Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harvey Auto Parts purchased a new crane on September 1 for $35,000, paying $10,000 cash and signing a 7%, 12-month note for the remaining

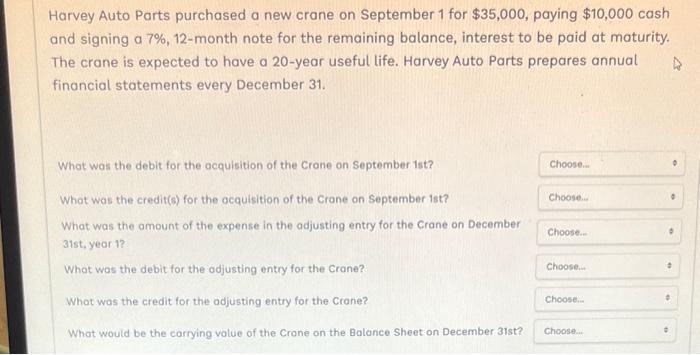

Harvey Auto Parts purchased a new crane on September 1 for $35,000, paying $10,000 cash and signing a 7%, 12-month note for the remaining balance, interest to be paid at maturity. The crane is expected to have a 20-year useful life. Harvey Auto Parts prepares annual financial statements every December 31. What was the debit for the acquisition of the Crane on September 1st? Choose... What was the credit(s) for the acquisition of the Crane on September 1st? Choose... 0 What was the amount of the expense in the adjusting entry for the Crane on December 31st, year 1? Choose... What was the debit for the adjusting entry for the Crane? Choose... What was the credit for the adjusting entry for the Crane? What would be the carrying value of the Crane on the Balance Sheet on December 31st? Choose... Choose...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Acquisition of the Crane on September 1st a What was the debit for the acquisition of the Crane on September 1st The total cost of the crane is 3500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started