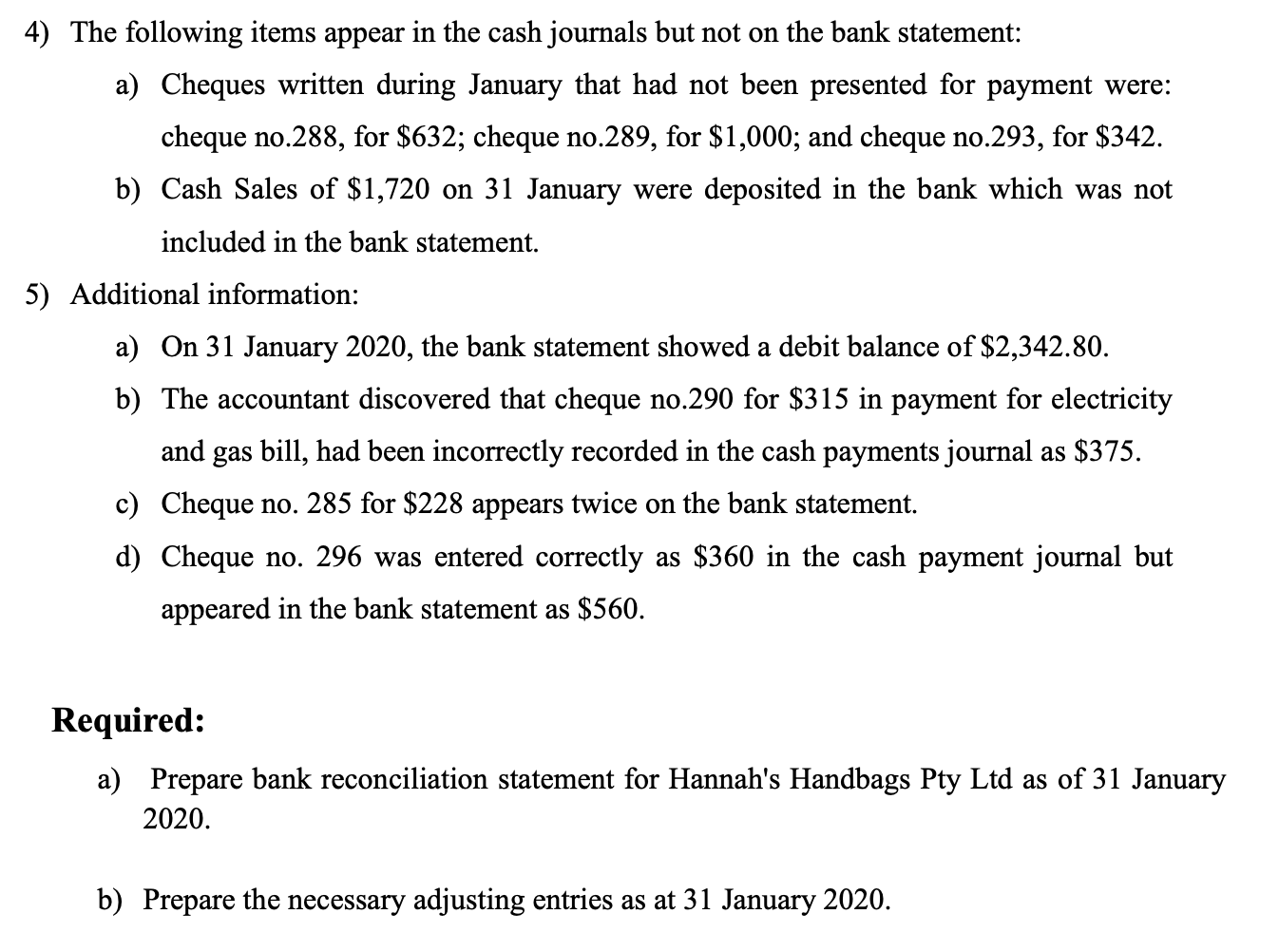

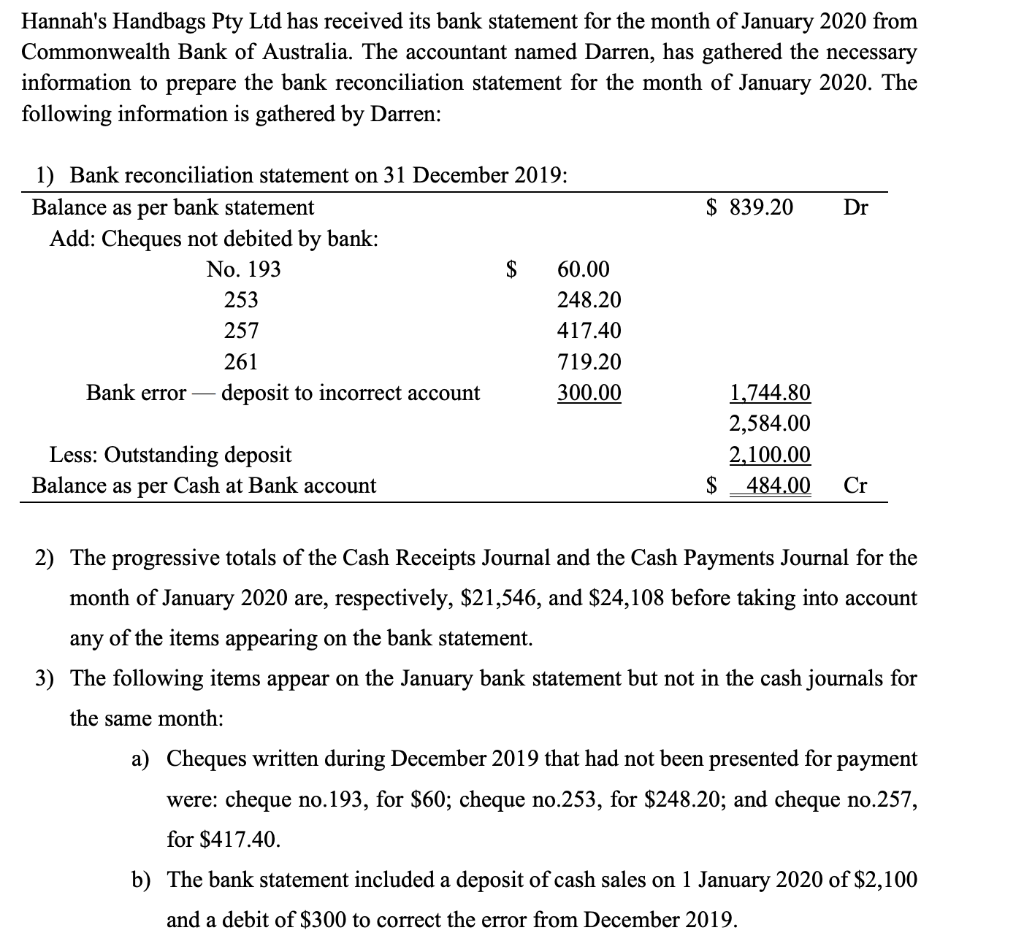

Hannah's Handbags Pty Ltd has received its bank statement for the month of January 2020 from Commonwealth Bank of Australia. The accountant named Darren, has gathered the necessary information to prepare the bank reconciliation statement for the month of January 2020. The following information is gathered by Darren: $ 839.20 Dr 1) Bank reconciliation statement on 31 December 2019: Balance as per bank statement Add: Cheques not debited by bank: No. 193 $ 60.00 253 248.20 257 417.40 261 719.20 Bank error deposit to incorrect account 300.00 1,744.80 2,584.00 2,100.00 484.00 Less: Outstanding deposit Balance as per Cash at Bank account $ Cr 2) The progressive totals of the Cash Receipts Journal and the Cash Payments Journal for the month of January 2020 are, respectively, $21,546, and $24,108 before taking into account any of the items appearing on the bank statement. 3) The following items appear on the January bank statement but not in the cash journals for the same month: a) Cheques written during December 2019 that had not been presented for payment were: cheque no.193, for $60; cheque no.253, for $248.20; and cheque no.257, for $417.40. b) The bank statement included a deposit of cash sales on 1 January 2020 of $2,100 and a debit of $300 to correct the error from December 2019. c) The bank had collected a rent of $420 from a tenant who leases space in Hannah's Handbags Pty Ltd's warehouse. d) On 30 January a $294 cheque that was received from a customer and deposited by Hannah's Handbags Pty Ltd, was returned and marked Insufficient Funds. This was shown in the January bank statement. 1 e) On 14 January 2020, NRMA had charged the company's bank account for insurance premiums, for the amount of $350. f) The bank statement included a debit of $30 for a Cheque book and $48 for interest on overdraft. g) A deposit of $400 by Hannah to her personal bank account held at Commonwealth Bank of Australia, appeared incorrectly in the Hannah's Handbags Pty Ltd's bank statement. 4) The following items appear in the cash journals but not on the bank statement: a) Cheques written during January that had not been presented for payment were: cheque no.288, for $632; cheque no.289, for $1,000; and cheque no.293, for $342. b) Cash Sales of $1,720 on 31 January were deposited in the bank which was not included in the bank statement. 5) Additional information: a) On 31 January 2020, the bank statement showed a debit balance of $2,342.80. b) The accountant discovered that cheque no.290 for $315 in payment for electricity and gas bill, had been incorrectly recorded in the cash payments journal as $375. c) Cheque no. 285 for $228 appears twice on the bank statement. d) Cheque no. 296 was entered correctly as $360 in the cash payment journal but appeared in the bank statement as $560. Required: a) Prepare bank reconciliation statement for Hannah's Handbags Pty Ltd as of 31 January 2020. b) Prepare the necessary adjusting entries as at 31 January 2020