Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $84,000 and it has claimed $38,000

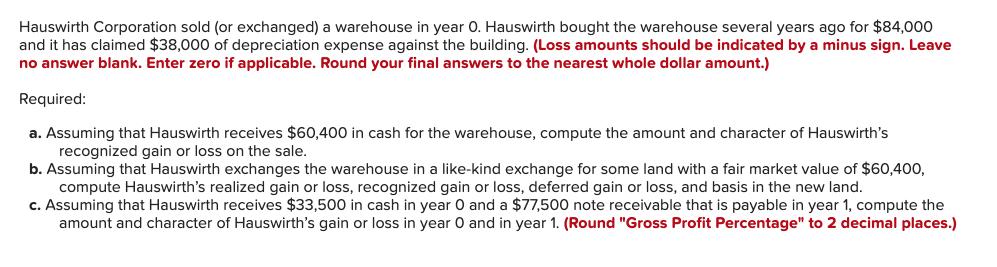

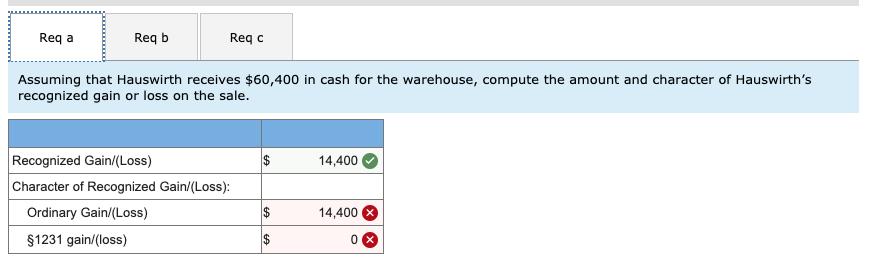

Hauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $84,000 and it has claimed $38,000 of depreciation expense against the building. (Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Round your final answers to the nearest whole dollar amount.) Required: a. Assuming that Hauswirth receives $60,400 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. b. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $60,400, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. c. Assuming that Hauswirth receives $33,500 in cash in year 0 and a $77,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year O and in year 1. (Round "Gross Profit Percentage" to 2 decimal places.) Req a Req b Req c Assuming that Hauswirth receives $60,400 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. Recognized Gain/(Loss) 14,400 Character of Recognized Gain/(Loss): Ordinary Gain/(Loss) 14,400 $1231 gain/(loss) %24 %24 Req a Req b Req c Assuming that Hauswirth receives $33,500 in cash in year 0 and a $77,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1. (Round "Gross Profit Percentage" to 2 decimal places.) Description Amount Character Amount Realized Original Basis Accumulated Depreciation 111,000 2$ 84,000 $ (38,000) Adjusted Basis Gain (Loss) Realized Depreciation Recapture Gain Eligible for Installment Reporting 46,000 2$ 65,000 $ 38,000 Ordinary Income $ 27,000 Gross Profit Percentage 24.32 8 % Installment Gain (Loss) in year 0 Section 1231 gain Section 1231 gain 8,147 Installment Gain (Loss) in year 1 18,848 %24 %24 %24

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answera Recognized GainLoss Claimed cost Claimed depreciation exp Bought costwarehouse 60400 38000 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started