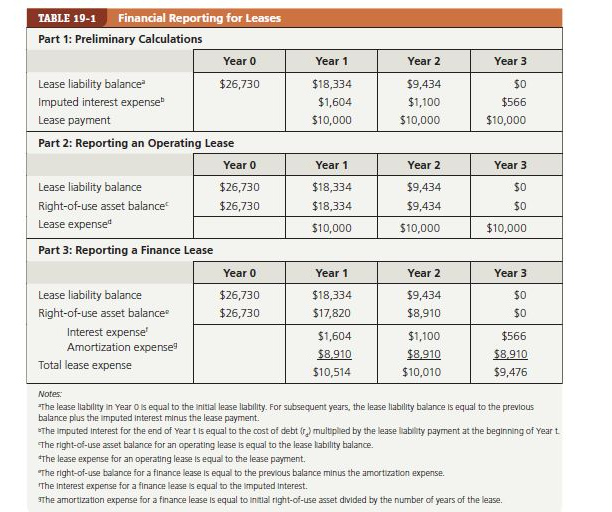

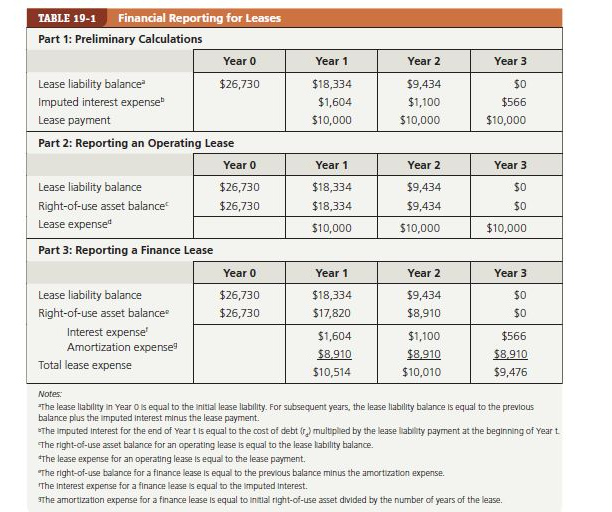

Harmeling Paint Ball (HPB) Corporation needs a new air compressor that costs $90,000. HPB will need it for only 5 years even though the compressor's economic life is long enough so that the lease is an operating lease. The firm can lease the compressor for 5 years with $20,000 lease payments at the end of each year. HPB's cost of debt is 15%. Answer the following questions. (Hint: See Table 19-1.) a. What is the initial lease liability that must be reported on the balance sheet? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ b. What is the initial riqht-of-use asset? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. What will HPB report as the Year-1 lease expense? Round your answer to the nearest cent. Enter your answer as a positive value. $ d. What is the Year-1 imputed interest expense? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ e. What lease liability must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ f. What riaht-of-use asset must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. Part 1: Preliminary Calculations Part 2: Reporting an Operating Lease Part 3: Reporting a Finance Lease Notes: The lease llability in Year o o s equal to the intilal lease llablitiy. For subsequent years, the lease llablity balance is equal to the previous balance plus the imputed interest minus the lease payment. The imputed interest for the end of Year t is equal to the cost of debt (r2) multipled by the lease llablity payment at the beginning of Year t The right-of-use asset balance for an operating lease is equal to the lease labbility balance. The lease expense for an operating lease is equal to the lease payment. The right-of-use balance for a finance lease is equal to the previous balance minus the amortization expense. The interest expense for a finance lease is equal to the imputed interest. The amortization expense for a finance lease is equal to intial right-of-use asset divided by the number of years of the lease. Harmeling Paint Ball (HPB) Corporation needs a new air compressor that costs $90,000. HPB will need it for only 5 years even though the compressor's economic life is long enough so that the lease is an operating lease. The firm can lease the compressor for 5 years with $20,000 lease payments at the end of each year. HPB's cost of debt is 15%. Answer the following questions. (Hint: See Table 19-1.) a. What is the initial lease liability that must be reported on the balance sheet? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ b. What is the initial riqht-of-use asset? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. What will HPB report as the Year-1 lease expense? Round your answer to the nearest cent. Enter your answer as a positive value. $ d. What is the Year-1 imputed interest expense? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ e. What lease liability must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. Enter your answer as a positive value. $ f. What riaht-of-use asset must be reported at Year 1? Do not round intermediate calculations. Round your answer to the nearest cent. Part 1: Preliminary Calculations Part 2: Reporting an Operating Lease Part 3: Reporting a Finance Lease Notes: The lease llability in Year o o s equal to the intilal lease llablitiy. For subsequent years, the lease llablity balance is equal to the previous balance plus the imputed interest minus the lease payment. The imputed interest for the end of Year t is equal to the cost of debt (r2) multipled by the lease llablity payment at the beginning of Year t The right-of-use asset balance for an operating lease is equal to the lease labbility balance. The lease expense for an operating lease is equal to the lease payment. The right-of-use balance for a finance lease is equal to the previous balance minus the amortization expense. The interest expense for a finance lease is equal to the imputed interest. The amortization expense for a finance lease is equal to intial right-of-use asset divided by the number of years of the lease