Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Having learned in macroeconomics that consumption depends on disposable income, you want to determine whether or not disposable income helps predict future consumption. You

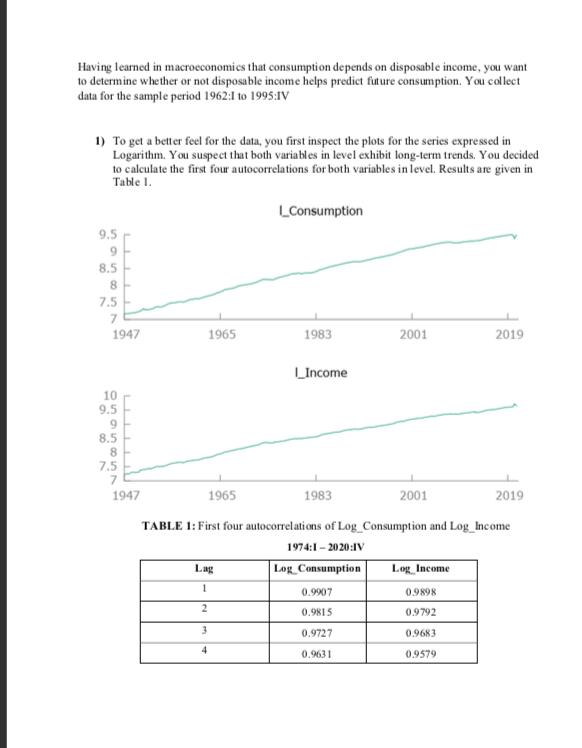

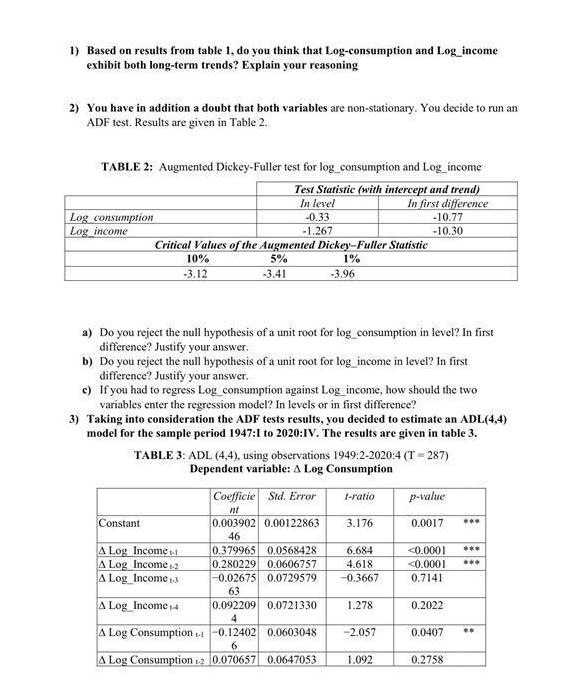

Having learned in macroeconomics that consumption depends on disposable income, you want to determine whether or not disposable income helps predict future consumption. You collect data for the sample period 1962:1 to 1995:IV 1) To get a better feel for the data, you first inspect the plots for the series expressed in Logarithm. You suspect that both variables in level exhibit long-term trends. You decided to calculate the first four autocorrelations for both variables in level. Results are given in Table 1. 9.5 9 8.5 8 7.5 7 1947 10 9.5 9 8.5 8 050 7.5 LLL 7 1947 1965 Lag 1 2 LConsumption 3 4 1983 LIncome 1965 TABLE 1: First four autocorrelations of Log_Consumption and Log_Income 1974:1-2020:IV Log Consumption 1983 2001 0.9907 0.9815 0.9727 0.9631 2001 2019 Log Income 0.9898 0.9792 0.9683 0.9579 2019 1) Based on results from table 1, do you think that Log-consumption and Log_income exhibit both long-term trends? Explain your reasoning 2) You have in addition a doubt that both variables are non-stationary. You decide to run an ADF test. Results are given in Table 2. TABLE 2: Augmented Dickey-Fuller test for log_consumption and Log_income Test Statistic (with intercept and trend) In level In first difference -10.77 -10.30 Log consumption Log income Critical Values of the Augmented Dickey-Fuller Statistic 5% 1% -3.41 -0.33 -1.267 10% -3.12 Constant a) Do you reject the null hypothesis of a unit root for log_consumption in level? In first difference? Justify your answer. b) Do you reject the null hypothesis of a unit root for log_income in level? In first difference? Justify your answer. -3.96 c) If you had to regress Log_consumption against Log income, how should the two variables enter the regression model? In levels or in first difference? 3) Taking into consideration the ADF tests results, you decided to estimate an ADL(4,4) model for the sample period 1947:1 to 2020:IV. The results are given in table 3. TABLE 3: ADL (4,4), using observations 1949:2-2020:4 (T-287) Dependent variable: A Log Consumption A Log Income t A Log Income-2 A Log_ Income 3 Coefficie Std. Error t-ratio nt 0.003902 0.00122863 3.176 46 0.379965 0.0568428 0.280229 0.0606757 -0.02675 0.0729579 63 0.092209 0.0721330 4 A Log_Income 4 1.278 A Log Consumption-0.12402 0.0603048 -2.057 6 A Log Consumption -2 0.070657 0.0647053 1.092 6.684 4.618 -0.3667 p-value 0.0017

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether or not past values of personal disposable income gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started