Question

Harry has worked at a medium size interior design firm for 5 years and earns a salary of $4080 per month. He also received $3000

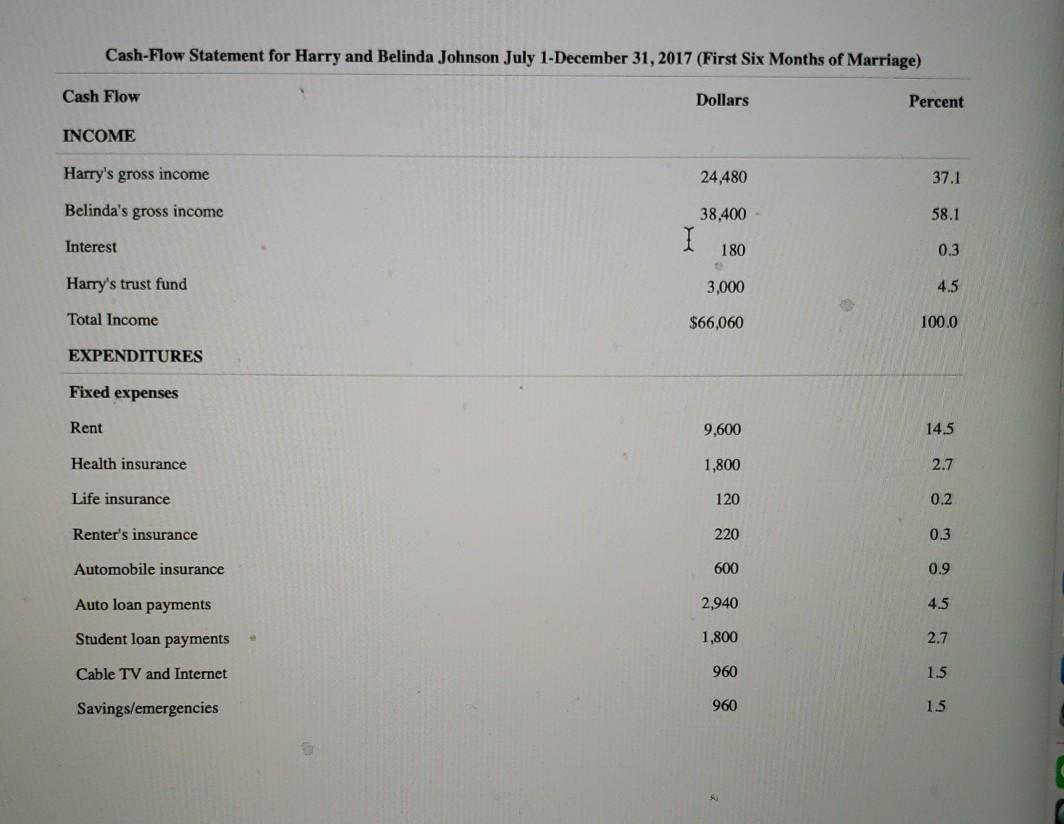

Harry has worked at a medium size interior design firm for 5 years and earns a salary of $4080 per month. He also received $3000 in interest income once a year from a trust fund set up by his deceased father's estate. Belinda earns a salary of $6400 per month, and she has many job-related benefits including flexible benefits program, life insurance, health insurance, a 401k retirement program, workplace financial education and a credit union.

Using data from the statements, calculate:

1)liquidity ratio 2)asset to debt ratio 3)debt to income ratio 4)debt payments to disposable income ratio 5) investment assets to total assets ratio

What do these ratios tell you about the Johnson financial situation? Should Harry and Belinda incur more debt, such as credit cards or a new vehicle loan?

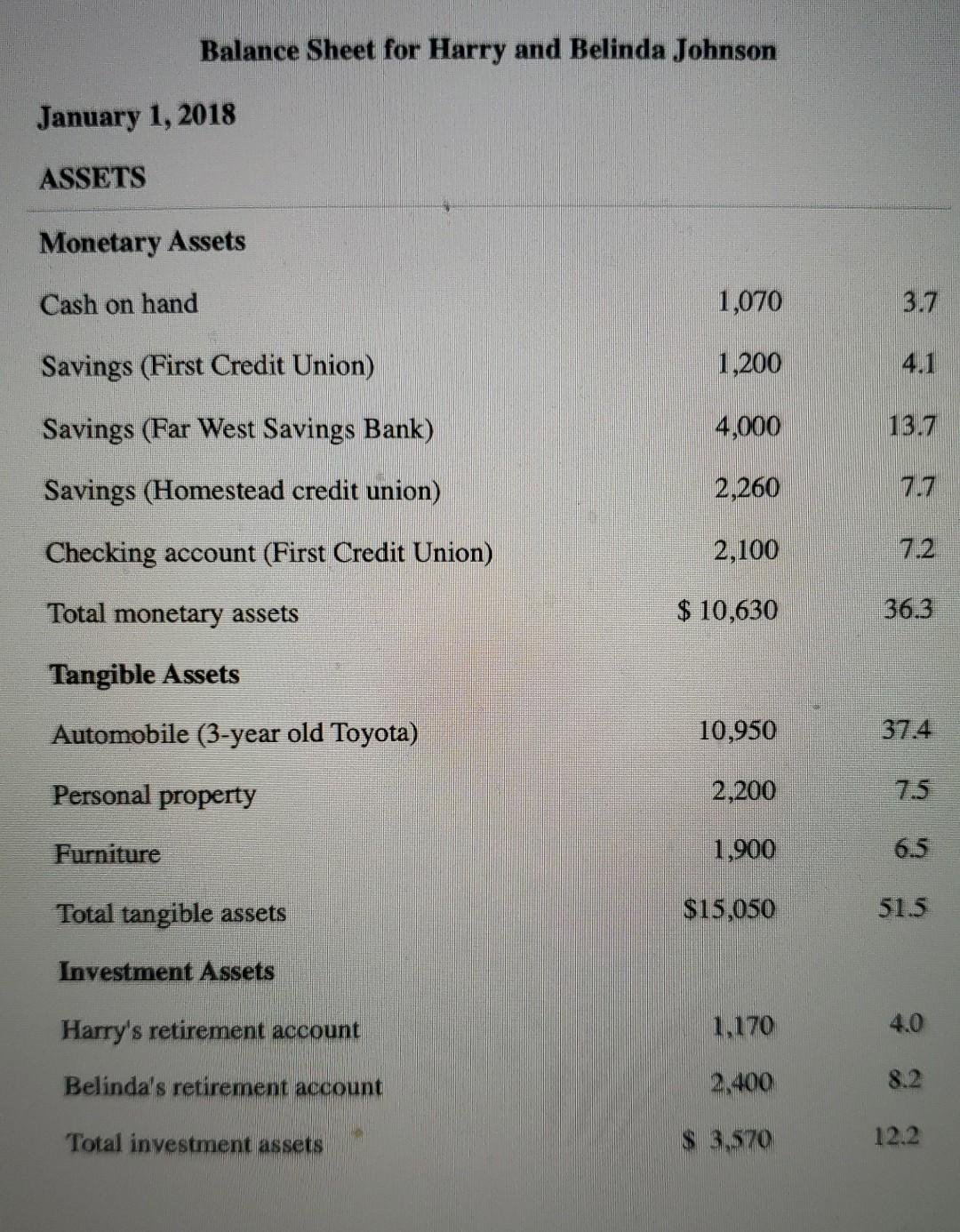

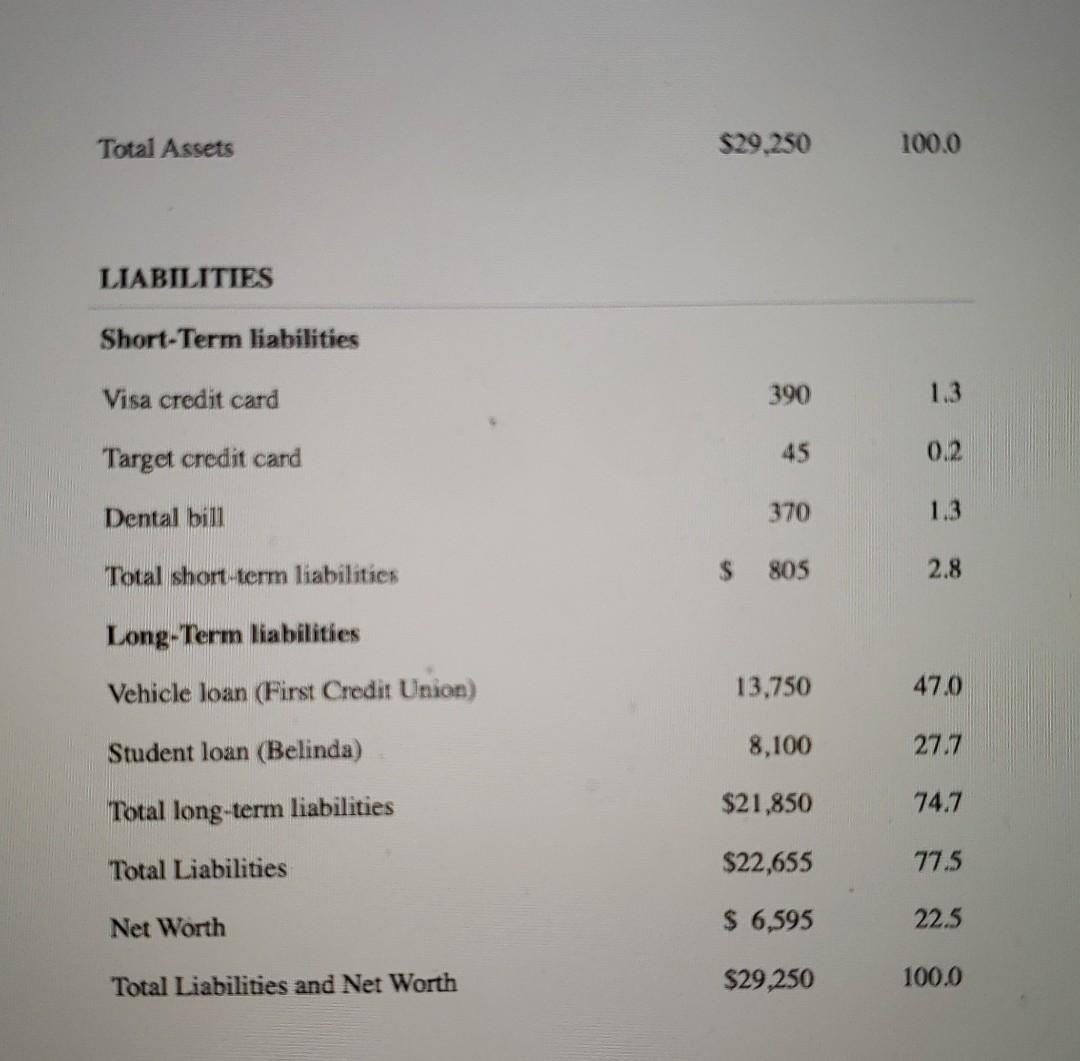

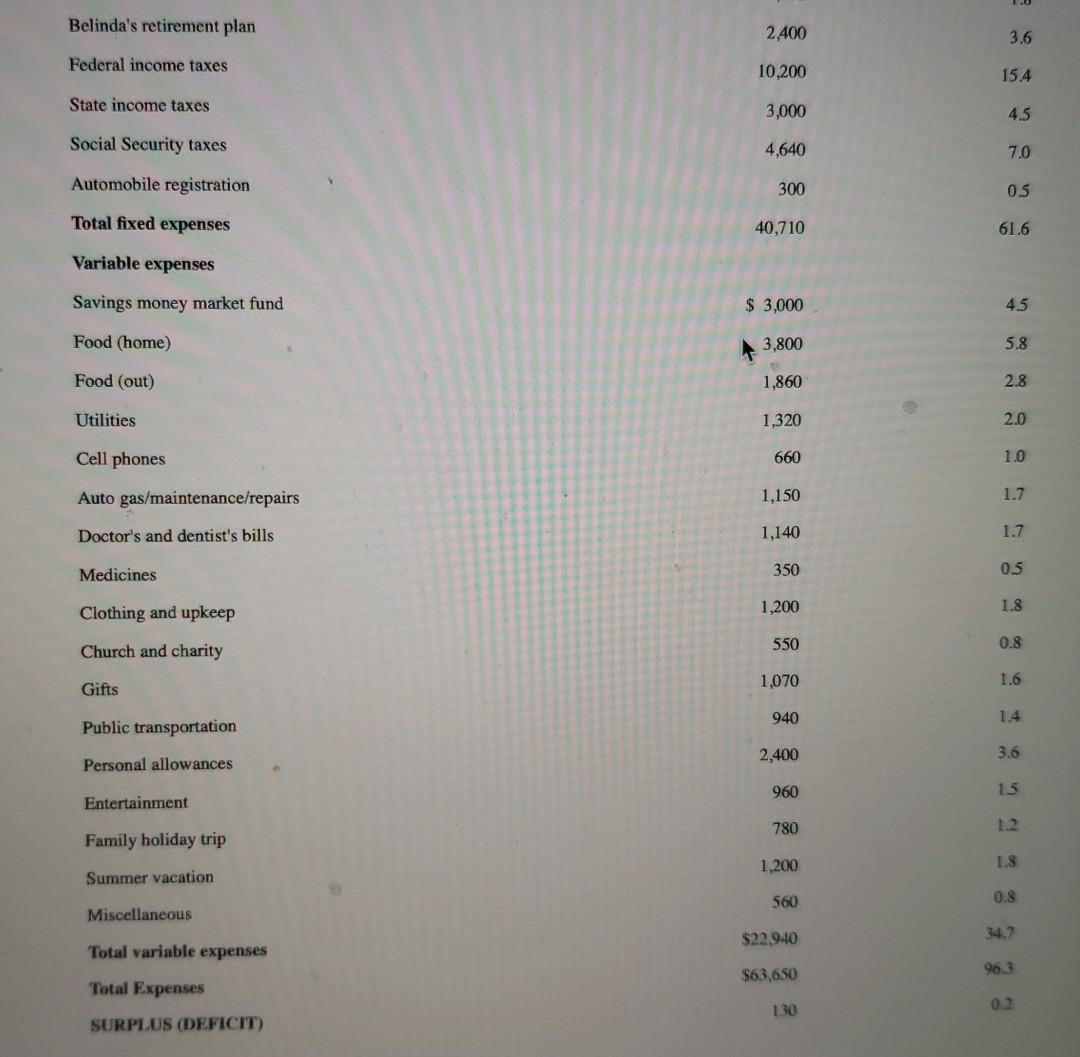

Balance Sheet for Harry and Belinda Johnson January 1, 2018 ASSETS Monetary Assets Cash on hand 1,070 3.7 Savings (First Credit Union) 1,200 4.1 Savings (Far West Savings Bank) 4,000 13.7 Savings (Homestead credit union) 2,260 Checking account (First Credit Union) 2,100 Total monetary assets $ 10,630 36.3 Tangible Assets Automobile (3-year old Toyota) 10,950 37.4 Personal property 2,200 Furniture 1,900 6.5 Total tangible assets $15,050 51.5 Investment Assets Harry's retirement account 1,170 4.0 Belinda's retirement account 2.400 8.2 Total investment assets $ 3,570 12.2 Total Assets $29.250 100.0 LIABILITIES Short-Term liabilities Visa credit card 390 1.3 Target credit card 45 0.2 Dental bili 370 1.3 Total short-term liabilities $ 805 2.8 Long-Term liabilities Vehicle loan (First Credit Union) 13,750 47.0 Student loan (Belinda) 8,100 27.7 Total long-term liabilities $21,850 74.7 Total Liabilities $22,655 77.5 Net Worth $ 6,595 22.5 Total Liabilities and Net Worth $29.250 100.0 Cash-Flow Statement for Harry and Belinda Johnson July 1-December 31, 2017 (First Six Months of Marriage) Cash Flow Dollars Percent INCOME Harry's gross income 24,480 37.1 Belinda's gross income 58.1 38,400 I 180 Interest 0.3 Harry's trust fund 3,000 4.5 Total Income $66,060 100.0 EXPENDITURES Fixed expenses Rent 9,600 14.5 Health insurance 1,800 2.7 Life insurance 120 0.2 Renter's insurance 220 0.3 Automobile insurance 600 0.9 Auto loan payments 2,940 4.5 Student loan payments 1,800 2.7 Cable TV and Internet 960 1.5 Savings/emergencies 960 1.5 Belinda's retirement plan 2,400 3.6 Federal income taxes 10,200 15.4 State income taxes 3,000 4.5 Social Security taxes 4,640 7.0 Automobile registration 300 05 Total fixed expenses 40,710 61.6 Variable expenses Savings money market fund $ 3,000 45 Food (home) 3,800 5.8 Food (out) 1,860 2.8 Utilities 1,320 2.0 Cell phones 660 1.0 1,150 1.7 Auto gas/maintenance/repairs Doctor's and dentist's bills 1,140 1.7 Medicines 350 05 1,200 1.8 Clothing and upkeep 550 0.8 Church and charity Gifts 1,070 1.6 940 1.4 Public transportation 2,400 3.6 Personal allowances 960 15 Entertainment 780 Family holiday trip 1,200 1.8 Summer vacation 560 0.8 Miscellaneous $22.940 34.7 Total variable expenses $63,650 963 Total Expenses 130 0.2 SURPLUS (DEFICIT)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started