Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harrington Company is giving each of its employees a holiday bonus of $ 2 5 0 on December 1 3 , 2 0 - -

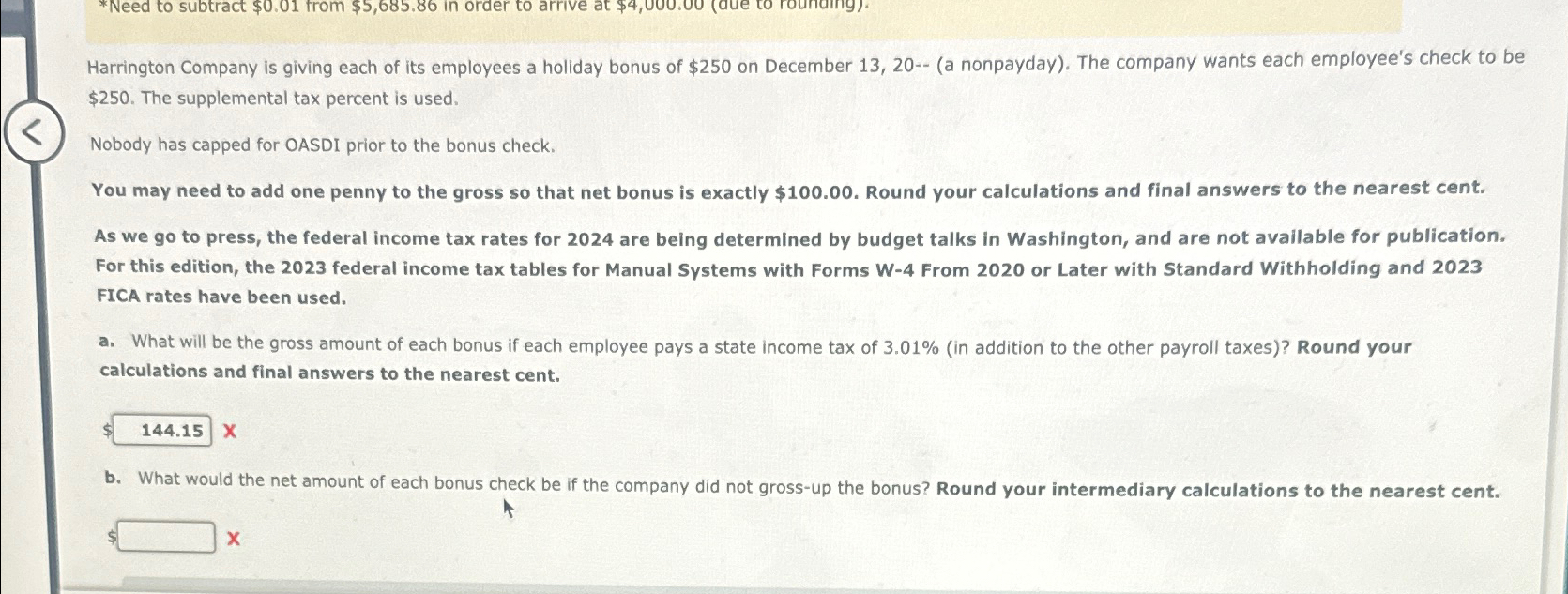

Harrington Company is giving each of its employees a holiday bonus of $ on December a nonpayday The company wants each employee's check to be $ The supplemental tax percent is used.

Nobody has capped for OASDI prior to the bonus check.

You may need to add one penny to the gross so that net bonus is exactly $ Round your calculations and final answers to the nearest cent.

As we go to press, the federal income tax rates for are being determined by budget talks in Washington, and are not avallable for publication. For this edition, the federal income tax tables for Manual Systems with Forms W From or Later with Standard Withholding and FICA rates have been used.

a What will be the gross amount of each bonus if each employee pays a state income tax of in addition to the other payroll taxes Round your calculations and final answers to the nearest cent.

$

b What would the net amount of each bonus check be if the company did not grossup the bonus? Round your intermediary calculations to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started