Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HAS TO BE ON BA II Plus Professional Calculator, please show key strokes. 1. Suppose that you take out a loan for $100,000. The loan

HAS TO BE ON BA II Plus Professional Calculator, please show key strokes.

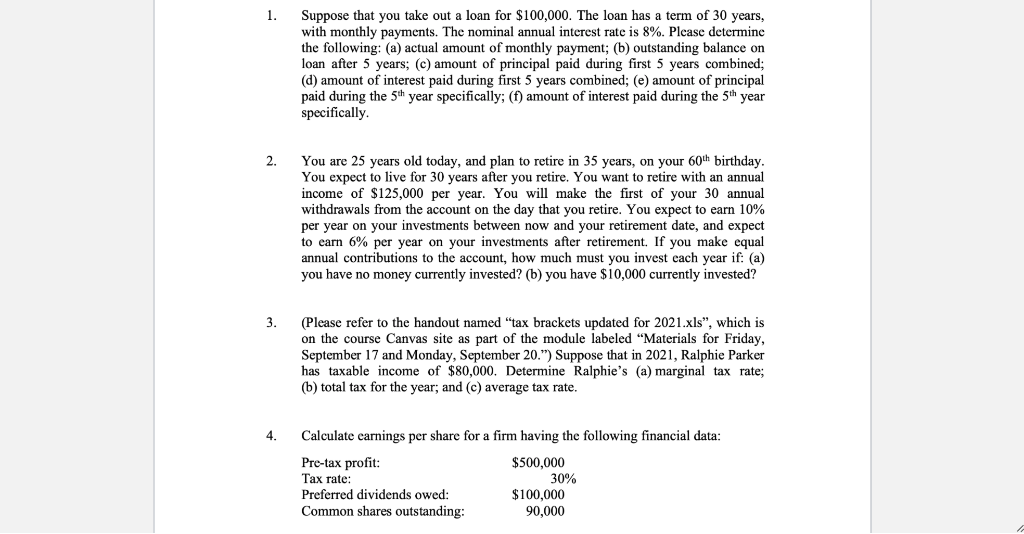

1. Suppose that you take out a loan for $100,000. The loan has a term of 30 years, with monthly payments. The nominal annual interest rate is 8%. Please determine the following: (a) actual amount of monthly payment; (b) outstanding balance on loan after 5 years; (c) amount of principal paid during first 5 years combined; (d) amount of interest paid during first 5 years combined; (e) amount of principal paid during the 5th year specifically; (f) amount of interest paid during the 5th year specifically. 2. You are 25 years old today, and plan to retire in 35 years, on your 60th birthday. You expect to live for 30 years after you retire. You want to retire with an annual income of $125,000 per year. You will make the first of your 30 annual withdrawals from the account on the day that you retire. You expect to earn 10% per year on your investments between now and your retirement date, and expect to earn 6% per year on your investments after retirement. If you make equal annual contributions to the account, how much must you invest each year if: (a) you have no money currently invested? (b) you have $10,000 currently invested? 3. (Please refer to the handout named "tax brackets updated for 2021.xls, which is on the course Canvas site as part of the module labeled Materials for Friday, September 17 and Monday, September 20.") Suppose that in 2021, Ralphie Parker has taxable income of $80,000. Determine Ralphie's (a) marginal tax rate; (b) total tax for the year, and (c) average tax rate. 4. Calculate earnings per share for a firm having the following financial data: Pre-tax profit: $500,000 Tax rate: 30% Preferred dividends owed: $100,000 Common shares outstanding: 90,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started