Answered step by step

Verified Expert Solution

Question

1 Approved Answer

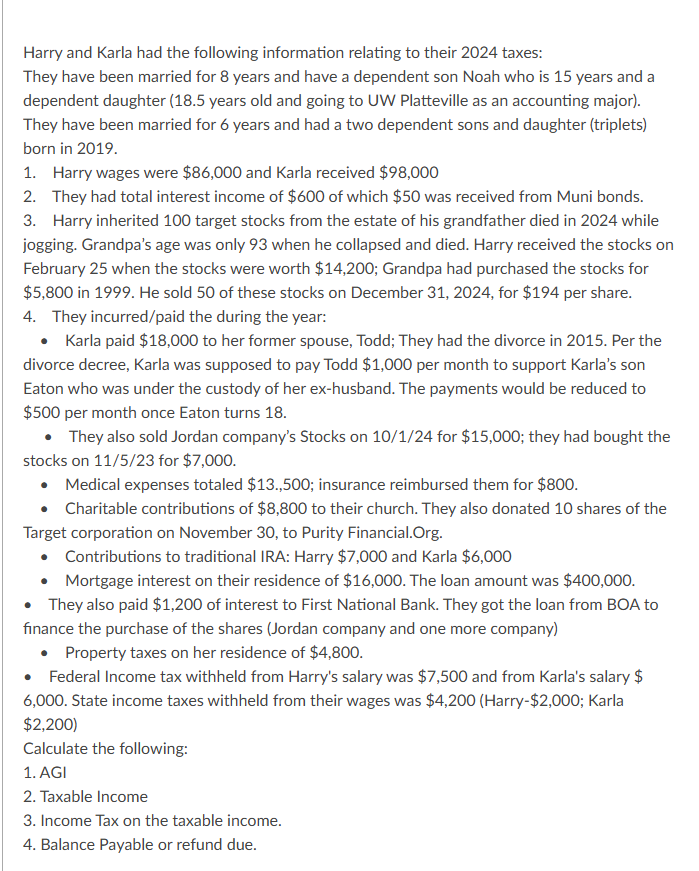

Harry and Karla had the following information relating to their 2 0 2 4 taxes: They have been married for 8 years and have a

Harry and Karla had the following information relating to their taxes:

They have been married for years and have a dependent son Noah who is years and a dependent daughter years old and going to UW Platteville as an accounting major They have been married for years and had a two dependent sons and daughter triplets born in

Harry wages were $ and Karla received $

They had total interest income of $ of which $ was received from Muni bonds.

Harry inherited target stocks from the estate of his grandfather died in while jogging. Grandpa's age was only when he collapsed and died. Harry received the stocks on February when the stocks were worth $ ; Grandpa had purchased the stocks for $ in He sold of these stocks on December for $ per share.

They incurredpaid the during the year:

Karla paid $ to her former spouse, Todd; They had the divorce in Per the divorce decree, Karla was supposed to pay Todd $ per month to support Karla's son Eaton who was under the custody of her exhusband. The payments would be reduced to $ per month once Eaton turns

They also sold Jordan company's Stocks on for $ ; they had bought the stocks on for $

Medical expenses totaled $ ; insurance reimbursed them for $

Charitable contributions of $ to their church. They also donated shares of the Target corporation on November to Purity Financial.Org.

Contributions to traditional IRA: Harry $ and Karla $

Mortgage interest on their residence of $ The loan amount was $

They also paid $ of interest to First National Bank. They got the loan from BOA to finance the purchase of the shares Jordan company and one more company

Property taxes on her residence of $

Federal Income tax withheld from Harry's salary was $ and from Karla's salary $

State income taxes withheld from their wages was $Harry$; Karla $

Calculate the following:

AGI

Taxable Income

Income Tax on the taxable income.

Balance Payable or refund due.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started