have some explanations please

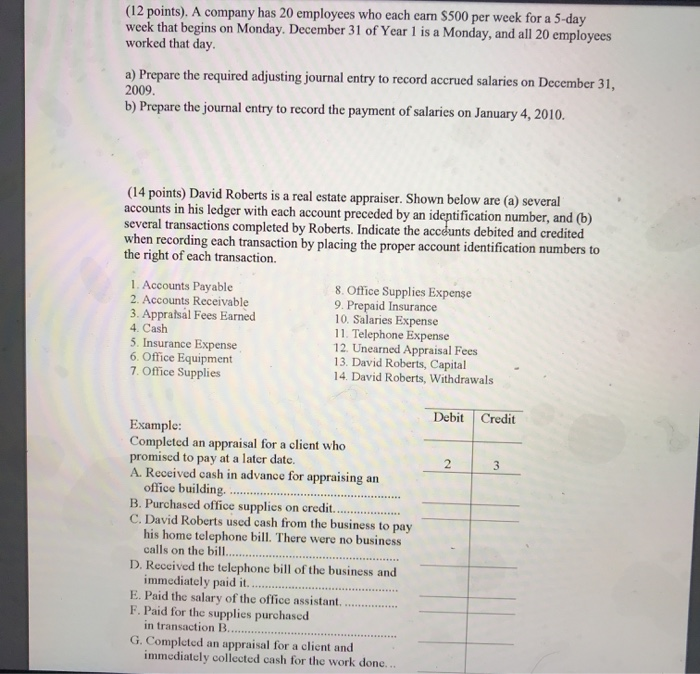

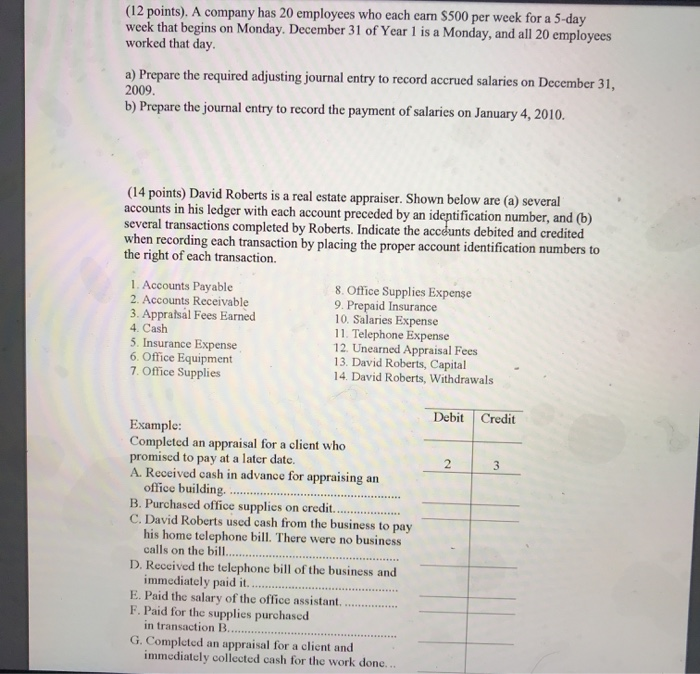

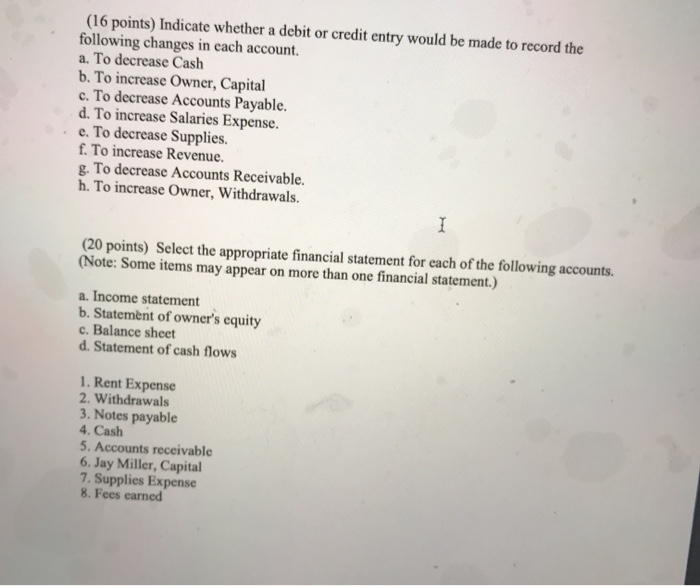

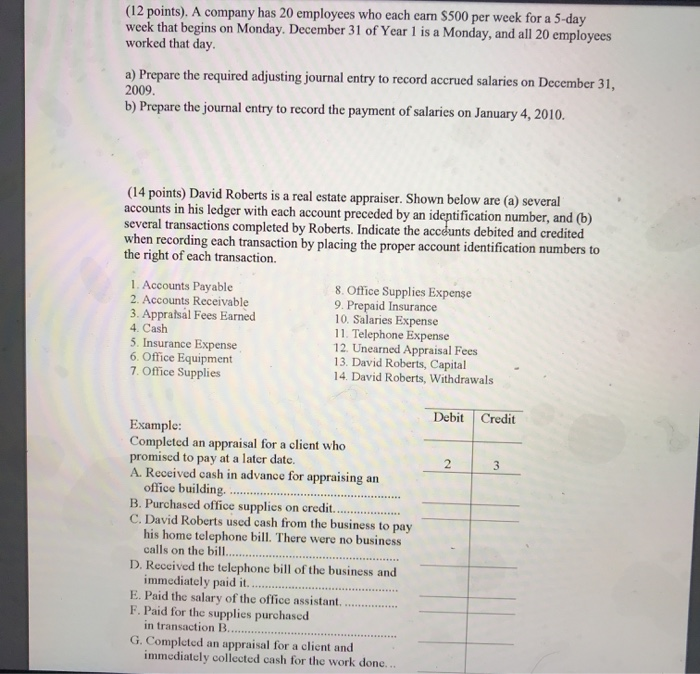

(12 points). A company has 20 employees who each earn $500 per week for a 5-day week that begins on Monday, December 31 of Year 1 is a Monday, and all 20 employees worked that day. a) Prepare the required adjusting journal entry to record accrued salaries on December 31, 2009 b) Prepare the journal entry to record the payment of salaries on January 4, 2010. (14 points) David Roberts is a real estate appraiser. Shown below are a) several accounts in his ledger with each account preceded by an identification number, and (b) several transactions completed by Roberts. Indicate the accdunts debited and credited when recording each transaction by placing the proper account identification numbers to the right of each transaction. 1. Accounts Payable 8. Office Supplies Expense 2. Accounts Receivable 9. Prepaid Insurance 3. Appraisal Fees Earned 10. Salaries Expense 11. Telephone Expense 5. Insurance Expense 12. Unearned Appraisal Fees 6. Office Equipment 13. David Roberts, Capital 7. Office Supplies 14. David Roberts, Withdrawals 4. Cash Debit Credit 2 3 Example: Completed an appraisal for a client who promised to pay at a later date. A. Received cash in advance for appraising an office building. B. Purchased office supplies on credit.. C. David Roberts used cash from the business to pay his home telephone bill. There were no business calls on the bill..... D. Received the telephone bill of the business and immediately paid it. E. Paid the salary of the office assistant F. Paid for the supplies purchased in transaction B.... G. Completed an appraisal for a client and immediately collected cash for the work done... (16 points) Indicate whether a debit or credit entry would be made to record the following changes in each account. a. To decrease Cash b. To increase Owner, Capital c. To decrease Accounts Payable. d. To increase Salaries Expense. e. To decrease Supplies. f. To increase Revenue. g. To decrease Accounts Receivable. h. To increase Owner, Withdrawals. I (20 points) Select the appropriate financial statement for each of the following accounts. (Note: Some items may appear on more than one financial statement.) a. Income statement b. Statement of owner's equity c. Balance sheet d. Statement of cash flows 1. Rent Expense 2. Withdrawals 3. Notes payable 4. Cash 5. Accounts receivable 6. Jay Miller, Capital 7. Supplies Expense 8. Fees earned