Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hansson needs to evaluate a potential expansion opportunity. You (done individually), as a special consulting team Hansson hires, need to provide a sound recommendation

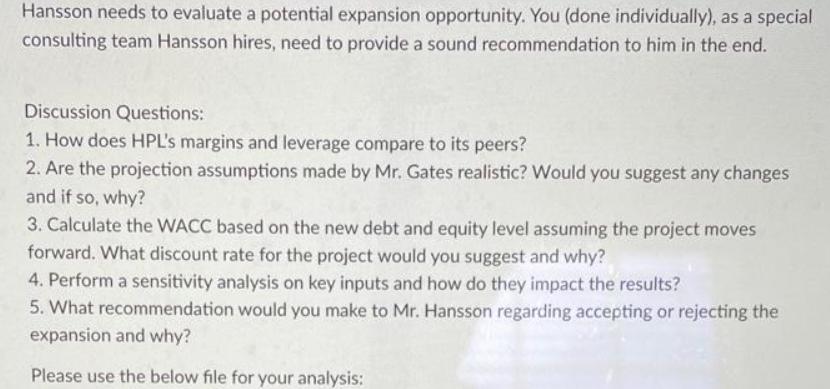

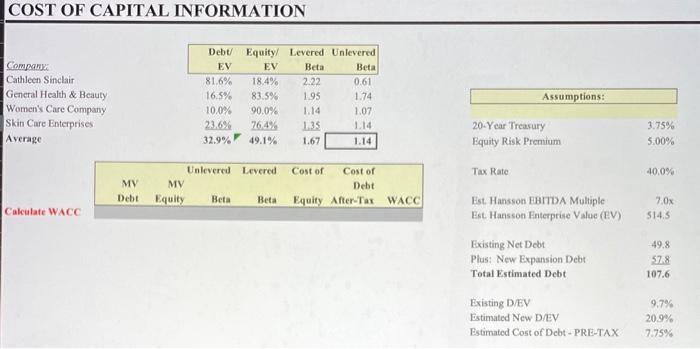

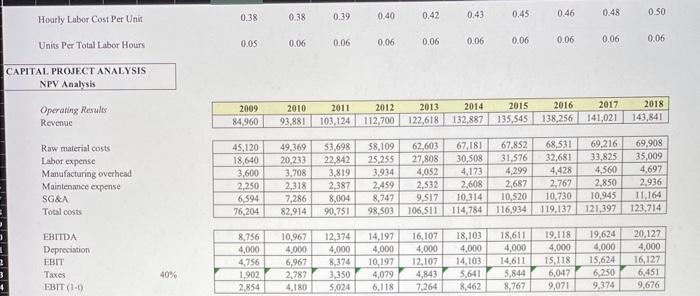

Hansson needs to evaluate a potential expansion opportunity. You (done individually), as a special consulting team Hansson hires, need to provide a sound recommendation to him in the end. Discussion Questions: 1. How does HPL's margins and leverage compare to its peers? 2. Are the projection assumptions made by Mr. Gates realistic? Would you suggest any changes and if so, why? 3. Calculate the WACC based on the new debt and equity level assuming the project moves forward. What discount rate for the project would you suggest and why? 4. Perform a sensitivity analysis on key inputs and how do they impact the results? 5. What recommendation would you make to Mr. Hansson regarding accepting or rejecting the expansion and why? Please use the below file for your analysis: COST OF CAPITAL INFORMATION Company Cathleen Sinclair General Health & Beauty Women's Care Company Skin Care Enterprises Average Calculate WACC Debt EV 81.6% 16.5% 10.0% 23.6% 32.9% Unlevered MV MV Debt Equity Beta Equity/ Levered Unlevered EV Beta 18.4% 83.5% 90.0% 76.4% 49.1% Leveredi 2.22 1.95 1.14 1.35 1.67 Cost of Beta 0.61 1.74 1.07 1.14 1.14 Cost of Debt Beta Equity After-Tax WACC Assumptions: 20-Year Treasury Equity Risk Premium Tax Rate Est. Hansson EBITDA Multiple Est. Hansson Enterprise Value (EV) Existing Net Debt Plus: New Expansion Debt Total Estimated Debt Existing D/EV Estimated New D/EV Estimated Cost of Debt-PRE-TAX 3.75% 5.00% 40.0% 7,0x 514.5 49.8 57.8 107.6 9.7% 20.9% 7.75% 5 Revenue Projection Total Capacity (000's) Capacity Utilization Unit Volume Selling Price Per Unit - Growing al 2.0% Revenue 37 Production Contr Raw Materials Per Unit Growing 6 0 1 FC/per unit 12 38 39 40 1.0% Manufacturing Overhead Growin 3.0% Maintenance Expense Growing at 3.0% Total Labor Cost 13 114 15 SGA/per unit 16 Selling, General & Administrative Revenue SGA/per unit Working Capital Assumptions (D Days Sales Outstanding Days Sales Inventory Days Payable Outstanding (Total costs) 2009 2010 80,000 80,000 60.0% 65.0% 52,000 48,000 1.77 84,960 3,600 2,250 18,640.0 1.79 7.8% 6,594 0.14 0.14 47.6x 37,6x 34.2x 1.81 1.84 93,881 103,124 0.95 1.74 7.8% 2011 2012 2013 2014 2015 2016 2017 2018 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 85.0% 85.0% 85.0% 85.0% 85.0% 70.0% 75.0% 80.0% 56,000 60,000 64,000 68,000 68,000 68,000 68,000 68,000 1.88 1.92 1.95 2.12 1.99 2.03 2.07 112,700 122,618 132,887 135,545 138,256 141,021 143,841 7 0.14 47,6x 37.6x 34.2x 0.96 0.97 1.74 1.73 7.8% 7.8% 0.14 47,6x 37,6x 34.2x 3,708 3,819 3,934 4,428 4,560 4,697 4,052 4,173 4,299 2,532 2,608 2,687 2,767 2,850 2,318 2,387 2,459 2,936 20,233.3 22,842.4 25,254,6 27,807.6 30,508,4 31,576.2 32,681.4 33,825.2 35,009.1 0.15 0.98 47.6x 37,6x 34.2x 1.73 7.8% 0.15 0.99 47.6x 37.6x 34,2x 1.74 7.8% 1.00 0.15 1.80 7.8% 0.15 1.01 47.6x 47.6x 37,6x 37.6x 34,2x 34,2x F 0.16 1.02 1.86 1.92 7.8% 7.8% 47.6x 37.6x 34,2x 0.16 1.03 47.6x 37.6x 34,2x 1.99 7.8% 0.16 47.6x 37.6x 34.2x Hourly Labor Cost Per Unit Units Per Total Labor Hours CAPITAL PROJECT ANALYSIS NPV Analysis Operating Results Revenue Raw material costs Labor expense Manufacturing overhead Maintenance expense SG&A Total costs EBITDA Depreciation EBIT Taxes EBIT (1-0) 40% 0.38 0,05 2009 84,960 6,594 76,204 0.38 8,756 4,000 4,756 0.06 2010 93,881 45,120 49,369 18,640 3,600 2,250 0.39 10,967 4,000 6,967 1,902 2,787 2,854 0.06 53,698 22,842 20,233 3,708 3,819 2,318 2,387 7,286 82,914 2011 2012 103,124 112,700 8,004 90,751 0.40 0.06 3,350 4,180 5,024 0.42 0.06 2013 122,618 4,079 6,118 3,934 4,052 2,459 8,747 98,503 0.43 12,374 14,197 4,000 4,000 4,000 8,374 10,197 12,107 0.06 58,109 62,603 67,181 25,255 27,808 0.45 2014 2015 132,887 135,545 2,532 2,608 9,517 106,511 114,784 0.06 0.46 0.06 68,531 67,852 32,681 31,576 4,428 30,508 4,173 4,299 2,687 10,314 10,520 10,730 2,767 16,107 18,103 18,611 4,000 4,000 14,103 4,843 5,641 7,264 8,462 2016 138,256 0.48 0.06 2017 141,021 69,216 33,825 4,560 2,850 10,945 116,934 119,137 121,397 19,118 19,624 4,000 4,000 14,611 15,118 15,624 5,844 6,047 6,250 8,767 9,071 9,374 0.50 0.06 2018 143,841 69,908 35,009 4,697 2,936 11,164 123,714 20,127 4,000 16,127 6,451 9,676 Accounts payable NWC CAPEX EBIT (1-1) + Depreciation Change in Working Capital CAPEX Cash Flow from Assets Return of working capital Final Year Cash Flow Total cash flow Discount Rate NPV

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To provide a sound recommendation to Mr Hansson regarding the potential expansion opportunity lets address the discussion questions one by one 1 Comparison of HPLs margins and leverage to its p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started