Answered step by step

Verified Expert Solution

Question

1 Approved Answer

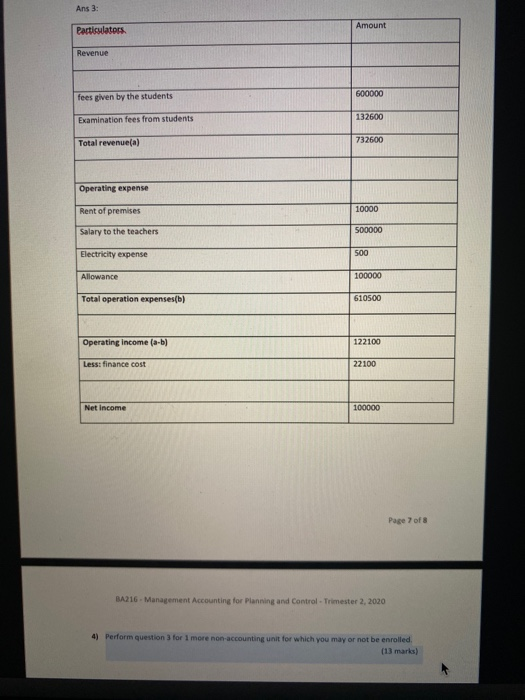

have to answer question number 4 using the answer of question number 3 Ans 3 Particulators Amount Revenue 600000 fees given by the students Examination

have to answer question number 4 using the answer of question number 3

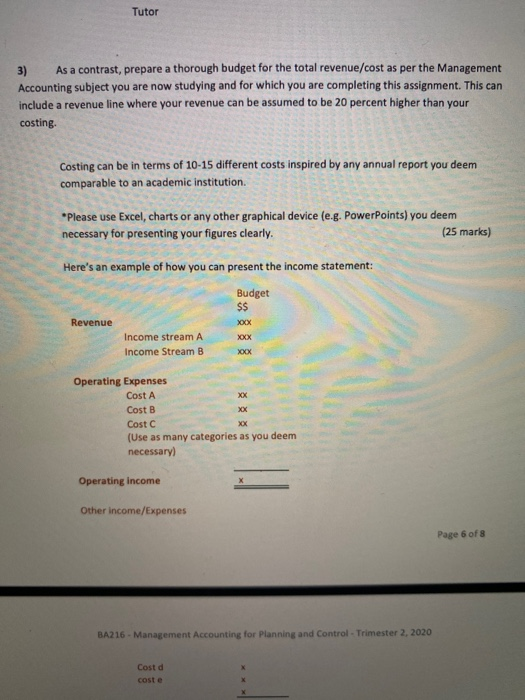

Ans 3 Particulators Amount Revenue 600000 fees given by the students Examination fees from students 132600 Total revenue(a) 732600 Operating expense Rent of premises 10000 Salary to the teachers 500000 Electricity expense 500 Allowance 100000 Total operation expenses(b) 610500 Operating income (a-b) 122100 Less: finance cost 22100 Net Income 100000 Page 7 of a BA216 - Management Accounting for Planning and Control - Trimester 2, 2020 4) Perform question 3 for 1 more non-accounting unit for which you may or not be enrolled (13 marks) Tutor 3) As a contrast, prepare a thorough budget for the total revenue/cost as per the Management Accounting subject you are now studying and for which you are completing this assignment. This can include a revenue line where your revenue can be assumed to be 20 percent higher than your costing. Costing can be in terms of 10-15 different costs inspired by any annual report you deem comparable to an academic institution. *Please use Excel, charts or any other graphical device (e.g. PowerPoints) you deem necessary for presenting your figures clearly. (25 marks) Here's an example of how you can present the income statement: Budget $$ xxx Revenue XOXX Income stream A Income Stream B XOOX Operating Expenses Cost A xx Cost B xx Cost C XX (Use as many categories as you deem necessary) Operating income Other income/Expenses Page 6 of 8 BA216 - Management Accounting for Planning and Control - Trimester 2, 2020 Cost d coste Compatibilit BA216-Management Accounting for Planning and Control - T2 2020 - Final Assessment Paper ferences Mailings Review View Tell me A 21 Abcde cDde No Spacing Aalbcode AaBbCcD Heading 1 Normal Body Text BA216 - Management Accounting for Planning and Control - Trimester 2, 2020 Case Study (Total = 50 Marks) The times have changed and the national economy faces severe constraints in these pandemic times. Vaccine development is progressing at a furious pace with over 100 R&D projects across the world, as we unite resources to attempt to defeat this new threat. The danger to lives and global financial structures is very real. One of the main economic drivers is income from universities. Whilst Australian student numbers had initially shown some resilience, the weakening economy means there are fewer jobs available for graduating students, who now face the possibility of abandoning all academic pursuits. Debt fears run rampant, both at a macro and micro-level. On the international front, the news is not much better. It is not favourable in the short term, nor even the mid-term. Business development has been thwarted in this aspect by a swathe of unrelenting travel restrictions. Online courses and delivery have dampened the economic blow or perhaps, simply delayed it. Universities find themselves in the unenviable position of having to further scrutinise their costs. As a result, your university has decided to adopt an activity-based costing system to estimate the cost of the various courses that are currently being delivered here. However, there are questions about whether an activity-based costing system has any demonstrable merit over traditional "top- to-bottom" budgeting processes Required: * All budgets need to be prepared in a table or inserted spreadsheet. (Australia) Focus Ans 3 Particulators Amount Revenue 600000 fees given by the students Examination fees from students 132600 Total revenue(a) 732600 Operating expense Rent of premises 10000 Salary to the teachers 500000 Electricity expense 500 Allowance 100000 Total operation expenses(b) 610500 Operating income (a-b) 122100 Less: finance cost 22100 Net Income 100000 Page 7 of a BA216 - Management Accounting for Planning and Control - Trimester 2, 2020 4) Perform question 3 for 1 more non-accounting unit for which you may or not be enrolled (13 marks) Tutor 3) As a contrast, prepare a thorough budget for the total revenue/cost as per the Management Accounting subject you are now studying and for which you are completing this assignment. This can include a revenue line where your revenue can be assumed to be 20 percent higher than your costing. Costing can be in terms of 10-15 different costs inspired by any annual report you deem comparable to an academic institution. *Please use Excel, charts or any other graphical device (e.g. PowerPoints) you deem necessary for presenting your figures clearly. (25 marks) Here's an example of how you can present the income statement: Budget $$ xxx Revenue XOXX Income stream A Income Stream B XOOX Operating Expenses Cost A xx Cost B xx Cost C XX (Use as many categories as you deem necessary) Operating income Other income/Expenses Page 6 of 8 BA216 - Management Accounting for Planning and Control - Trimester 2, 2020 Cost d coste Compatibilit BA216-Management Accounting for Planning and Control - T2 2020 - Final Assessment Paper ferences Mailings Review View Tell me A 21 Abcde cDde No Spacing Aalbcode AaBbCcD Heading 1 Normal Body Text BA216 - Management Accounting for Planning and Control - Trimester 2, 2020 Case Study (Total = 50 Marks) The times have changed and the national economy faces severe constraints in these pandemic times. Vaccine development is progressing at a furious pace with over 100 R&D projects across the world, as we unite resources to attempt to defeat this new threat. The danger to lives and global financial structures is very real. One of the main economic drivers is income from universities. Whilst Australian student numbers had initially shown some resilience, the weakening economy means there are fewer jobs available for graduating students, who now face the possibility of abandoning all academic pursuits. Debt fears run rampant, both at a macro and micro-level. On the international front, the news is not much better. It is not favourable in the short term, nor even the mid-term. Business development has been thwarted in this aspect by a swathe of unrelenting travel restrictions. Online courses and delivery have dampened the economic blow or perhaps, simply delayed it. Universities find themselves in the unenviable position of having to further scrutinise their costs. As a result, your university has decided to adopt an activity-based costing system to estimate the cost of the various courses that are currently being delivered here. However, there are questions about whether an activity-based costing system has any demonstrable merit over traditional "top- to-bottom" budgeting processes Required: * All budgets need to be prepared in a table or inserted spreadsheet. (Australia) Focus Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started