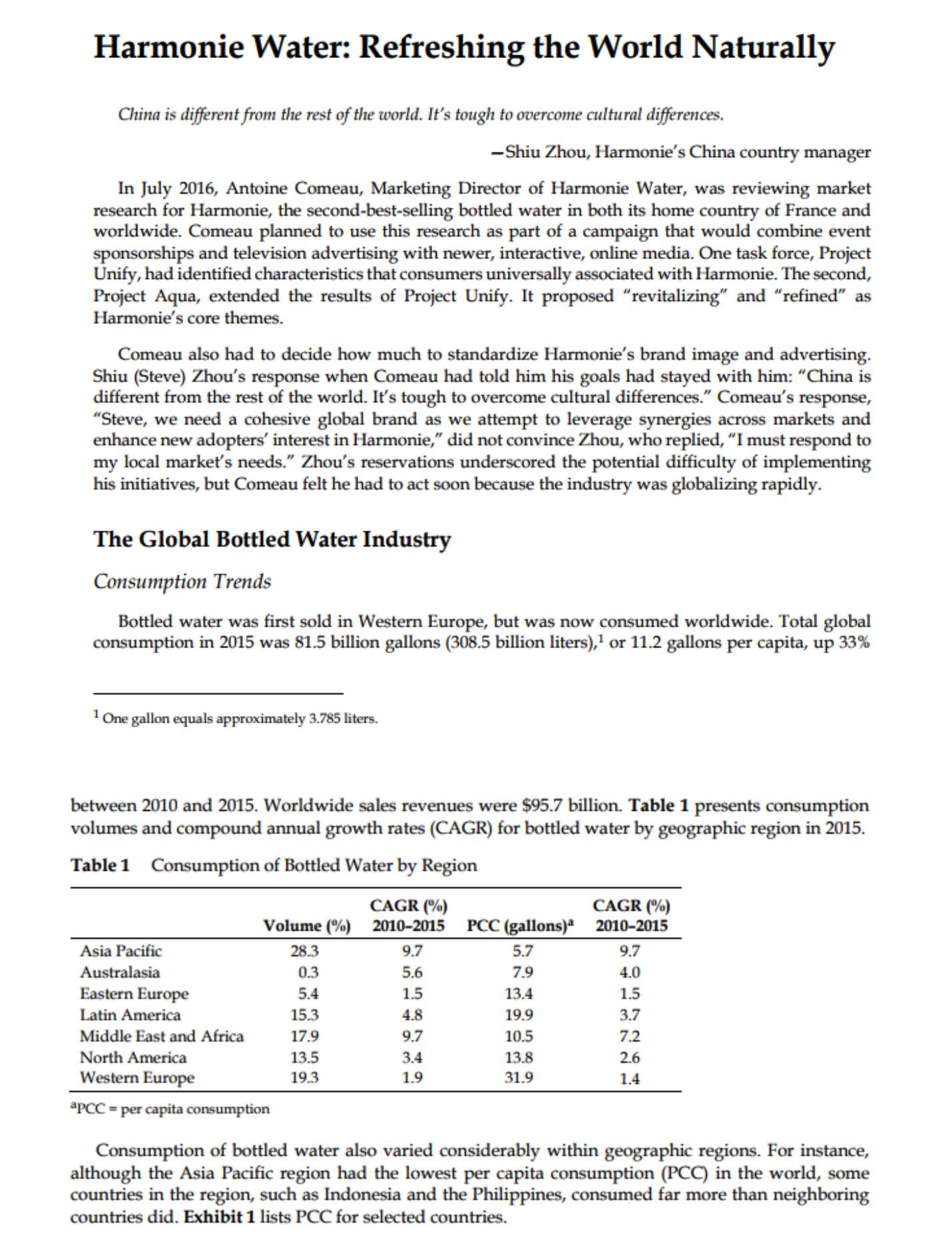

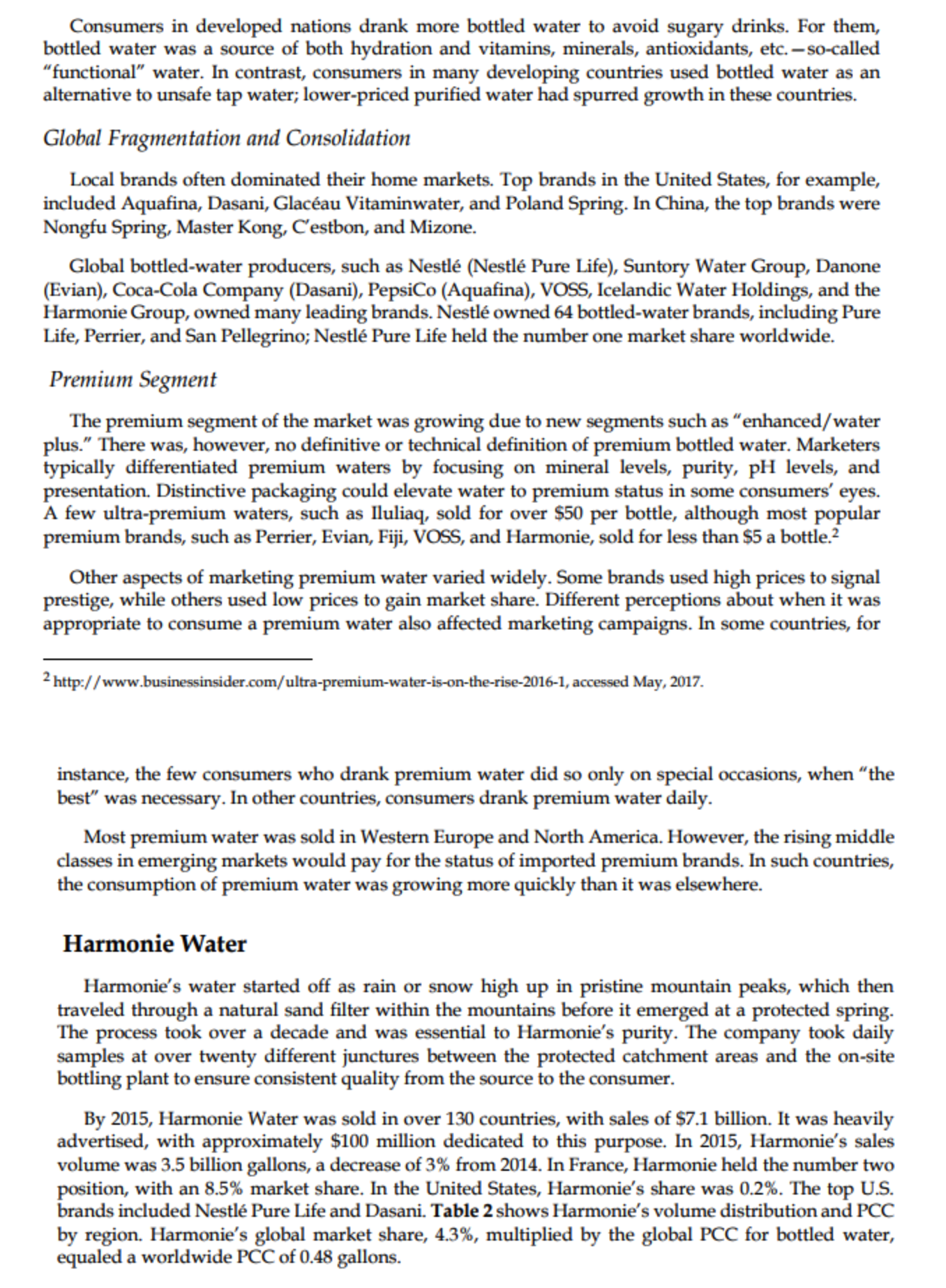

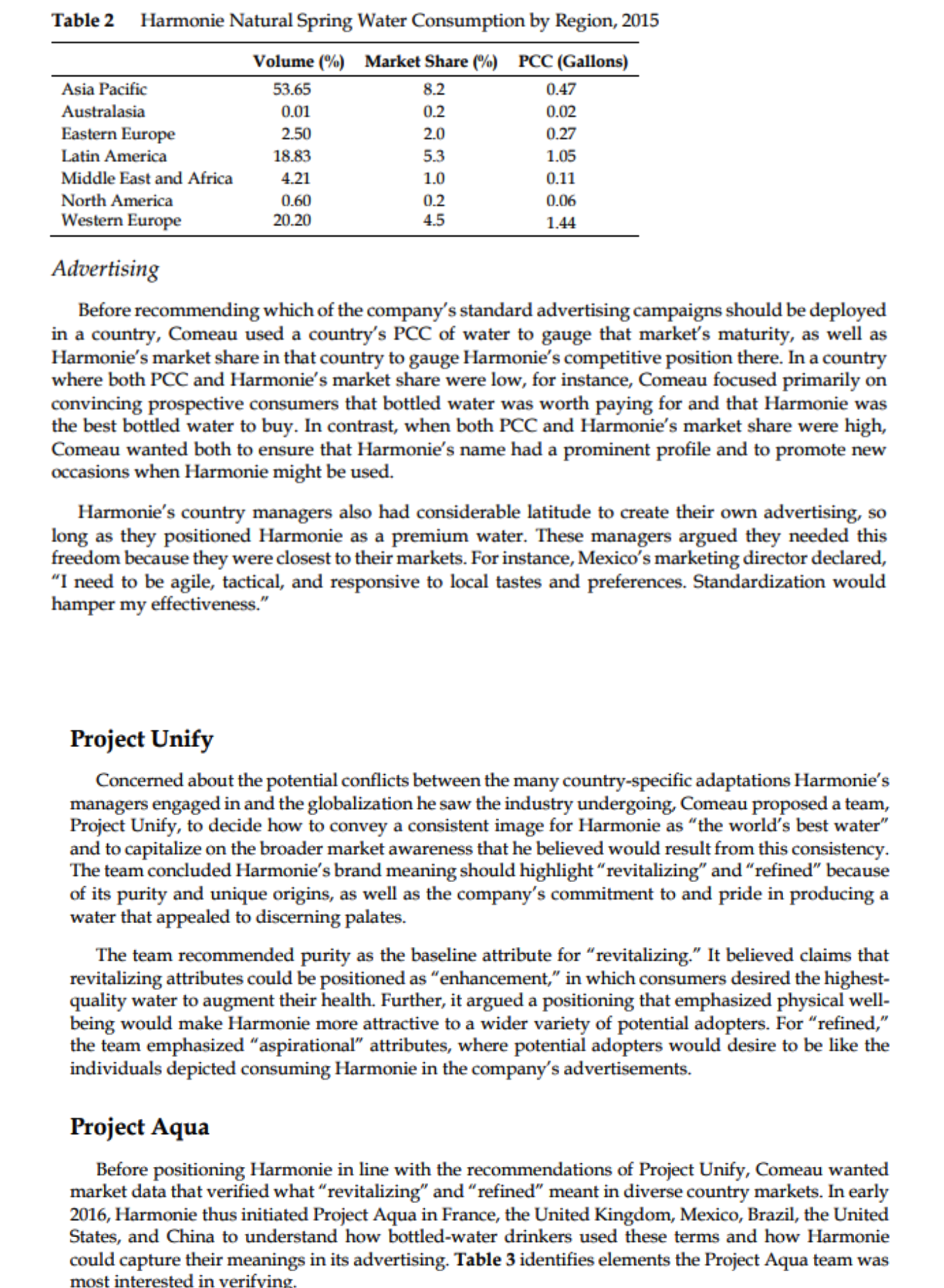

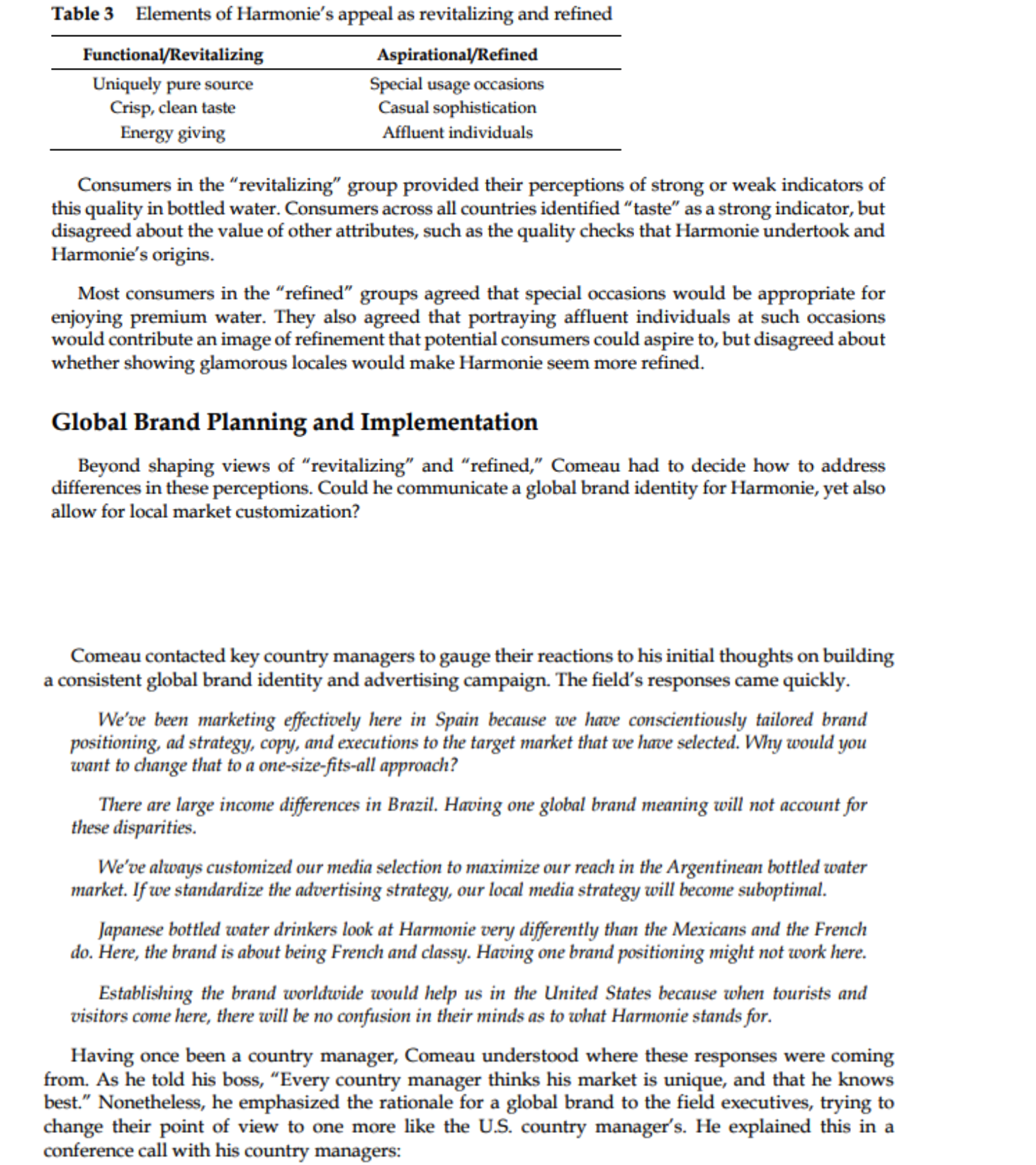

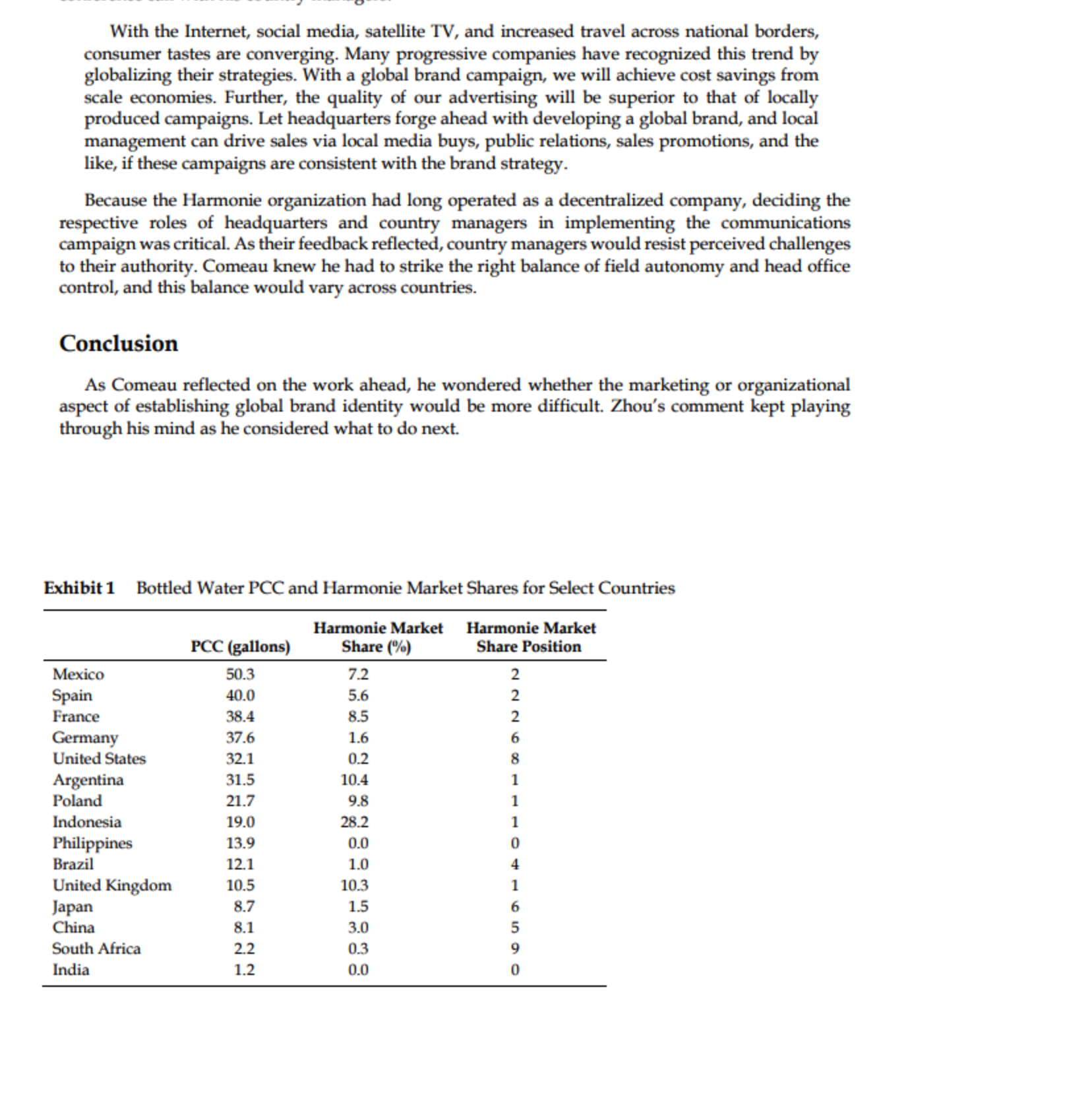

Harmonie Water: Refreshing the World Naturally China is different from the rest of the world. It's tough to overcome cultural differences. -Shiu Zhou, Harmonie's China country manager In July 2016, Antoine Comeau, Marketing Director of Harmonie Water, was reviewing market research for Harmonie, the second-best-selling bottled water in both its home country of France and worldwide. Comeau planned to use this research as part of a campaign that would combine event sponsorships and television advertising with newer, interactive, online media. One task force, Project Unify, had identified characteristics that consumers universally associated with Harmonie. The second, Project Aqua, extended the results of Project Unify. It proposed "revitalizing" and "refined" as Harmonie's core themes. Comeau also had to decide how much to standardize Harmonie's brand image and advertising. Shiu (Steve) Zhou's response when Comeau had told him his goals had stayed with him: "China is different from the rest of the world. It's tough to overcome cultural differences." Comeau's response, "Steve, we need a cohesive global brand as we attempt to leverage synergies across markets and enhance new adopters' interest in Harmonie," did not convince Zhou, who replied, "I must respond to my local market's needs." Zhou's reservations underscored the potential difficulty of implementing his initiatives, but Comeau felt he had to act soon because the industry was globalizing rapidly. The Global Bottled Water Industry Consumption Trends Bottled water was first sold in Western Europe, but was now consumed worldwide. Total global consumption in 2015 was 81.5 billion gallons (308.5 billion liters),' or 11.2 gallons per capita, up 33% 1 One gallon equals approximately 3.785 liters. between 2010 and 2015. Worldwide sales revenues were $95.7 billion. Table 1 presents consumption volumes and compound annual growth rates (CAGR) for bottled water by geographic region in 2015. Table 1 Consumption of Bottled Water by Region CAGR (%) CAGR (%) Volume (%) 2010-2015 PCC (gallons) 2010-2015 Asia Pacific 28.3 9.7 5.7 9.7 Australasia 0.3 5.6 7.9 4.0 Eastern Europe 5.4 1.5 13.4 1.5 Latin America 15.3 4.8 19.9 3.7 Middle East and Africa 17.9 9.7 10.5 7.2 North America 13.5 3.4 13.8 2.6 Western Europe 19. 1.9 31.9 1.4 apCC = per capita consumption Consumption of bottled water also varied considerably within geographic regions. For instance, although the Asia Pacific region had the lowest per capita consumption (PCC) in the world, some countries in the region, such as Indonesia and the Philippines, consumed far more than neighboring countries did. Exhibit 1 lists PCC for selected countries.Consumers in developed nations drank more bottled water to avoid sugary drinks. For them, bottled water was a source of both hydration and vitamins, minerals, antioxidants, etc. -so-called "functional" water. In contrast, consumers in many developing countries used bottled water as an alternative to unsafe tap water; lower-priced purified water had spurred growth in these countries. Global Fragmentation and Consolidation Local brands often dominated their home markets. Top brands in the United States, for example, included Aquafina, Dasani, Glaceau Vitaminwater, and Poland Spring. In China, the top brands were Nongfu Spring, Master Kong, C'estbon, and Mizone. Global bottled-water producers, such as Nestle (Nestle Pure Life), Suntory Water Group, Danone (Evian), Coca-cola Company (Dasani), PepsiCo (Aquafina), VOSS, Icelandic Water Holdings, and the Harmonie Group, owned many leading brands. Nestle owned 64 bottled-water brands, including Pure Life, Perrier, and San Pellegrino; Nestle Pure Life held the number one market share worldwide. Premium Segment The premium segment of the market was growing due to new segments such as "enhanced/water plus." There was, however, no definitive or technical definition of premium bottled water. Marketers typically differentiated premium waters by focusing on mineral levels, purity, PH levels, and presentation. Distinctive packaging could elevate water to premium status in some consumers' eyes. A few ultra-premium waters, such as Iluliaq, sold for over $50 per bottle, although most popular premium brands, such as Perrier, Evian, Fiji, VOSS, and Harmonie, sold for less than $5 a bottle.2 Other aspects of marketing premium water varied widely. Some brands used high prices to signal prestige, while others used low prices to gain market share. Different perceptions about when it was appropriate to consume a premium water also affected marketing campaigns. In some countries, for 2 http://www.businessinsider.com/ ultra-premium-water-is-on-the-rise-2016-1, accessed May, 2017. instance, the few consumers who drank premium water did so only on special occasions, when "the best" was necessary. In other countries, consumers drank premium water daily. Most premium water was sold in Western Europe and North America. However, the rising middle classes in emerging markets would pay for the status of imported premium brands. In such countries, the consumption of premium water was growing more quickly than it was elsewhere. Harmonie Water Harmonie's water started off as rain or snow high up in pristine mountain peaks, which then traveled through a natural sand filter within the mountains before it emerged at a protected spring. The process took over a decade and was essential to Harmonie's purity. The company took daily samples at over twenty different junctures between the protected catchment areas and the on-site bottling plant to ensure consistent quality from the source to the consumer. By 2015, Harmonie Water was sold in over 130 countries, with sales of $7.1 billion. It was heavily advertised, with approximately $100 million dedicated to this purpose. In 2015, Harmonie's sales volume was 3.5 billion gallons, a decrease of 3% from 2014. In France, Harmonie held the number two position, with an 8.5% market share. In the United States, Harmonie's share was 0.2%. The top U.S. brands included Nestle Pure Life and Dasani. Table 2 shows Harmonie's volume distribution and PCC by region. Harmonie's global market share, 4.3%, multiplied by the global PCC for bottled water, equaled a worldwide PCC of 0.48 gallons.Table 2 Harmonie Natural Spring Water Consumption by Region, 2015 Volume (%) Market Share (%) PCC (Gallons) Asia Pacific 53.65 8.2 0.47 Australasia 0.01 0.2 0.02 Eastern Europe 2.50 2.0 0.27 Latin America 18.83 5.3 1.05 Middle East and Africa 4.21 1.0 0.11 North America 0.60 0.2 0.06 Western Europe 20.20 4.5 1.44 Advertising Before recommending which of the company's standard advertising campaigns should be deployed in a country, Comeau used a country's PCC of water to gauge that market's maturity, as well as Harmonie's market share in that country to gauge Harmonie's competitive position there. In a country where both PCC and Harmonie's market share were low, for instance, Comeau focused primarily on convincing prospective consumers that bottled water was worth paying for and that Harmonie was the best bottled water to buy. In contrast, when both PCC and Harmonie's market share were high, Comeau wanted both to ensure that Harmonie's name had a prominent profile and to promote new occasions when Harmonie might be used. Harmonie's country managers also had considerable latitude to create their own advertising, so long as they positioned Harmonie as a premium water. These managers argued they needed this freedom because they were closest to their markets. For instance, Mexico's marketing director declared, "I need to be agile, tactical, and responsive to local tastes and preferences. Standardization would hamper my effectiveness." Project Unify Concerned about the potential conflicts between the many country-specific adaptations Harmonie's managers engaged in and the globalization he saw the industry undergoing, Comeau proposed a team, Project Unify, to decide how to convey a consistent image for Harmonie as "the world's best water" and to capitalize on the broader market awareness that he believed would result from this consistency. The team concluded Harmonie's brand meaning should highlight "revitalizing" and "refined" because of its purity and unique origins, as well as the company's commitment to and pride in producing a water that appealed to discerning palates. The team recommended purity as the baseline attribute for "revitalizing." It believed claims that revitalizing attributes could be positioned as "enhancement," in which consumers desired the highest- quality water to augment their health. Further, it argued a positioning that emphasized physical well- being would make Harmonie more attractive to a wider variety of potential adopters. For "refined," the team emphasized "aspirational" attributes, where potential adopters would desire to be like the individuals depicted consuming Harmonie in the company's advertisements. Project Aqua Before positioning Harmonie in line with the recommendations of Project Unify, Comeau wanted market data that verified what "revitalizing" and "refined" meant in diverse country markets. In early 2016, Harmonie thus initiated Project Aqua in France, the United Kingdom, Mexico, Brazil, the United States, and China to understand how bottled-water drinkers used these terms and how Harmonie could capture their meanings in its advertising. Table 3 identifies elements the Project Aqua team was most interested in verifyinTable 3 Elements of Harmonie's appeal as revitalizing and refined Functional/Revitalizing Aspirational/Refined Uniquely pure source Special usage occasions Crisp, clean taste Casual sophistication Energy giving Affluent individuals Consumers in the "revitalizing" group provided their perceptions of strong or weak indicators of this quality in bottled water. Consumers across all countries identified "taste" as a strong indicator, but disagreed about the value of other attributes, such as the quality checks that Harmonie undertook and Harmonie's origins. Most consumers in the "refined" groups agreed that special occasions would be appropriate for enjoying premium water. They also agreed that portraying affluent individuals at such occasions would contribute an image of refinement that potential consumers could aspire to, but disagreed about whether showing glamorous locales would make Harmonie seem more refined. Global Brand Planning and Implementation Beyond shaping views of "revitalizing" and "refined," Comeau had to decide how to address differences in these perceptions. Could he communicate a global brand identity for Harmonie, yet also allow for local market customization? Comeau contacted key country managers to gauge their reactions to his initial thoughts on building a consistent global brand identity and advertising campaign. The field's responses came quickly. We've been marketing effectively here in Spain because we have conscientiously tailored brand positioning, ad strategy, copy, and executions to the target market that we have selected. Why would you want to change that to a one-size-fits-all approach? these disparities. There are large income differences in Brazil. Having one global brand meaning will not account for We've always customized our media selection to maximize our reach in the Argentinean bottled water market. If we standardize the advertising strategy, our local media strategy will become suboptimal. Japanese bottled water drinkers look at Harmonie very differently than the Mexicans and the French do. Here, the brand is about being French and classy. Having one brand positioning might not work here. Establishing the brand worldwide would help us in the United States because when tourists and visitors come here, there will be no confusion in their minds as to what Harmonie stands for. Having once been a country manager, Comeau understood where these responses were coming from. As he told his boss, "Every country manager thinks his market is unique, and that he knows best." Nonetheless, he emphasized the rationale for a global brand to the field executives, trying to change their point of view to one more like the U.S. country manager's. He explained this in a conference call with his country managers:With the Internet, social media, satellite TV, and increased travel across national borders, consumer tastes are converging. Many progressive companies have recognized this trend by globalizing their strategies. With a global brand campaign, we will achieve cost savings from scale economies. Further, the quality of our advertising will be superior to that of locally produced campaigns. Let headquarters forge ahead with developing a global brand, and local management can drive sales via local media buys, public relations, sales promotions, and the like, if these campaigns are consistent with the brand strategy. Because the Harmonie organization had long operated as a decentralized company, deciding the respective roles of headquarters and country managers in implementing the communications campaign was critical. As their feedback reflected, country managers would resist perceived challenges to their authority. Comeau knew he had to strike the right balance of field autonomy and head office control, and this balance would vary across countries. Conclusion As Comeau reflected on the work ahead, he wondered whether the marketing or organizational aspect of establishing global brand identity would be more difficult. Zhou's comment kept playing through his mind as he considered what to do next. Exhibit 1 Bottled Water PCC and Harmonie Market Shares for Select Countries Harmonie Market Harmonie Market PCC (gallons) Share (%) Share Position Mexico 50.3 7.2 Spain 40.0 5.6 France 38.4 8.5 Germany 37.6 1.6 United States 32.1 0.2 Argentina 31.5 10.4 Poland 21.7 98 Indonesia 190 28.2 Philippines 13.9 0.0 Brazil 12.1 1.0 United Kingdom 10.5 10.3 Japan 8.7 1.5 China 8.1 3.0 South Africa 2.2 0.3 India 1.2 0.0 ODUa HA OHH HOG N NN