Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Happy Travel Limited is a company operating two hotels. Happy Travel Limited had two cash generating units CGU1 - ABC Hotel and CGU2 -

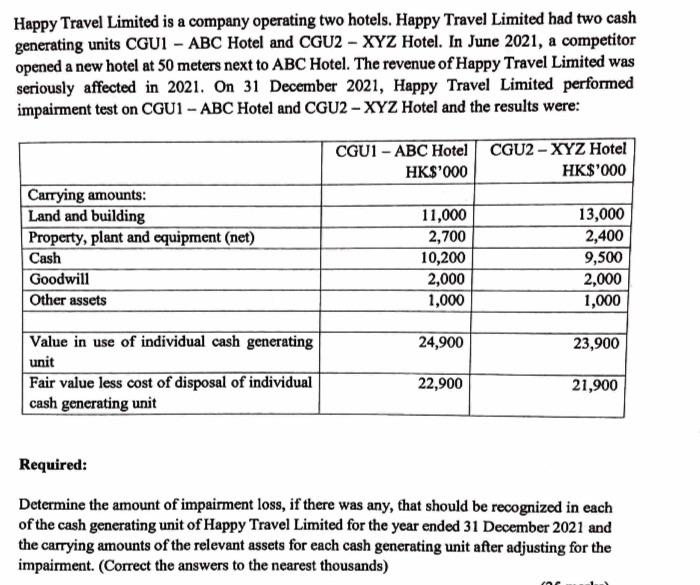

Happy Travel Limited is a company operating two hotels. Happy Travel Limited had two cash generating units CGU1 - ABC Hotel and CGU2 - XYZ Hotel. In June 2021, a competitor opened a new hotel at 50 meters next to ABC Hotel. The revenue of Happy Travel Limited was seriously affected in 2021. On 31 December 2021, Happy Travel Limited performed impairment test on CGU1 - ABC Hotel and CGU2 - XYZ Hotel and the results were: Carrying amounts: Land and building Property, plant and equipment (net) Cash Goodwill Other assets Value in use of individual cash generating unit Fair value less cost of disposal of individual cash generating unit CGU1-ABC Hotel CGU2-XYZ Hotel HK$'000 HK$'000 11,000 2,700 10,200 2,000 1,000 24,900 22,900 13,000 2,400 9,500 2,000 1,000 23,900 21,900 Required: Determine the amount of impairment loss, if there was any, that should be recognized in each of the cash generating unit of Happy Travel Limited for the year ended 31 December 2021 and the carrying amounts of the relevant assets for each cash generating unit after adjusting for the impairment. (Correct the answers to the nearest thousands)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution To determine the amount of impairment if any that should be recognized in each cash generating unit of Happy Travel Limited for the year ended 31 December 2021 we need to compare the carrying ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started