Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Havel Robotics Company (a U.S-based firm) is considering establishing a subsidiary in China to assemble industrial robots on January 1, Year 1. If Havel

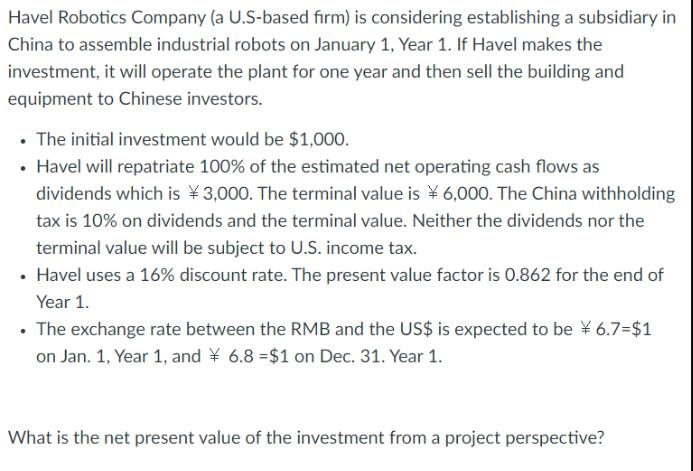

Havel Robotics Company (a U.S-based firm) is considering establishing a subsidiary in China to assemble industrial robots on January 1, Year 1. If Havel makes the investment, it will operate the plant for one year and then sell the building and equipment to Chinese investors. The initial investment would be $1,000. Havel will repatriate 100% of the estimated net operating cash flows as dividends which is 3,000. The terminal value is 6,000. The China withholding tax is 10% on dividends and the terminal value. Neither the dividends nor the terminal value will be subject to U.S. income tax. Havel uses a 16% discount rate. The present value factor is 0.862 for the end of Year 1. The exchange rate between the RMB and the US$ is expected to be 6.7=$1 on Jan. 1, Year 1, and \ 6.8 =$1 on Dec. 31. Year 1. What is the net present value of the investment from a project perspective?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started