Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Haulem Equipment Inc. issued $82 million in 20-year bonds to finance the expansion of its school bus manufacturing operations in Winnipeg. The bonds pay

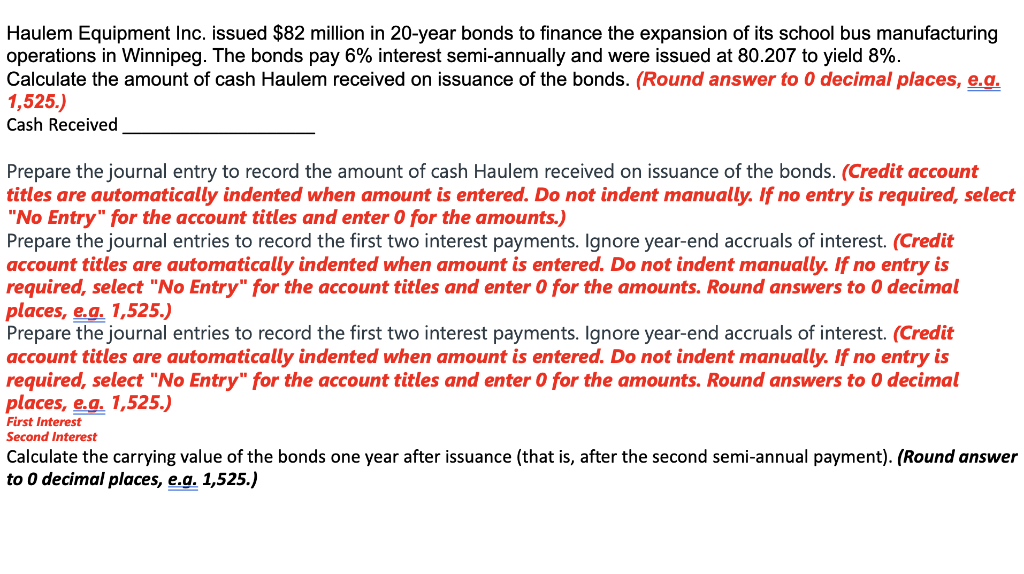

Haulem Equipment Inc. issued $82 million in 20-year bonds to finance the expansion of its school bus manufacturing operations in Winnipeg. The bonds pay 6% interest semi-annually and were issued at 80.207 to yield 8%. Calculate the amount of cash Haulem received on issuance of the bonds. (Round answer to 0 decimal places, e.g. 1,525.) Cash Received Prepare the journal entry to record the amount of cash Haulem received on issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Prepare the journal entries to record the first two interest payments. Ignore year-end accruals of interest. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 1,525.) Prepare the journal entries to record the first two interest payments. Ignore year-end accruals of interest. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 1,525.) First Interest Second Interest Calculate the carrying value of the bonds one year after issuance (that is, after the second semi-annual payment). (Round answer to 0 decimal places, e.g. 1,525.)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Cash Price received on Issue of Bonds 82 Million 80207 Cash Price received on Issue of Bonds 6576974...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started