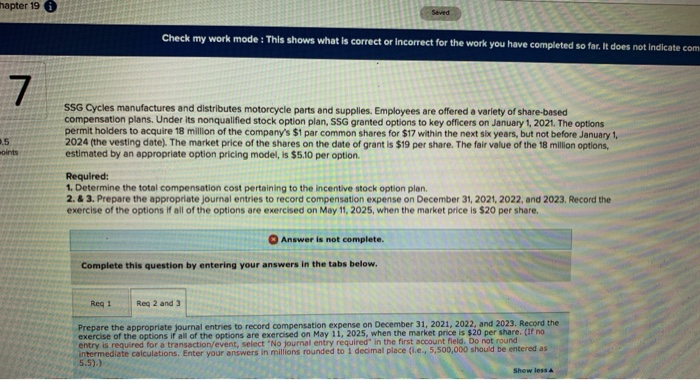

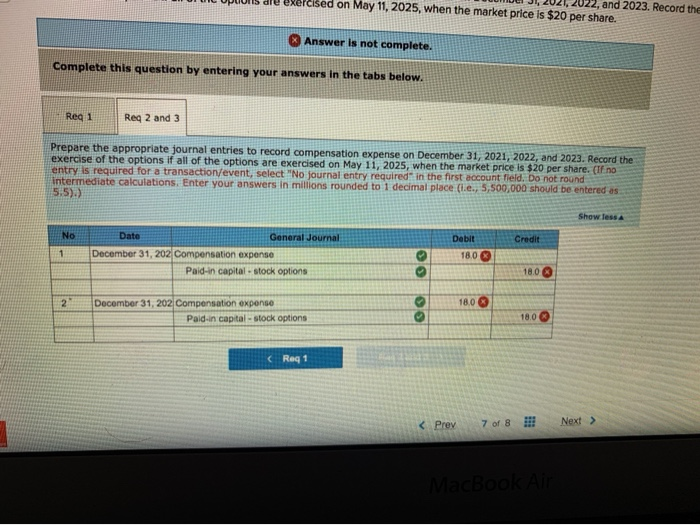

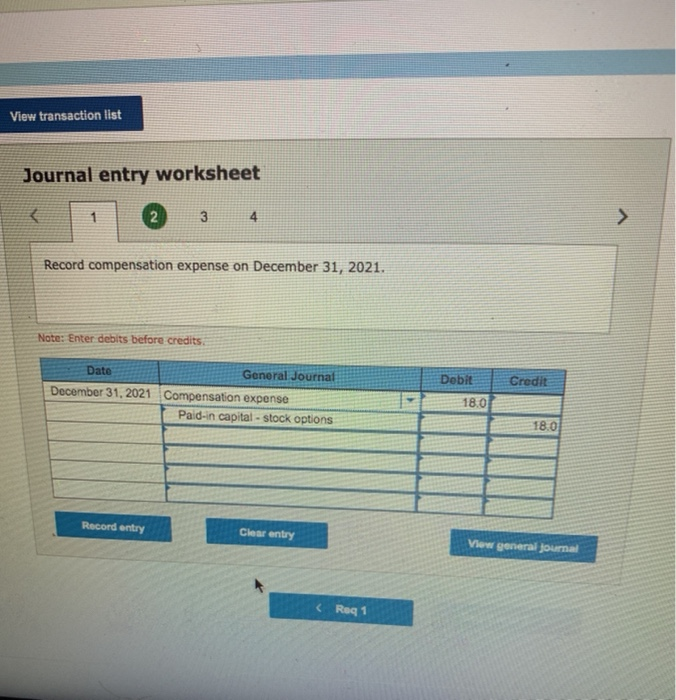

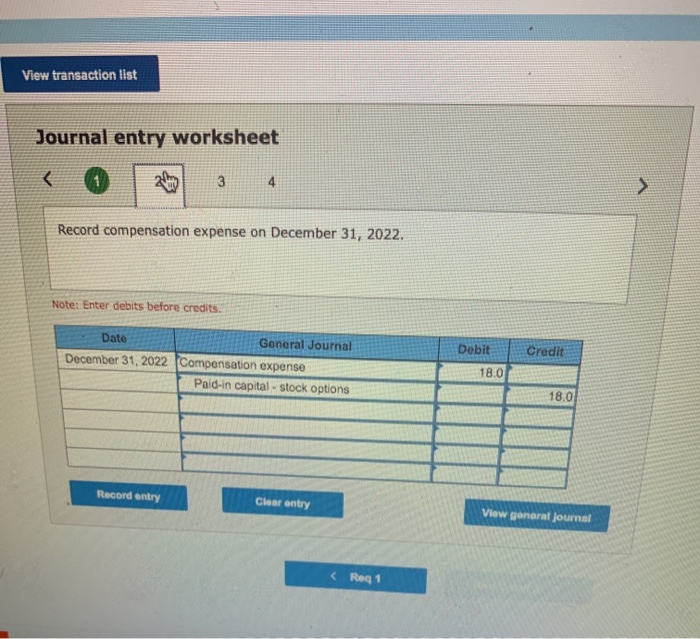

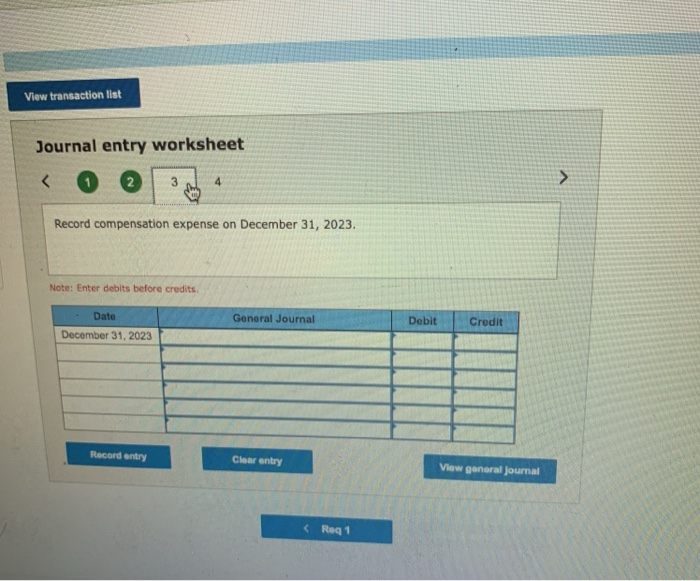

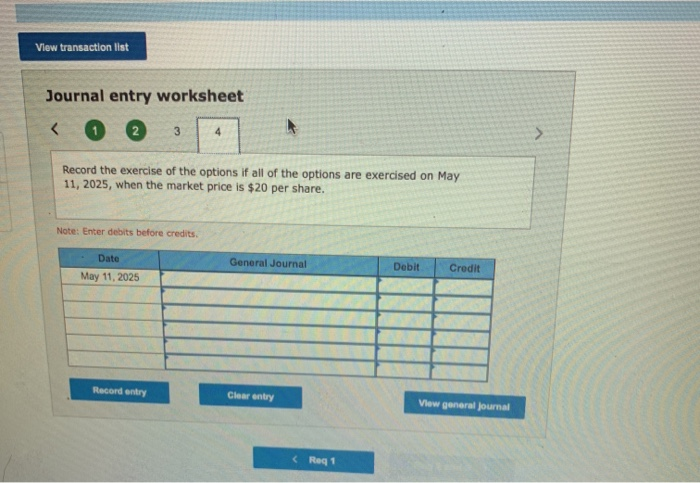

hapter 19 Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate com 0.5 moints SSG Cycles manufactures and distributes motorcycle Parts and supplies. Employees are offered a variety of share-based compensation plans. Under its nonqualified stock option plan, SSG granted options to key officers on January 1, 2021. The options permit holders to acquire 18 million of the company's $1 par common shares for $17 within the next six years, but not before January 1, 2024 (the vesting date). The market price of the shares on the date of grant is $19 per share. The fair value of the 18 million options, estimated by an appropriate option pricing model, is $5.10 per option Required: 1. Determine the total compensation cost pertaining to the incentive stock option plan. 2. & 3. Prepare the appropriate journal entries to record compensation expense on December 31, 2021, 2022, and 2023. Record the exercise of the options if all of the options are exercised on May 11, 2025, when the market price is $20 per share. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and Prepare the appropriate journal entries to record compensation expense on December 31, 2021, 2022, and 2023. Record the exercise of the options if all of the options are exercised on May 11, 2025, when the market price is $20 per share. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (ie, 5,500,000 should be entered as 5.5).) Show less 022, and 2023. Record the Peised on May 11, 2025, when the market price is $20 per share. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Prepare the appropriate journal entries to record compensation expense on December 31, 2021, 2022, and 2023. Record the exercise of the options if all of the options are exercised on May 11, 2025, when the market price is $20 per share. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (1.e., 5,500,000 should be entered as 5.5).) Show less Credit No 1 Date General Journal December 31, 202 Compensation expense Paid-in capital - stock options Debit 18.0 18.0 2 18.0 December 31, 202 Compensation expense Pald.in capital - stock options 18.0 Reg 1 MacBOOK AIR View transaction list Journal entry worksheet 1 3 4 Record compensation expense on December 31, 2021. Note: Enter debits before credits Credit Date General Journal December 31, 2021 Compensation expense Pald-in capital - stock options Dobit 18.0 18.0 Record entry Clear entry View general journal Record compensation expense on December 31, 2023. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2023 Record entry Clear entry View general Journal Req1 View transaction list Journal entry worksheet Record the exercise of the options if all of the options are exercised on May 11, 2025, when the market price is $20 per share. Note: Enter debits before credits Date General Journal Debit Credit May 11, 2025 Recorder Clear entry View general Journal