Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harper is considering three alternative investments of $10,000. Assume that the taxpayer is in the 24 % marginal tax bracket for ordinary income and

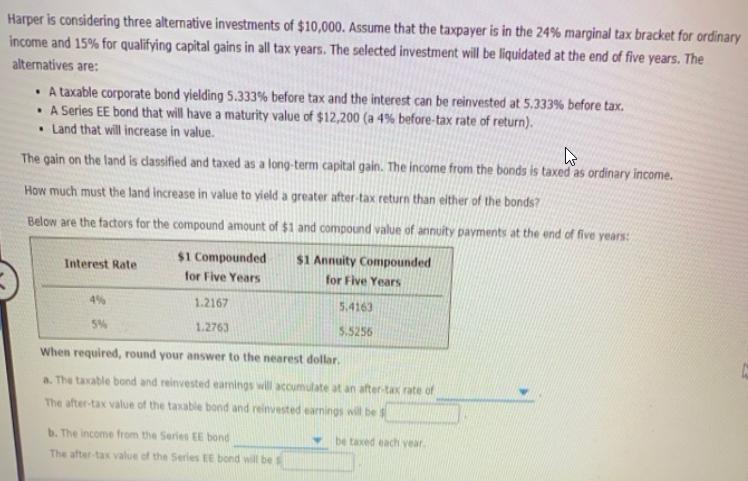

Harper is considering three alternative investments of $10,000. Assume that the taxpayer is in the 24 % marginal tax bracket for ordinary income and 15% for qualifying capital gains in all tax years. The selected investment will be liquidated at the end of five years. The alternatives are: A taxable corporate bond yielding 5.333% before tax and the interest can be reinvested at 5.333% before tax. A Series EE bond that will have a maturity value of $12,200 (a 4% before-tax rate of return). Land that will increase in value. The gain on the land is dassified and taxed as a long-term capital gain. The income from the bonds is taxed as ordinary income. How much must the land increase in value to yield a greater after-tax return than either of the bonds? Below are the factors for the compound amount of $1 and compound value of annuity pavments at the end of five years: $1 Compounded $1 Annuity Compounded Interest Rate for Five Years for Five Years 4% 1.2167 5.4163 5% 1.2763 5.5256 When required, round your answer to the nearest dollar. a. The taxable bond and reinvested earmings will accumulate at an after-tax rate of The after-tax value of the taxable bond and reinvested earnings will be $ b. The income from the Series EE bond be taxed each vear. The after-tax value of the Series EE bond will be

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Ans a The taxable bond and reinvested earnings will accumulated an aftertax rate of 4 The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started