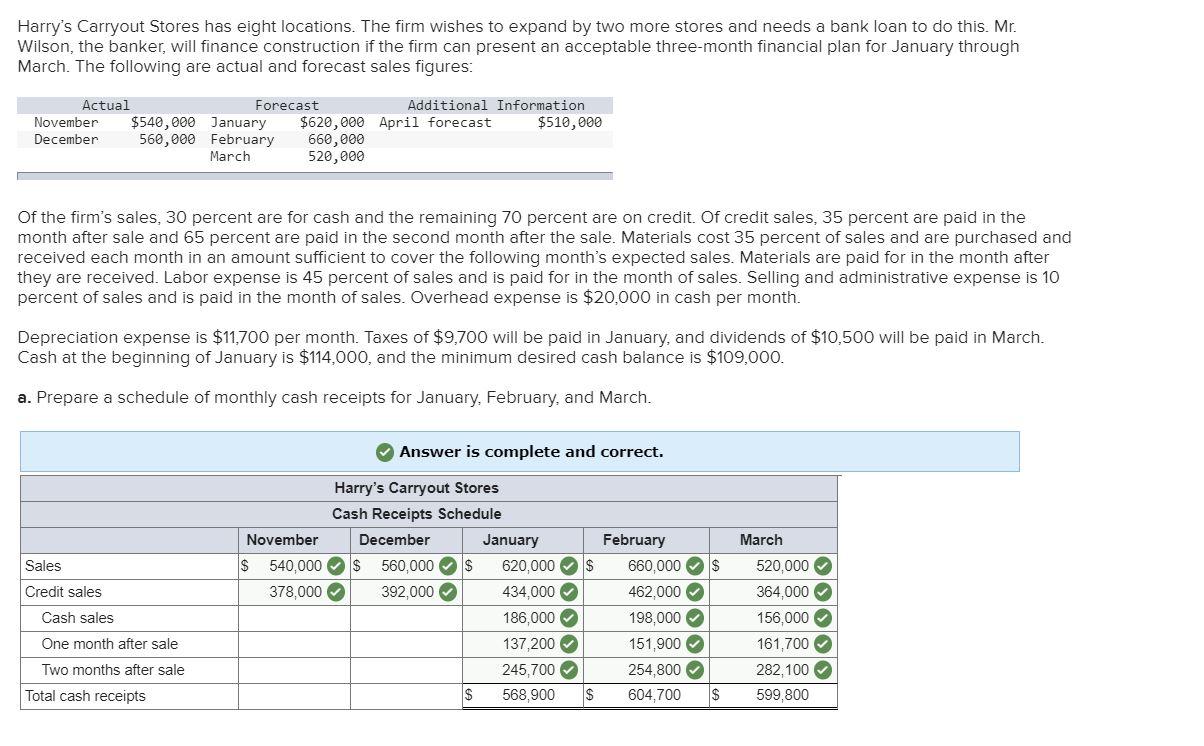

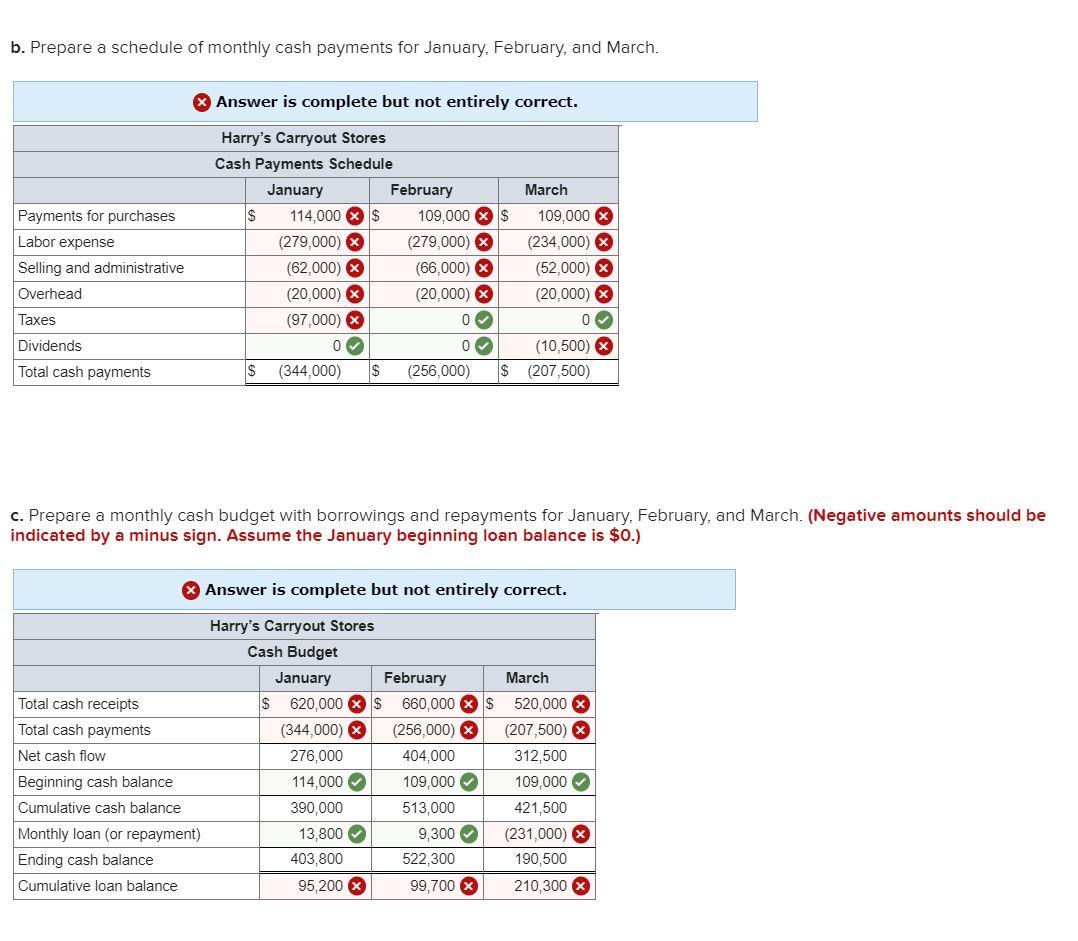

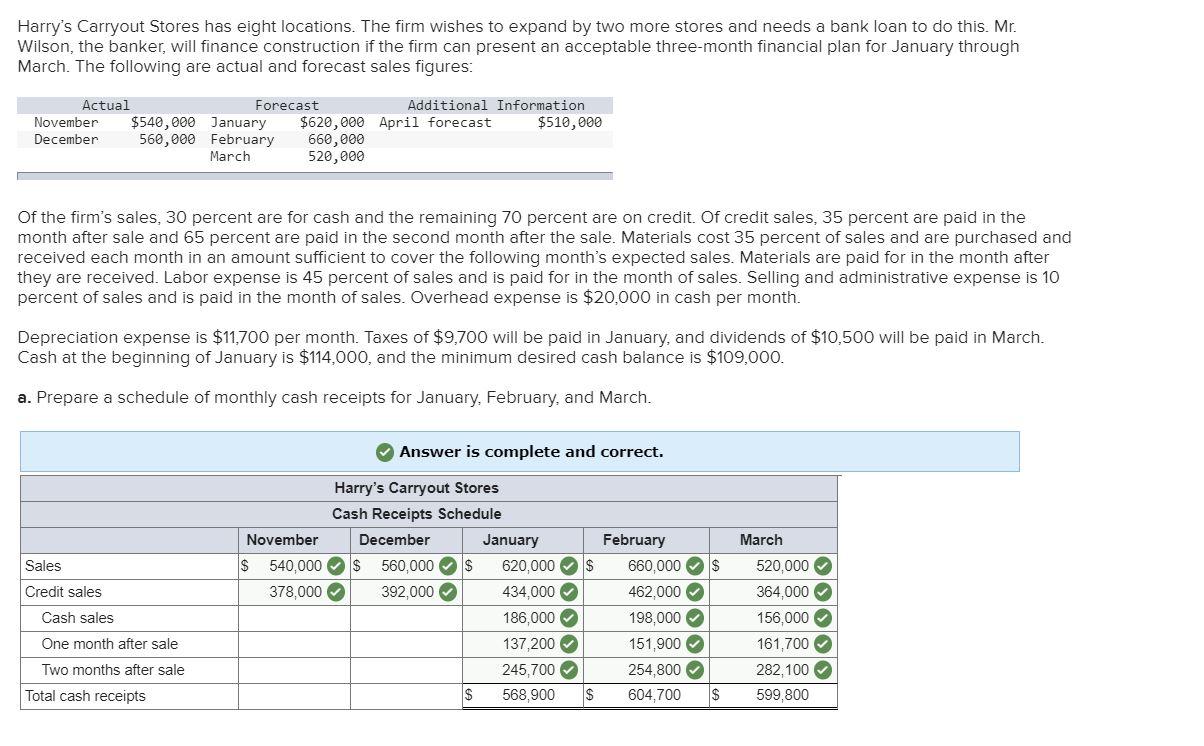

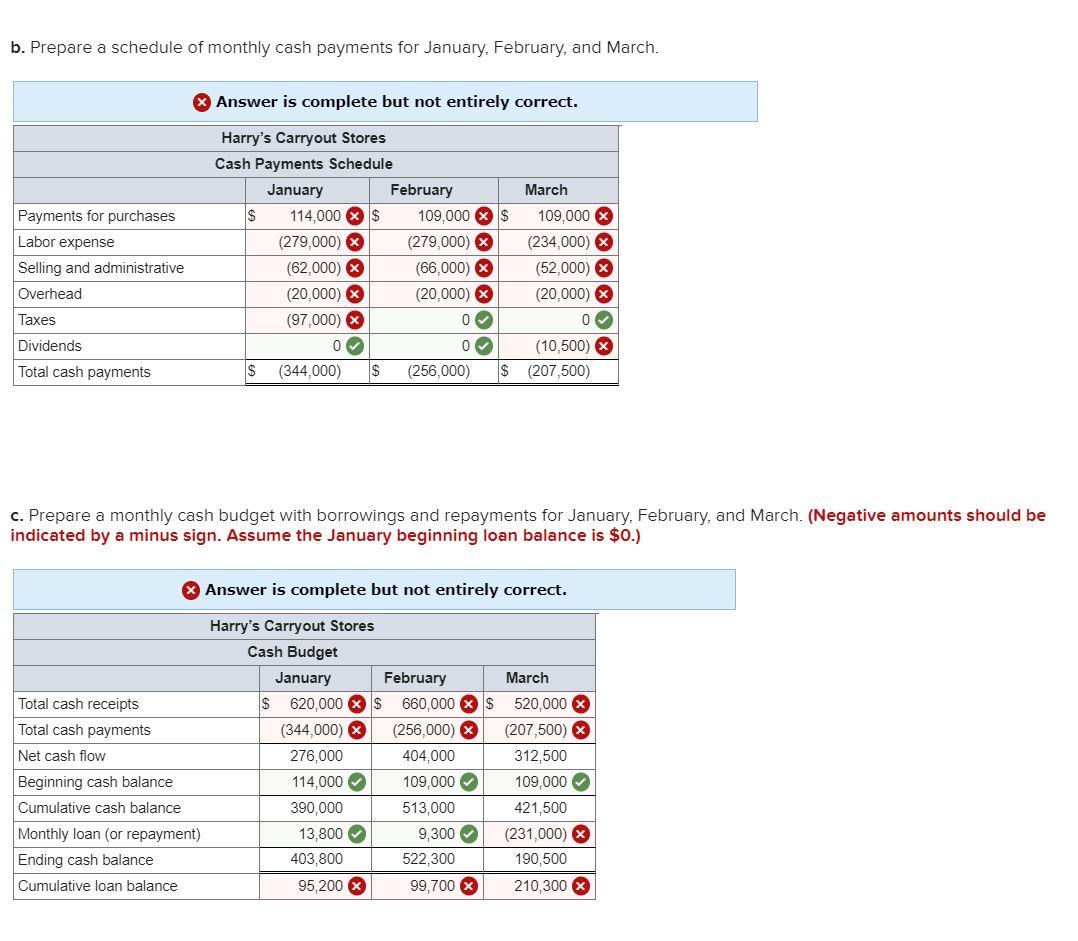

Harry's Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mr. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: Actual Forecast Additional Information November $540,000 January $620,000 April forecast $510,000 December 560,000 February 660,000 March 520,000 Of the firm's sales, 30 percent are for cash and the remaining 70 percent are on credit. Of credit sales, 35 percent are paid in the month after sale and 65 percent are paid in the second month after the sale. Materials cost 35 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 45 percent of sales and is paid for in the month of sales. Selling and administrative expense is 10 percent of sales and is paid in the month of sales. Overhead expense is $20,000 in cash per month. Depreciation expense is $11,700 per month. Taxes of $9,700 will be paid in January, and dividends of $10,500 will be paid in March. Cash at the beginning of January is $114,000, and the minimum desired cash balance is $109,000. a. Prepare a schedule of monthly cash receipts for January, February, and March. Answer is complete and correct. March Sales Credit sales Harry's Carryout Stores Cash Receipts Schedule November December January $ 540,000 $ 560,000 $ 620,000$ 378,000 392,000 434,000 186,000 137,200 245,700 $ 568,900 $ Cash sales February 660,000$ 462,000 198,000 151,900 254,800 604,700 $ 520,000 364,000 156,000 161,700 282,100 599,800 One month after sale Two months after sale Total cash receipts b. Prepare a schedule of monthly cash payments for January, February, and March. Answer is complete but not entirely correct. Payments for purchases Labor expense Selling and administrative Overhead Harry's Carryout Stores Cash Payments Schedule January February $ 114,000 X $ 109,000 X $ (279,000) X (279,000) X (62,000) X (66.000) x (20,000) X (20,000) X (97,000) 0 0 $ (344,000) $ (256,000) $ March 109,000 X (234,000) X (52,000) X (20.000) X Taxes 0 Dividends Total cash payments (10,500) X (207,500) c. Prepare a monthly cash budget with borrowings and repayments for January, February, and March. (Negative amounts should be indicated by a minus sign. Assume the January beginning loan balance is $0.) * Answer is complete but not entirely correct. Total cash receipts Total cash payments Net cash flow Beginning cash balance Cumulative cash balance Monthly loan (or repayment) Ending cash balance Cumulative loan balance Harry's Carryout Stores Cash Budget January February March $ 620,000 X $ 660.000 $ 520,000 (344,000) X (256,000) X (207,500) X 276,000 404,000 312,500 114,000 109,000 109,000 390,000 513,000 421,500 13,800 9,300 (231,000) X 403,800 522,300 190,500 95,200 X 99,700 210,300 Harry's Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mr. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: Actual Forecast Additional Information November $540,000 January $620,000 April forecast $510,000 December 560,000 February 660,000 March 520,000 Of the firm's sales, 30 percent are for cash and the remaining 70 percent are on credit. Of credit sales, 35 percent are paid in the month after sale and 65 percent are paid in the second month after the sale. Materials cost 35 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 45 percent of sales and is paid for in the month of sales. Selling and administrative expense is 10 percent of sales and is paid in the month of sales. Overhead expense is $20,000 in cash per month. Depreciation expense is $11,700 per month. Taxes of $9,700 will be paid in January, and dividends of $10,500 will be paid in March. Cash at the beginning of January is $114,000, and the minimum desired cash balance is $109,000. a. Prepare a schedule of monthly cash receipts for January, February, and March. Answer is complete and correct. March Sales Credit sales Harry's Carryout Stores Cash Receipts Schedule November December January $ 540,000 $ 560,000 $ 620,000$ 378,000 392,000 434,000 186,000 137,200 245,700 $ 568,900 $ Cash sales February 660,000$ 462,000 198,000 151,900 254,800 604,700 $ 520,000 364,000 156,000 161,700 282,100 599,800 One month after sale Two months after sale Total cash receipts b. Prepare a schedule of monthly cash payments for January, February, and March. Answer is complete but not entirely correct. Payments for purchases Labor expense Selling and administrative Overhead Harry's Carryout Stores Cash Payments Schedule January February $ 114,000 X $ 109,000 X $ (279,000) X (279,000) X (62,000) X (66.000) x (20,000) X (20,000) X (97,000) 0 0 $ (344,000) $ (256,000) $ March 109,000 X (234,000) X (52,000) X (20.000) X Taxes 0 Dividends Total cash payments (10,500) X (207,500) c. Prepare a monthly cash budget with borrowings and repayments for January, February, and March. (Negative amounts should be indicated by a minus sign. Assume the January beginning loan balance is $0.) * Answer is complete but not entirely correct. Total cash receipts Total cash payments Net cash flow Beginning cash balance Cumulative cash balance Monthly loan (or repayment) Ending cash balance Cumulative loan balance Harry's Carryout Stores Cash Budget January February March $ 620,000 X $ 660.000 $ 520,000 (344,000) X (256,000) X (207,500) X 276,000 404,000 312,500 114,000 109,000 109,000 390,000 513,000 421,500 13,800 9,300 (231,000) X 403,800 522,300 190,500 95,200 X 99,700 210,300