Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harding Company is in the process of purchasing several large pieces of equipment from Danning Machine Corporation. Several financing alternatives have been offered by

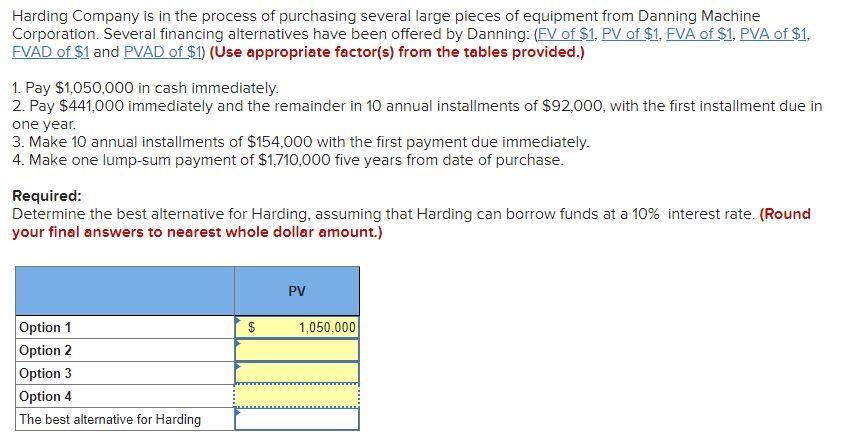

Harding Company is in the process of purchasing several large pieces of equipment from Danning Machine Corporation. Several financing alternatives have been offered by Danning: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. Pay $1,050,000 in cash immediately. 2. Pay $441,000 immediately and the remainder in 10 annual installments of $92,000, with the first installment due in one year. 3. Make 10 annual installments of $154,000 with the first payment due immediately. 4. Make one lump-sum payment of $1,710,000 five years from date of purchase. Required: Determine the best alternative for Harding, assuming that Harding can borrow funds at a 10% interest rate. (Round your final answers to nearest whole dollar amount.) PV Option 1 Option 2 Option 3 Option 4 $ 1,050,000 The best alternative for Harding Harding Company is in the process of purchasing several large pieces of equipment from Danning Machine Corporation. Several financing alternatives have been offered by Danning: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. Pay $1,050,000 in cash immediately. 2. Pay $441,000 immediately and the remainder in 10 annual installments of $92,000, with the first installment due in one year. 3. Make 10 annual installments of $154,000 with the first payment due immediately. 4. Make one lump-sum payment of $1,710,000 five years from date of purchase. Required: Determine the best alternative for Harding, assuming that Harding can borrow funds at a 10% interest rate. (Round your final answers to nearest whole dollar amount.) PV Option 1 Option 2 Option 3 Option 4 $ 1,050,000 The best alternative for Harding Harding Company is in the process of purchasing several large pieces of equipment from Danning Machine Corporation. Several financing alternatives have been offered by Danning: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. Pay $1,050,000 in cash immediately. 2. Pay $441,000 immediately and the remainder in 10 annual installments of $92,000, with the first installment due in one year. 3. Make 10 annual installments of $154,000 with the first payment due immediately. 4. Make one lump-sum payment of $1,710,000 five years from date of purchase. Required: Determine the best alternative for Harding, assuming that Harding can borrow funds at a 10% interest rate. (Round your final answers to nearest whole dollar amount.) PV Option 1 Option 2 Option 3 Option 4 $ 1,050,000 The best alternative for Harding Harding Company is in the process of purchasing several large pieces of equipment from Danning Machine Corporation. Several financing alternatives have been offered by Danning: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. Pay $1,050,000 in cash immediately. 2. Pay $441,000 immediately and the remainder in 10 annual installments of $92,000, with the first installment due in one year. 3. Make 10 annual installments of $154,000 with the first payment due immediately. 4. Make one lump-sum payment of $1,710,000 five years from date of purchase. Required: Determine the best alternative for Harding, assuming that Harding can borrow funds at a 10% interest rate. (Round your final answers to nearest whole dollar amount.) PV Option 1 Option 2 Option 3 Option 4 $ 1,050,000 The best alternative for Harding

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Best Option Option 2 Present Value Option 1 Option 2 Option 3 Option 4 2 10500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started