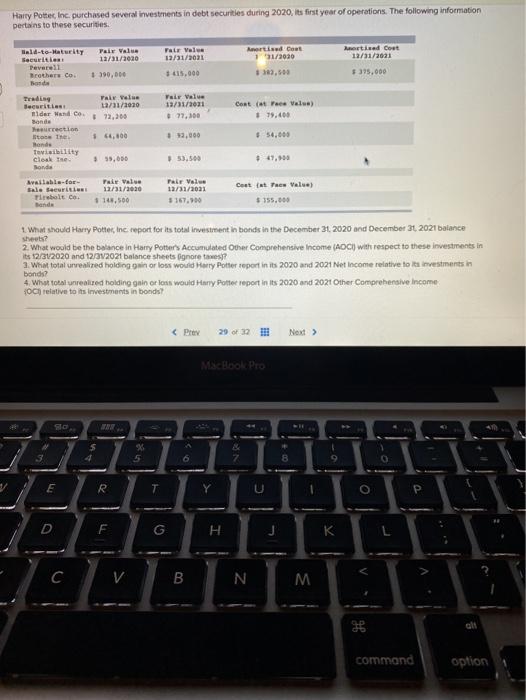

Harry Potter, Inc. purchased several investments in debt securities during 2020, its first year of operations. The following information pertains to these securities. 14-to-Maturity Fair Val Securities 13/31/2010 Peverell Brothers Coi 190,00 hands Tale Value 12/31/2021 415.000 Knerted out 1 31/3030 133,603 Artied Coet 12/31/2021 $395,000 Vair value 19/31/2001 Contace Value) 19,400 Trading Tai Velo Securities ta/31/2010 der Wand co. 73.300 Bonde erection toe te honde Toisibility cloak the $ 55,000 ) # 12,000 #54.000 53,500 #49,95 Available for Sale Securi! Tubolt co Bande Paie Value 12/31/2010 10,500 Pair Value 12/31/2001 3167.900 Costit Pes Value) 355.000 1. What should Harry Potter, Inc. report for its total investment in bonds in the December 31, 2020 and December 31, 2021 balance 2. What would be the balance in Harry Potter's Accumulated Other Comprehensive Income (ADC) with respect to these investments in its 12/312020 and 12/012021 balance sheets ignore 3. Wist total unrealized holding in or loss would Hary Potter report in its 2020 and 2021 Net Income reintive to ta investments in bonds? what tonai surrealized holding onin or lonn would Hary Potter report in its 2020 and 2021 Other Comprehensive Income Och relative to its investments in bonds MScHook Pro HO. $ % 6 7 E R D F G H K c V B N M * commond option Harry Potter, Inc. purchased several investments in debt securities during 2020, its first year of operations. The following information pertains to these securities. 14-to-Maturity Fair Val Securities 13/31/2010 Peverell Brothers Coi 190,00 hands Tale Value 12/31/2021 415.000 Knerted out 1 31/3030 133,603 Artied Coet 12/31/2021 $395,000 Vair value 19/31/2001 Contace Value) 19,400 Trading Tai Velo Securities ta/31/2010 der Wand co. 73.300 Bonde erection toe te honde Toisibility cloak the $ 55,000 ) # 12,000 #54.000 53,500 #49,95 Available for Sale Securi! Tubolt co Bande Paie Value 12/31/2010 10,500 Pair Value 12/31/2001 3167.900 Costit Pes Value) 355.000 1. What should Harry Potter, Inc. report for its total investment in bonds in the December 31, 2020 and December 31, 2021 balance 2. What would be the balance in Harry Potter's Accumulated Other Comprehensive Income (ADC) with respect to these investments in its 12/312020 and 12/012021 balance sheets ignore 3. Wist total unrealized holding in or loss would Hary Potter report in its 2020 and 2021 Net Income reintive to ta investments in bonds? what tonai surrealized holding onin or lonn would Hary Potter report in its 2020 and 2021 Other Comprehensive Income Och relative to its investments in bonds MScHook Pro HO. $ % 6 7 E R D F G H K c V B N M * commond option