Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harold's Inc. is trying to determine whether its current assembly system needs to be replaced with a more efficient one. The new system would

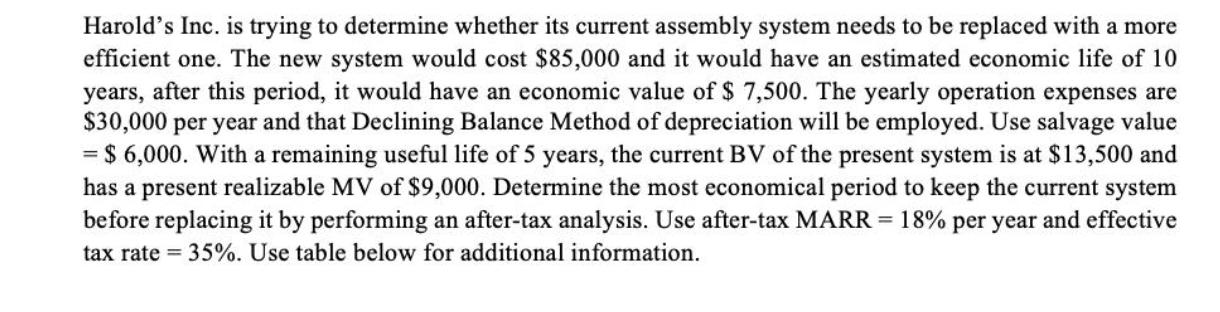

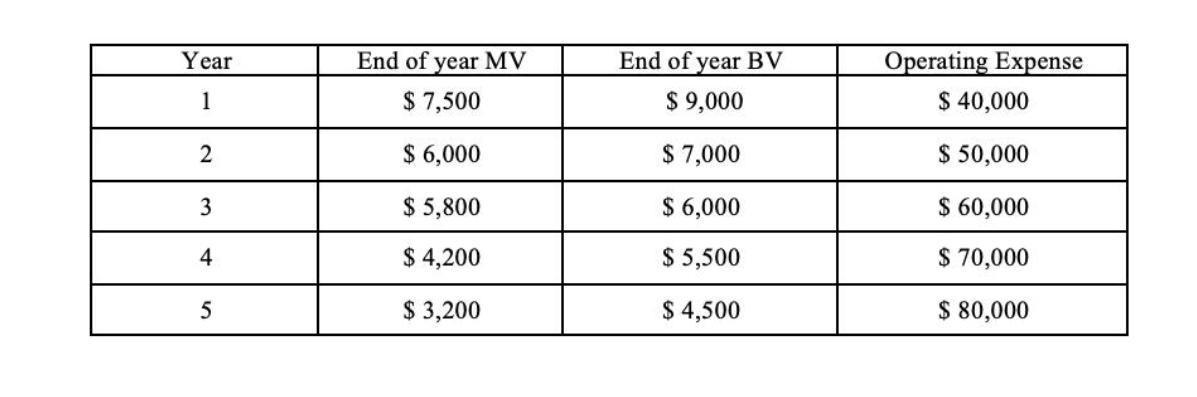

Harold's Inc. is trying to determine whether its current assembly system needs to be replaced with a more efficient one. The new system would cost $85,000 and it would have an estimated economic life of 10 years, after this period, it would have an economic value of $ 7,500. The yearly operation expenses are $30,000 per year and that Declining Balance Method of depreciation will be employed. Use salvage value = $6,000. With a remaining useful life of 5 years, the current BV of the present system is at $13,500 and has a present realizable MV of $9,000. Determine the most economical period to keep the current system before replacing it by performing an after-tax analysis. Use after-tax MARR = 18% per year and effective tax rate = 35%. Use table below for additional information. = Year 1 2 3 4 5 End of year MV $ 7,500 $ 6,000 $ 5,800 $ 4,200 $3,200 End of year BV $ 9,000 $ 7,000 $ 6,000 $5,500 $ 4,500 Operating Expense $ 40,000 $ 50,000 $ 60,000 $ 70,000 $ 80,000

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To determine the most economical period to keep the current system before replacing it we need to compare the costs and benefits of keeping the curren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started