Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harold Brown, a single taxpayer, has adjusted gross income of $600,000. He has a deduction fr home mortgage interest of $23,000, cash contributions of

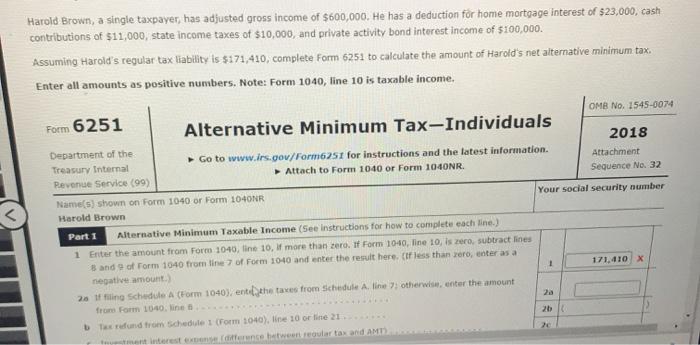

Harold Brown, a single taxpayer, has adjusted gross income of $600,000. He has a deduction fr home mortgage interest of $23,000, cash contributions of $11,000, state income taxes of $10,000, and private activity bond interest income of $100,000. Assuming Harold's regular tax liability is $171,410, complete Form 6251 to calculate the amount of Harold's net alternative minimum tax. Enter all amounts as positive numbers. Note: Form 1040, line 10 is taxable income. OMB No. 1545-0074 Form 6251 Alternative Minimum Tax-Individuals 2018 Department of the Go to wwwv.irs.gov/Form6251 for instructions and the latest information. Treasury Internal Attachment Attach to Form 1040 or Form 1040NR. Revenue Service (99) Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR Your social security number Harold Brown Part 1 Alternative Minimum Taxable Income (See instructions for how to complete each line.) 1 Ernter the amount from Form 1040, line 10, if more than zero. If Form 1040, line 10, is zero, subtract lines 8 and 9 of Form 1040 from line 7 of Form 1040 and enter the result here. (If less than azero, enter as a negative amount.) 171,410 X 20 if filing Schedule A (Form 1040), entthe taves from Schedule A. line 7; otherwise, enter the amount from Form 1040. line .. 2a 2b b Tax refund from Schedule 1 (Form 1040), line 10 or fine 21 20 ntment interest expense (difference betweert egular tax and AMT)

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION FORM NO 1040 SNO PARTICULARS AMOUNT AMOUNT 7 ADJUSTED GROSS INCOME 600000 8 STANDARD DEDUCTIONS HOME MORTGAGE INTEREST 23000 STATE INCOME TAX...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started