Answered step by step

Verified Expert Solution

Question

1 Approved Answer

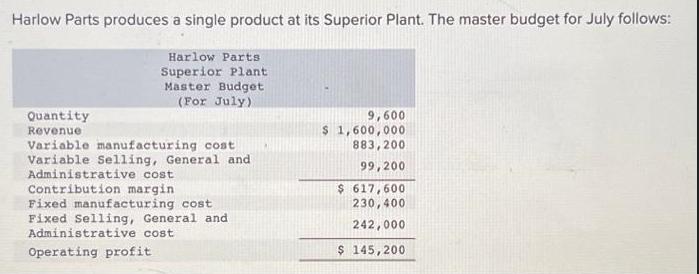

Harlow Parts produces a single product at its Superior Plant. The master budget for July follows: Harlow Parts Superior Plant Master Budget (For July)

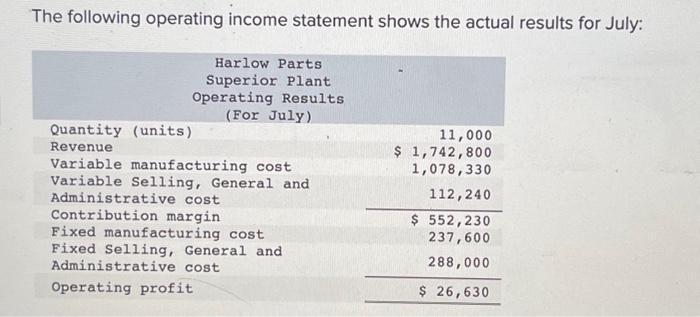

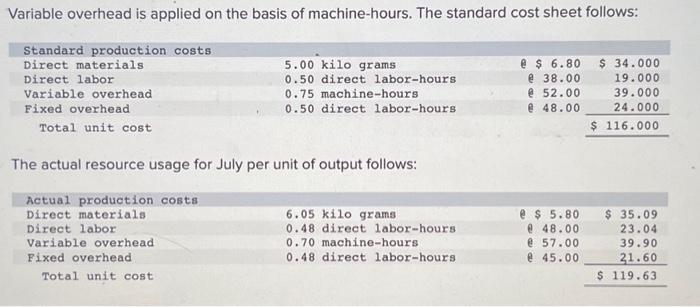

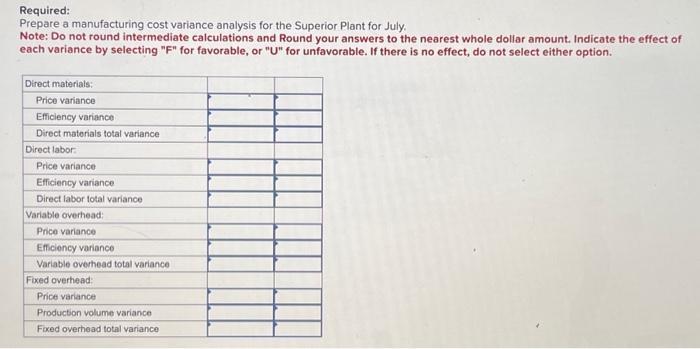

Harlow Parts produces a single product at its Superior Plant. The master budget for July follows: Harlow Parts Superior Plant Master Budget (For July) Quantity Revenue Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit 9,600 $ 1,600,000 883,200. 99,200 $ 617,600 230,400 242,000 $ 145,200 The following operating income statement shows the actual results for July: Harlow Parts Superior Plant Operating Results (For July) Quantity (units) Revenue Variable manufacturing cost Variable Selling, General and Administrative cost Contribution margin Fixed manufacturing cost Fixed Selling, General and Administrative cost Operating profit 11,000 $ 1,742,800 1,078,330 112,240 $ 552,230 237,600 288,000 $ 26,630 Variable overhead is applied on the basis of machine-hours. The standard cost sheet follows: Standard production costs Direct materials Direct labor Variable overhead Fixed overhead Total unit cost 5.00 kilo grams 0.50 direct labor-hours 0.75 machine-hours 0.50 direct labor-hours The actual resource usage for July per unit of output follows: Actual production costs Direct materials Direct labor Variable overhead Fixed overhead Total unit cost. 6.05 kilo grams 0.48 direct labor-hours 0.70 machine-hours. 0.48 direct labor-hours @ $6.80 $ 34.000 @ 38.00 19.000 @ 52.00 39.000 @ 48.00 24.000 $ 116.000 e$ 5.80 e 48.00 @ 57.00 @ 45.00 $ 35.09 23.04 39.90 21.60 $ 119.63 Required: Prepare a manufacturing cost variance analysis for the Superior Plant for July. Note: Do not round intermediate calculations and Round your answers to the nearest whole dollar amount. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Direct materials: Price variance Efficiency variance Direct materials total variance Direct labor Price variance Efficiency variance Direct labor total variance Variable overhead: Price variance Efficiency variance Variable overhead total variance Fixed overhead: Price variance Production volume variance Fixed overhead total variance

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Define variance analysis In variance analysis management compares actual results with the bud...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started