Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harris Corp. has a corporate tax rate of 40%, has two sources of funds: long-term debt with a market value of $10,000,000 and an

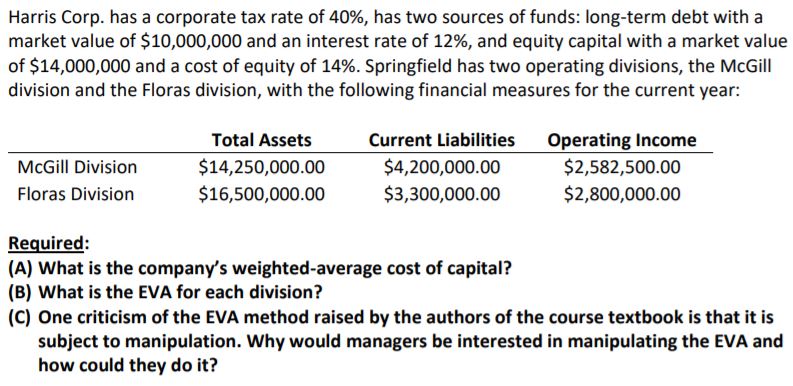

Harris Corp. has a corporate tax rate of 40%, has two sources of funds: long-term debt with a market value of $10,000,000 and an interest rate of 12%, and equity capital with a market value of $14,000,000 and a cost of equity of 14%. Springfield has two operating divisions, the McGill division and the Floras division, with the following financial measures for the current year: McGill Division Total Assets $14,250,000.00 $16,500,000.00 Current Liabilities $4,200,000.00 $3,300,000.00 Operating Income $2,582,500.00 $2,800,000.00 Floras Division Required: (A) What is the company's weighted-average cost of capital? (B) What is the EVA for each division? (C) One criticism of the EVA method raised by the authors of the course textbook is that it is subject to manipulation. Why would managers be interested in manipulating the EVA and how could they do it?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started