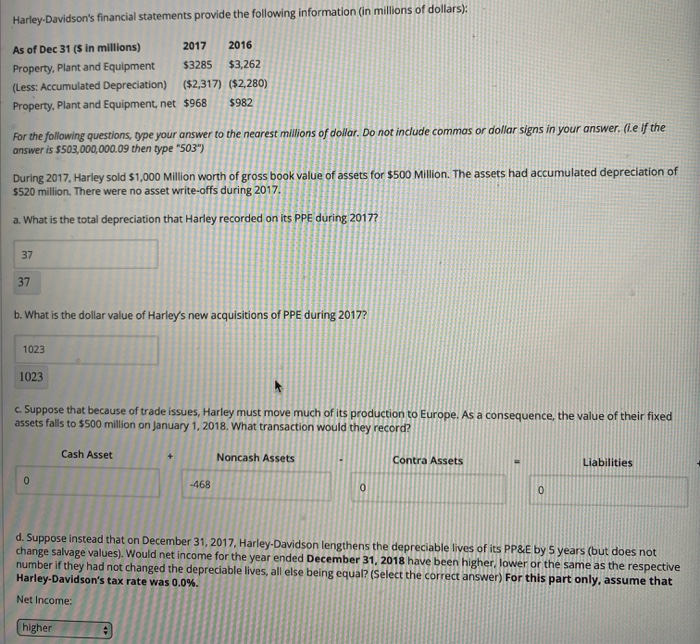

Harley-Davidson's financial statements provide the following information (in millions of dollars): As of Dec 31 ($ in millions) 2017 2016 Property, Plant and Equipment $3285 $3,262 (Less: Accumulated Depreciation) ($2,317) ($2,280) Property, Plant and Equipment, net $968 $982 For the following questions, type your answer to the nearest millions of dollar. Do not include commas or dollar signs in your answer. (Le if the answer is $503,000,000.09 then type "503") During 2017, Harley sold $1,000 Million worth of gross book value of assets for $500 Million. The assets had accumulated depreciation of $520 million. There were no asset write-offs during 2017 a. What is the total depreciation that Harley recorded on its PPE during 2017? 37 37 b. What is the dollar value of Harley's new acquisitions of PPE during 2017? 1023 1023 c. Suppose that because of trade issues, Harley must move much of its production to Europe. As a consequence, the value of their fixed assets falls to $500 million on January 1, 2018. What transaction would they record? Cash Asset Noncash Assets Contra Assets Liabilities 0 -468 0 0 d. Suppose instead that on December 31, 2017, Harley-Davidson lengthens the depreciable lives of its PP&E by 5 years (but does not change salvage values). Would net income for the year ended December 31, 2018 have been higher, lower or the same as the respective number if they had not changed the depreciable lives, all else being equal? (Select the correct answer) For this part only, assume that Harley-Davidson's tax rate was 0.0%. Net Income: higher Harley-Davidson's financial statements provide the following information (in millions of dollars): As of Dec 31 ($ in millions) 2017 2016 Property, Plant and Equipment $3285 $3,262 (Less: Accumulated Depreciation) ($2,317) ($2,280) Property, Plant and Equipment, net $968 $982 For the following questions, type your answer to the nearest millions of dollar. Do not include commas or dollar signs in your answer. (Le if the answer is $503,000,000.09 then type "503") During 2017, Harley sold $1,000 Million worth of gross book value of assets for $500 Million. The assets had accumulated depreciation of $520 million. There were no asset write-offs during 2017 a. What is the total depreciation that Harley recorded on its PPE during 2017? 37 37 b. What is the dollar value of Harley's new acquisitions of PPE during 2017? 1023 1023 c. Suppose that because of trade issues, Harley must move much of its production to Europe. As a consequence, the value of their fixed assets falls to $500 million on January 1, 2018. What transaction would they record? Cash Asset Noncash Assets Contra Assets Liabilities 0 -468 0 0 d. Suppose instead that on December 31, 2017, Harley-Davidson lengthens the depreciable lives of its PP&E by 5 years (but does not change salvage values). Would net income for the year ended December 31, 2018 have been higher, lower or the same as the respective number if they had not changed the depreciable lives, all else being equal? (Select the correct answer) For this part only, assume that Harley-Davidson's tax rate was 0.0%. Net Income: higher