Answered step by step

Verified Expert Solution

Question

1 Approved Answer

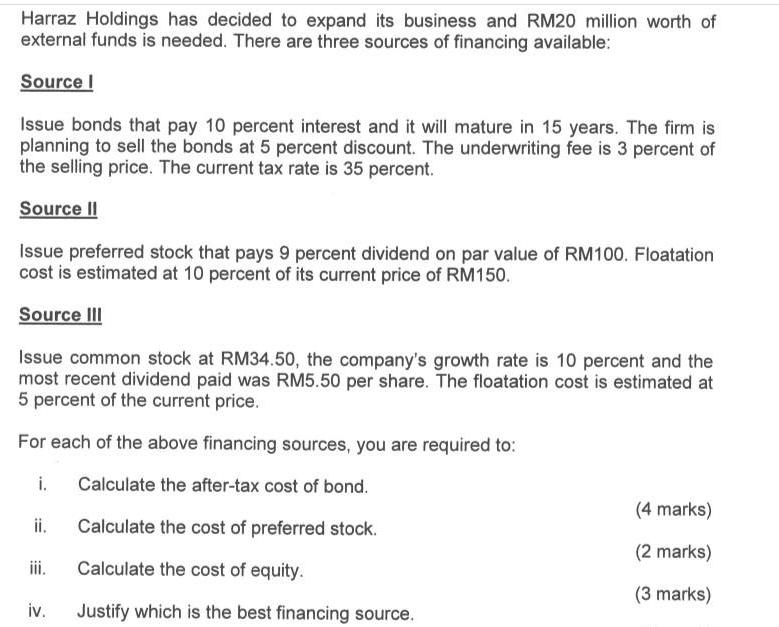

Harraz Holdings has decided to expand its business and RM20 million worth of external funds is needed. There are three sources of financing available:

Harraz Holdings has decided to expand its business and RM20 million worth of external funds is needed. There are three sources of financing available: Source I Issue bonds that pay 10 percent interest and it will mature in 15 years. The firm is planning to sell the bonds at 5 percent discount. The underwriting fee is 3 percent of the selling price. The current tax rate is 35 percent. Source II Issue preferred stock that pays 9 percent dividend on par value of RM100. Floatation cost is estimated at 10 percent of its current price of RM150. Source III Issue common stock at RM34.50, the company's growth rate is 10 percent and the most recent dividend paid was RM5.50 per share. The floatation cost is estimated at 5 percent of the current price. For each of the above financing sources, you are required to: Calculate the after-tax cost of bond. Calculate the cost of preferred stock. Calculate the cost of equity. Justify which is the best financing source. i. ii. iv. (4 marks) (2 marks) (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started