Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Having a potential product is only one part, the project needs to be financially sound in order to make it worth. As such, the

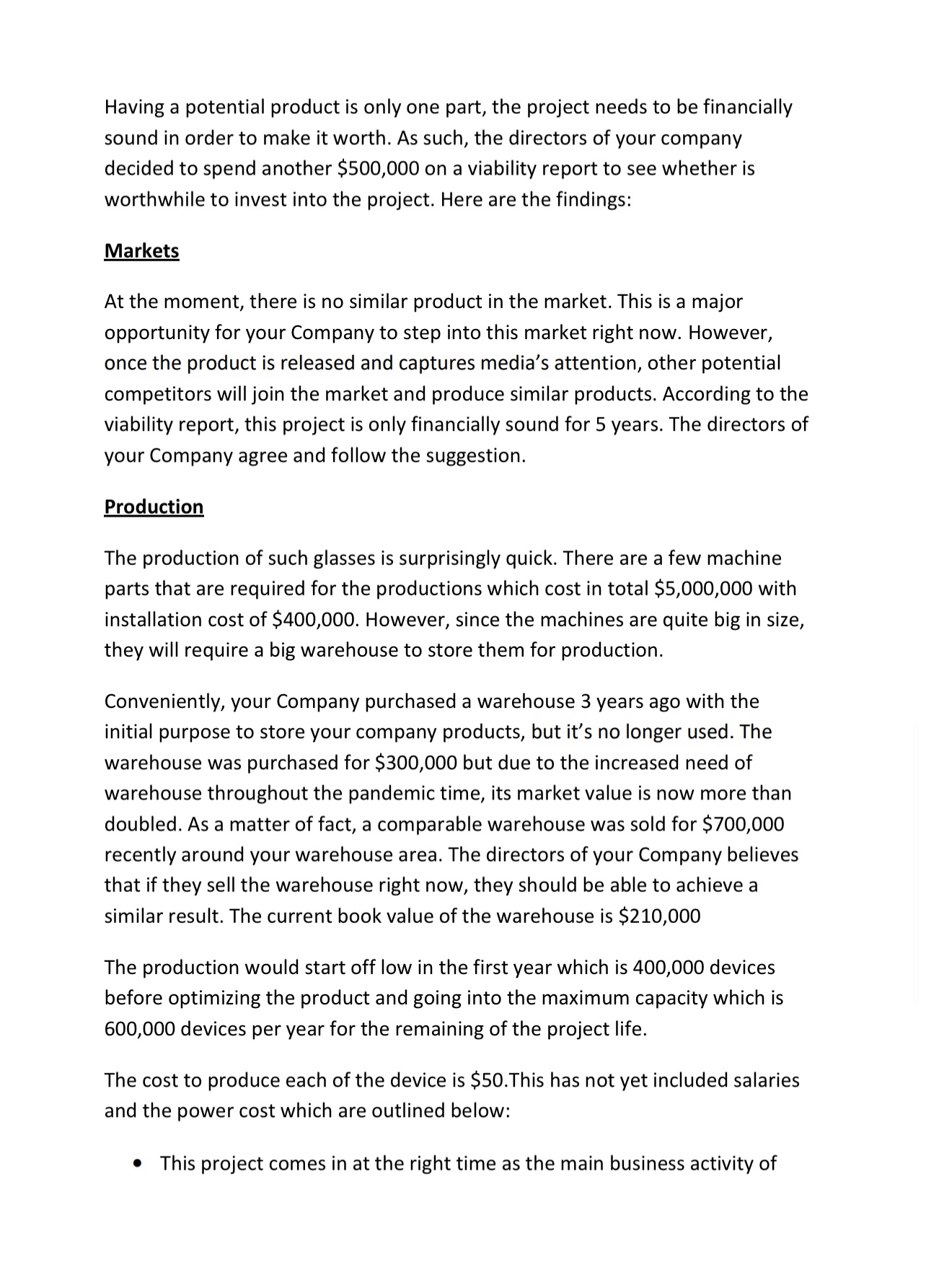

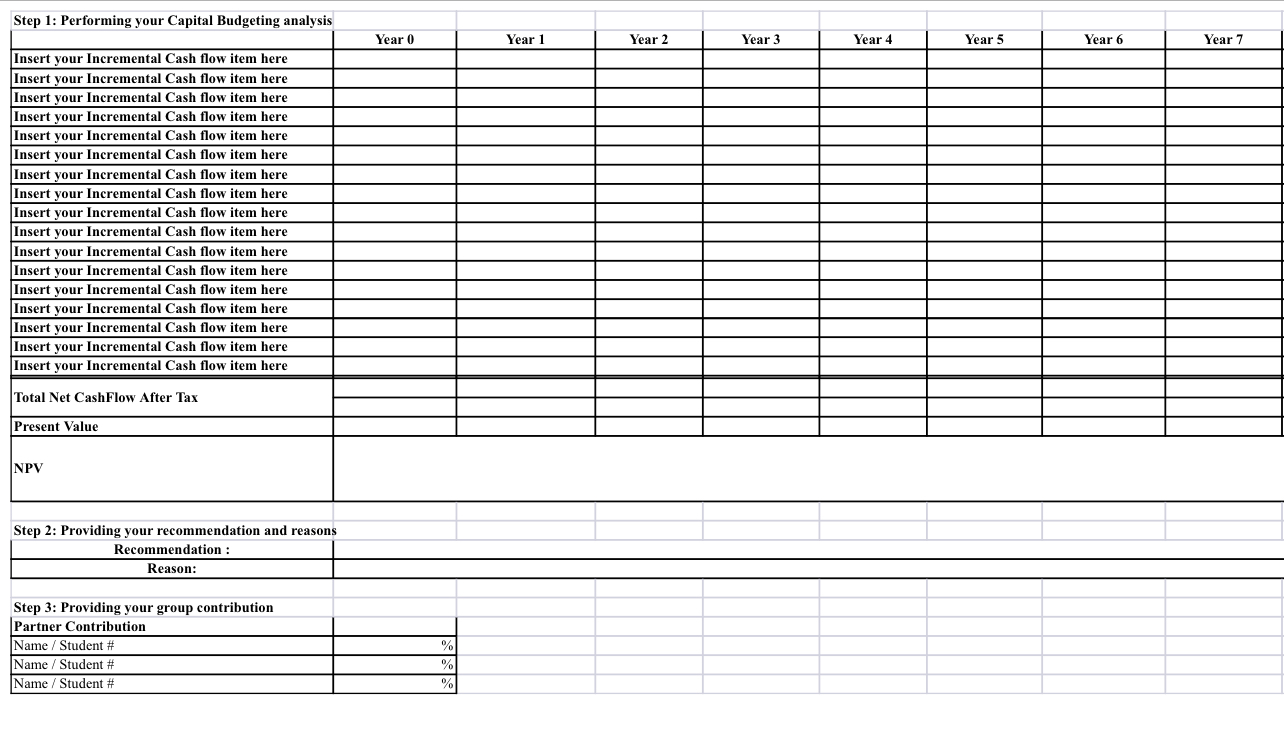

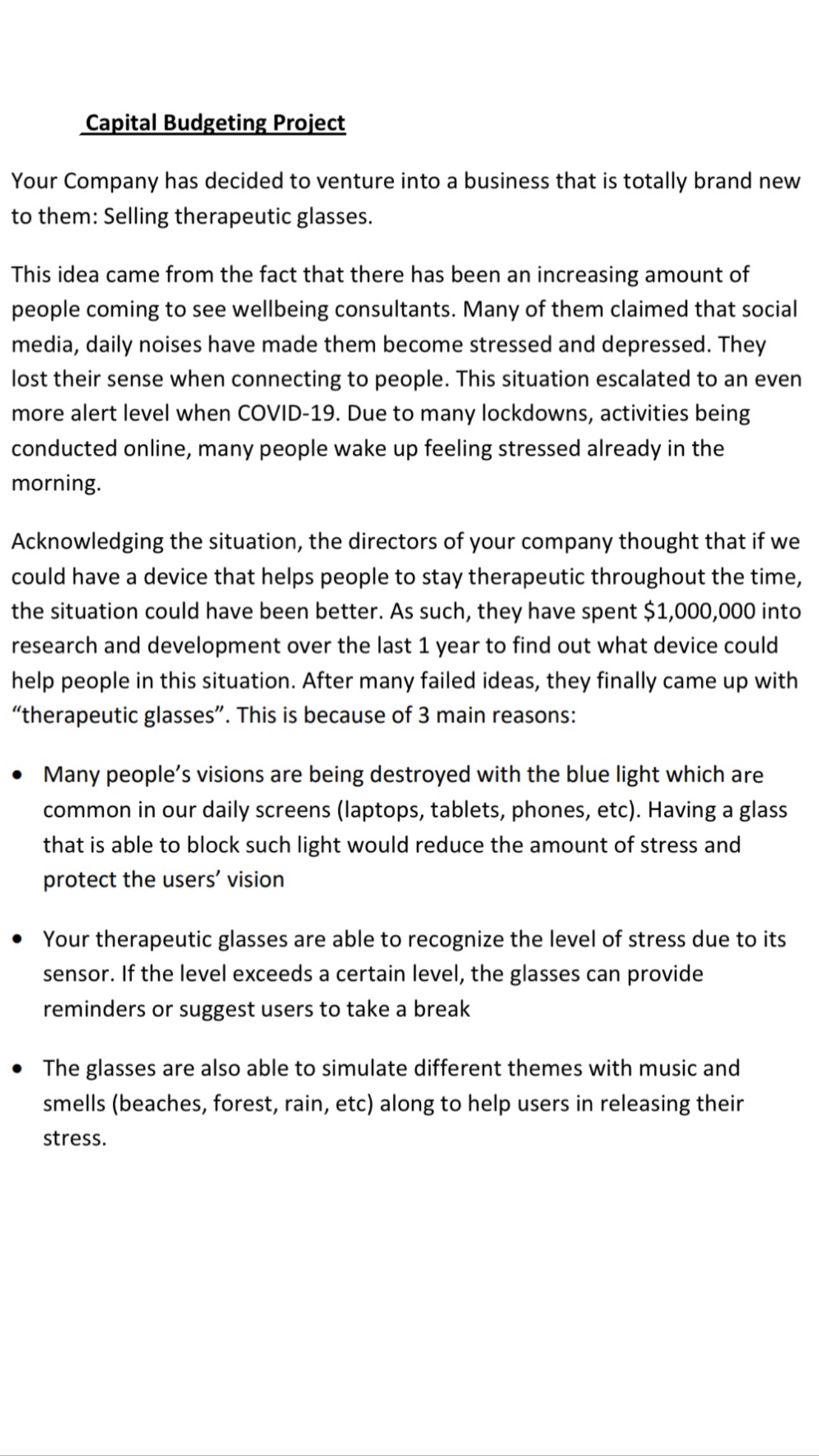

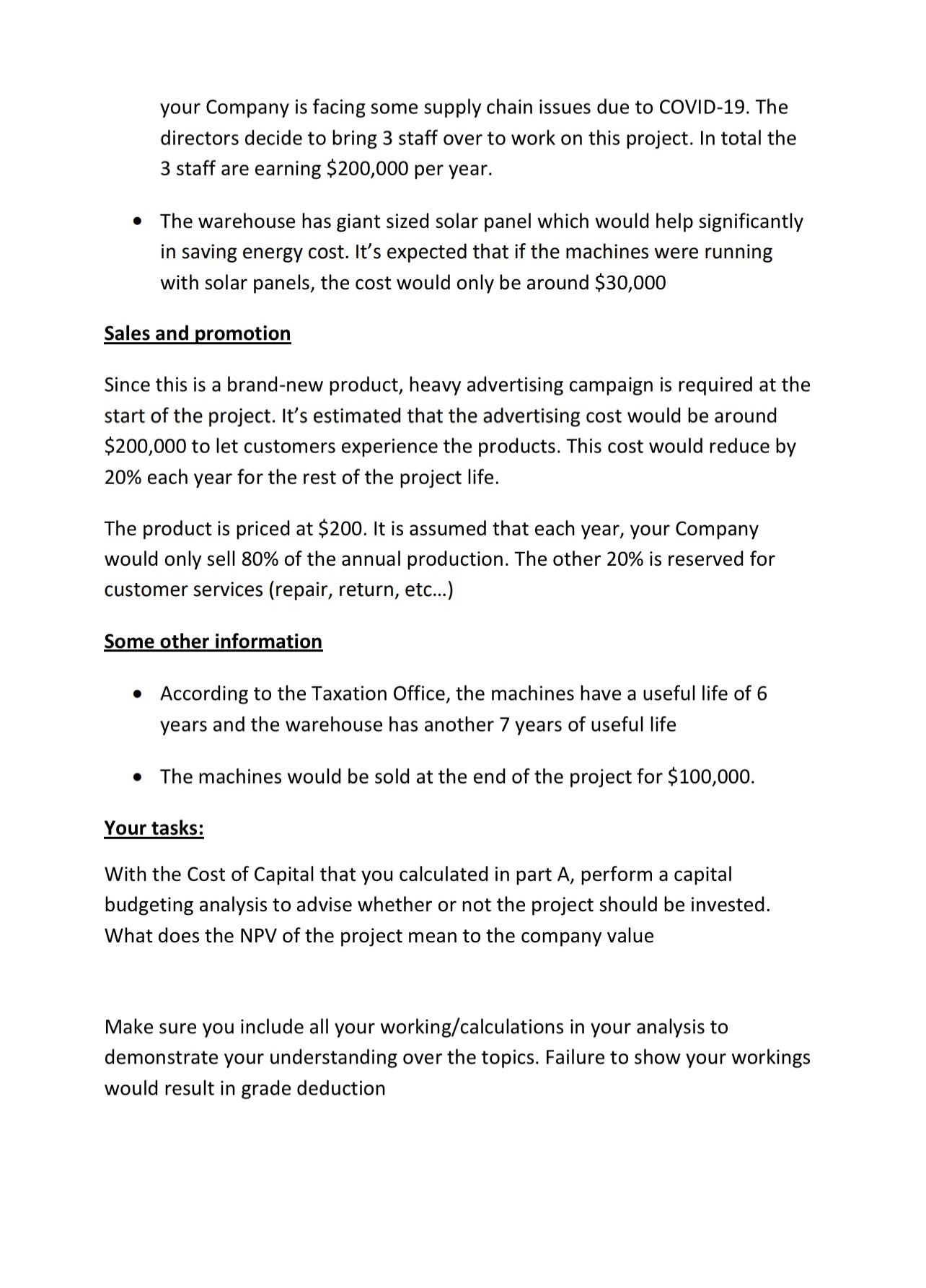

Having a potential product is only one part, the project needs to be financially sound in order to make it worth. As such, the directors of your company decided to spend another $500,000 on a viability report to see whether is worthwhile to invest into the project. Here are the findings: Markets At the moment, there is no similar product in the market. This is a major opportunity for your Company to step into this market right now. However, once the product is released and captures media's attention, other potential competitors will join the market and produce similar products. According to the viability report, this project is only financially sound for 5 years. The directors of your Company agree and follow the suggestion. Production The production of such glasses is surprisingly quick. There are a few machine parts that are required for the productions which cost in total $5,000,000 with installation cost of $400,000. However, since the machines are quite big in size, they will require a big warehouse to store them for production. Conveniently, your Company purchased a warehouse 3 years ago with the initial purpose to store your company products, but it's no longer used. The warehouse was purchased for $300,000 but due to the increased need of warehouse throughout the pandemic time, its market value is now more than doubled. As a matter of fact, a comparable warehouse was sold for $700,000 recently around your warehouse area. The directors of your Company believes that if they sell the warehouse right now, they should be able to achieve a similar result. The current book value of the warehouse is $210,000 The production would start off low in the first year which is 400,000 devices before optimizing the product and going into the maximum capacity which is 600,000 devices per year for the remaining of the project life. The cost to produce each of the device is $50. This has not yet included salaries and the power cost which are outlined below: This project comes in at the right time as the main business activity of Step 1: Performing your Capital Budgeting analysis Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Insert your Incremental Cash flow item here Total Net CashFlow After Tax Present Value NPV Step 2: Providing your recommendation and reasons Recommendation : Reason: Step 3: Providing your group contribution Partner Contribution Name / Student # Name / Student # Name / Student # Year 0 % % % Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Capital Budgeting Project Your Company has decided to venture into a business that is totally brand new to them: Selling therapeutic glasses. This idea came from the fact that there has been an increasing amount of people coming to see wellbeing consultants. Many of them claimed that social media, daily noises have made them become stressed and depressed. They lost their sense when connecting to people. This situation escalated to an even more alert level when COVID-19. Due to many lockdowns, activities being conducted online, many people wake up feeling stressed already in the morning. Acknowledging the situation, the directors of your company thought that if we could have a device that helps people to stay therapeutic throughout the time, the situation could have been better. As such, they have spent $1,000,000 into research and development over the last 1 year to find out what device could help people in this situation. After many failed ideas, they finally came up with "therapeutic glasses". This is because of 3 main reasons: Many people's visions are being destroyed with the blue light which are common in our daily screens (laptops, tablets, phones, etc). Having a glass that is able to block such light would reduce the amount of stress and protect the users' vision Your therapeutic glasses are able to recognize the level of stress due to its sensor. If the level exceeds a certain level, the glasses can provide reminders or suggest users to take a break The glasses are also able to simulate different themes with music and smells (beaches, forest, rain, etc) along to help users in releasing their stress. your Company is facing some supply chain issues due to COVID-19. The directors decide to bring 3 staff over to work on this project. In total the 3 staff are earning $200,000 per year. The warehouse has giant sized solar panel which would help significantly in saving energy cost. It's expected that if the machines were running with solar panels, the cost would only be around $30,000 Sales and promotion Since this is a brand-new product, heavy advertising campaign is required at the start of the project. It's estimated that the advertising cost would be around $200,000 to let customers experience the products. This cost would reduce by 20% each year for the rest of the project life. The product is priced at $200. It is assumed that each year, your Company would only sell 80% of the annual production. The other 20% is reserved for customer services (repair, return, etc...) Some other information According to the Taxation Office, the machines have a useful life of 6 years and the warehouse has another 7 years of useful life The machines would be sold at the end of the project for $100,000. Your tasks: With the Cost of Capital that you calculated in part A, perform a capital budgeting analysis to advise whether or not the project should be invested. What does the NPV of the project mean to the company value Make sure you include all your working/calculations in your analysis to demonstrate your understanding over the topics. Failure to show your workings would result in grade deduction

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

the Company is currently declining and the production facility has available capacity The Company has a team of skilled engineers and technicians who can handle the production process effectively The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started