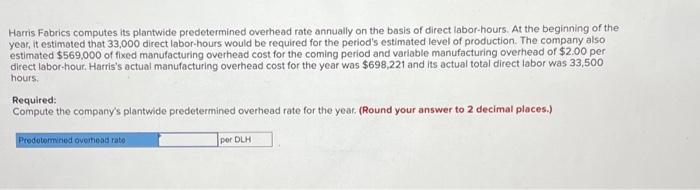

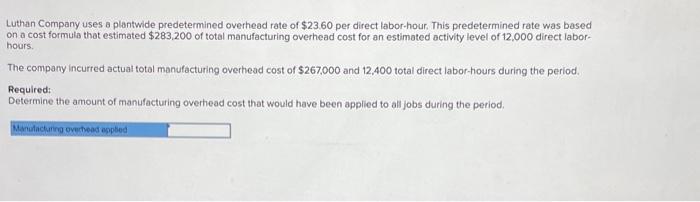

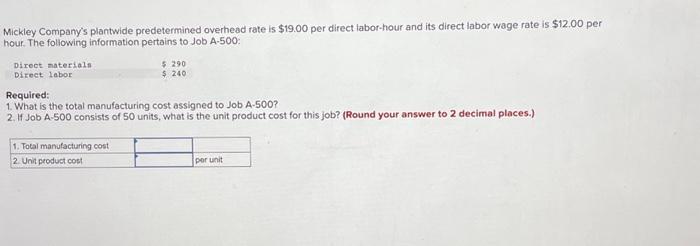

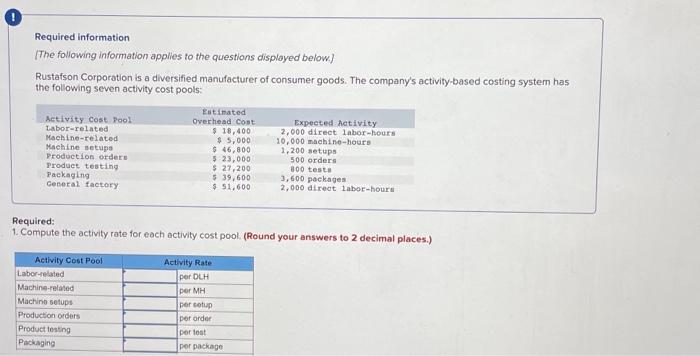

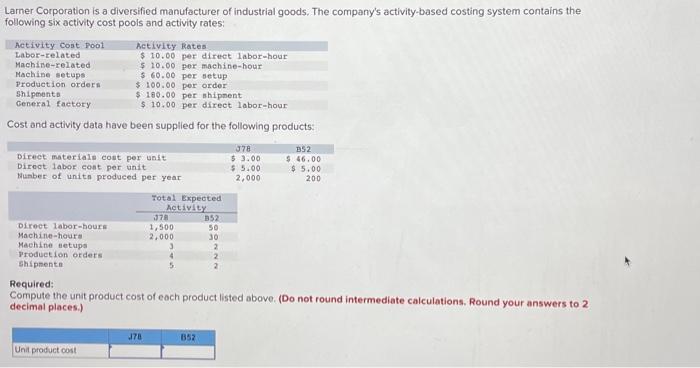

Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimoted that 33,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $569,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $2.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $698,221 and its actual total direct labor was 33,500 hours: Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) Luthan Company uses a plantwide predetermined overheed rate of $23.60 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $2.83,200 of total manufacturing overhead cost for an estimated activity level of 12,000 direct laborhours. The company incurred actual total manufacturing overhead cost of $267,000 and 12,400 total direct labor-hours during the period. Required: Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period. Mickley Company's plantwide predetermined overhead rate is $19.00 per direct labor-hour and its direct labor wage rate is $12.00 per hour. The foliowing information pertains to Job A-500: Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 50 units, whot is the unit product cost for this job? (Round your answer to 2 decimal places.) Required information [The following information applies to the questions displayed below.] Rustafson Corporation is a diversified manufacturer of consumer goods. The company's activity-based costing system has the following seven activity cost pools: Required: 1. Compute the activity rate for each activity cost pook. (Round your answers to 2 decimal places.) Lamer Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Cost and activity data have been supplied for the following products: Required: Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2 decimal places.)