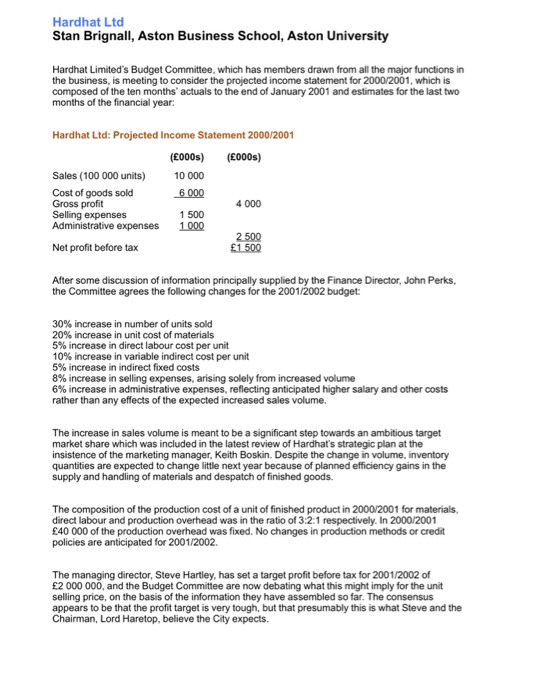

Hardhat Ltd Stan Brignall, Aston Business School, Aston University Hardhat Limited's Budget Committee, which has members drawn from all the major functions in the business, is meeting to consider the projected income statement for 2000/2001, which is composed of the ten months' actuals to the end of January 2001 and estimates for the last two months of the financial year: Hardhat Ltd: Projected Income Statement 2000/2001 (E000s) (E000s) 10 000 6 000 1 500 Sales (100 000 units) Cost of goods sold Gross profit Selling expenses Administrative expenses 4 000 1000 Net profit before tax 1 500 After some discussion of information principally supplied by the Finance Director, John Perks, the Committee agrees the following changes for the 2001/2002 budget 30% increase in number of units sold 20% increase in unit cost of materials 5% increase in direct labour cost per unit 10% increase in variable indirect cost per unit 5% increase in indirect fixed costs 8% increase in selling expenses, arising solely from increased volume 6% increase in administrative expenses, reflecting anticipated higher salary and other costs rather than any effects of the expected increased sales volume. The increase in sales volume is meant to be a significant step towards an ambitious target market share which was included in the latest review of Hardhat's strategic plan at the insistence of the marketing manager, Keith Boskin. Despite the change in volume, inventory quantities are expected to change little next year because of planned efficiency gains in the supply and handling of materials and despatch of finished goods. The composition of the production cost of a unit of finished product in 2000/2001 for materials. direct labour and production overhead was in the ratio of 3:2:1 respectively. In 2000/2001 40 000 of the production overhead was fixed. No changes in production methods or credit policies are anticipated for 2001/2002 The managing director, Steve Hartley, has set a target profit before tax for 2001/2002 of 2 000 000, and the Budget Committee are now debating what this might imply for the unit selling price, on the basis of the information they have assembled so far. The consensus appears to be that the profit target is very tough, but that presumably this is what Steve and the Chairman, Lord Haretop, believe the City expects