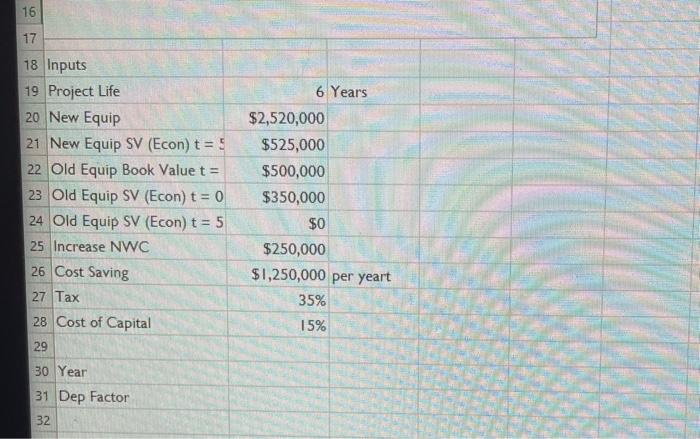

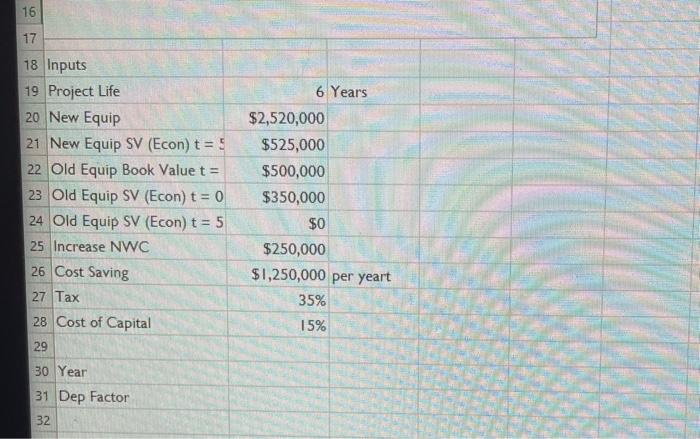

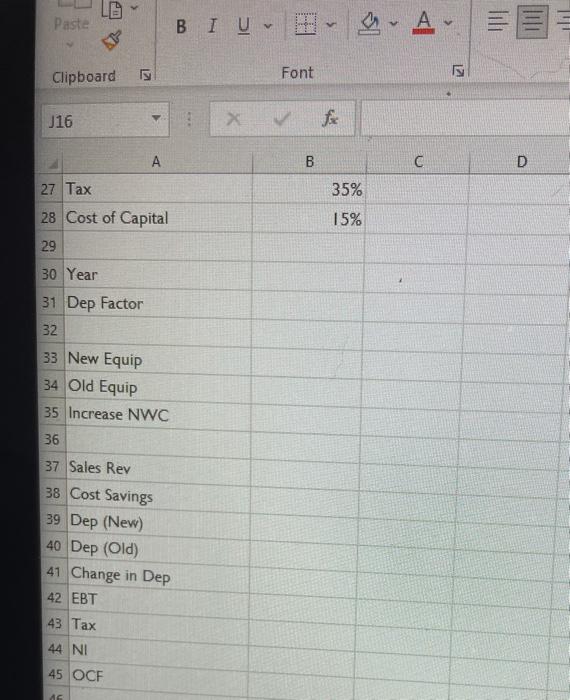

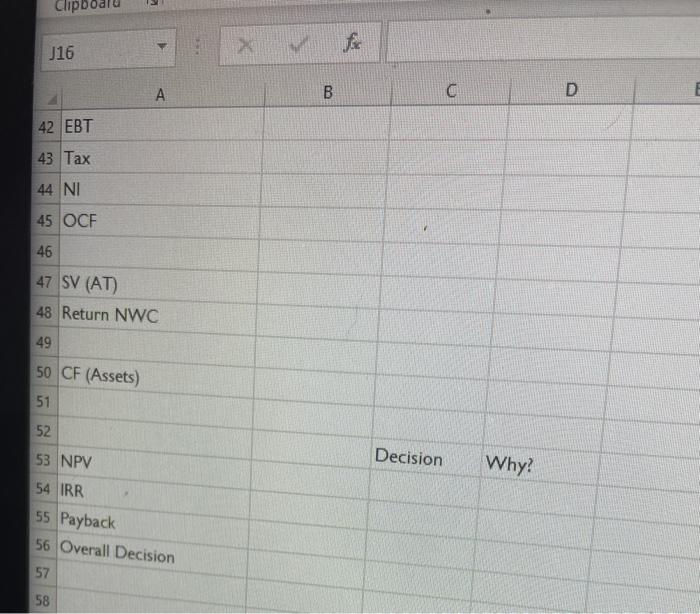

having trouble stuck on problem

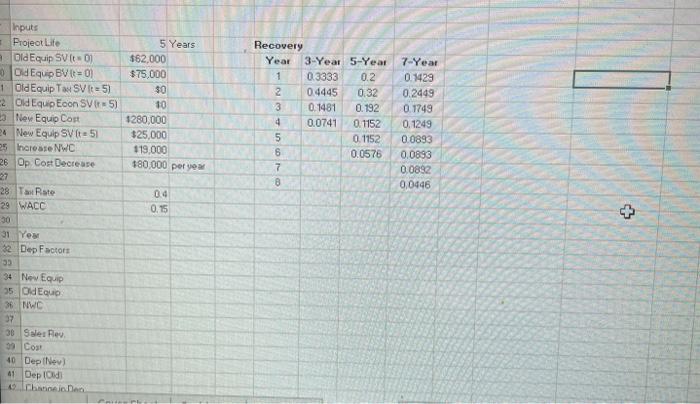

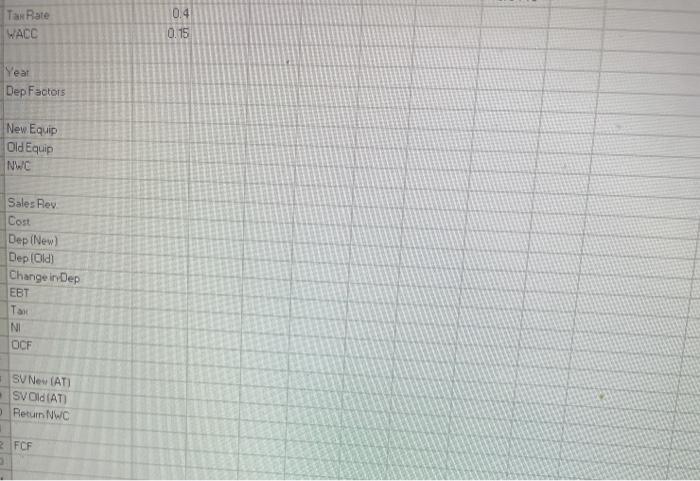

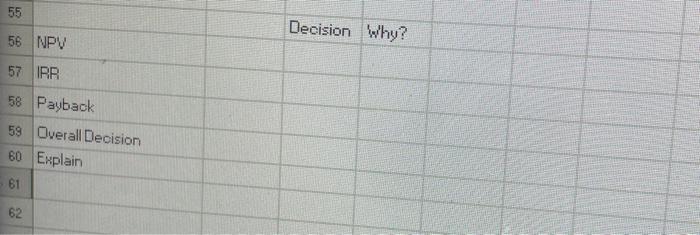

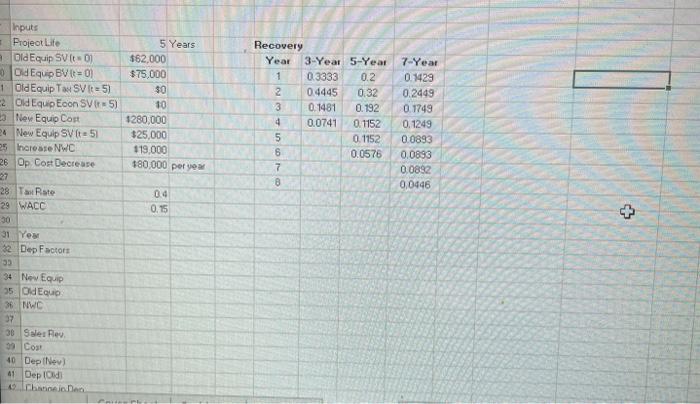

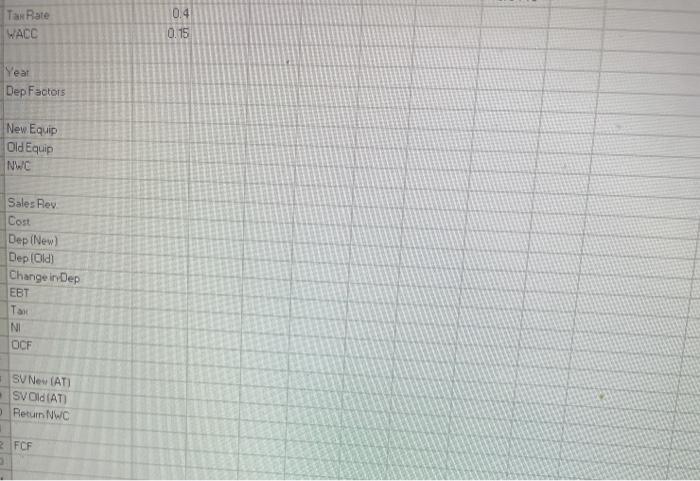

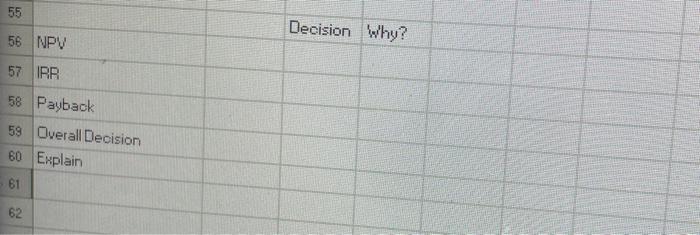

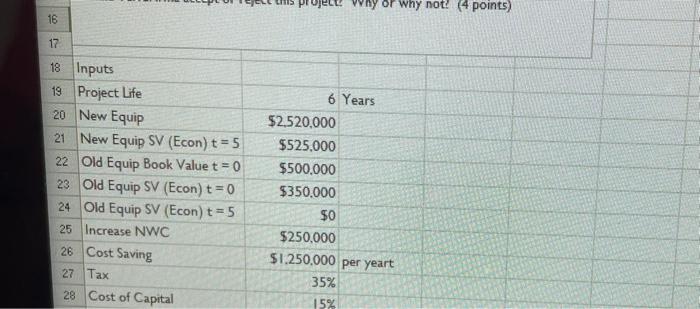

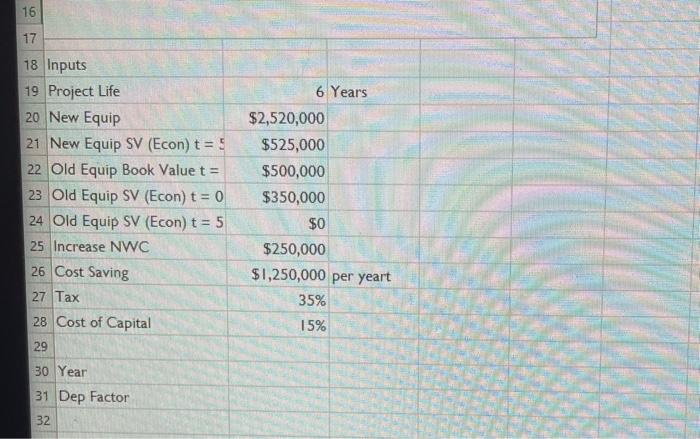

heres a pic of the cells

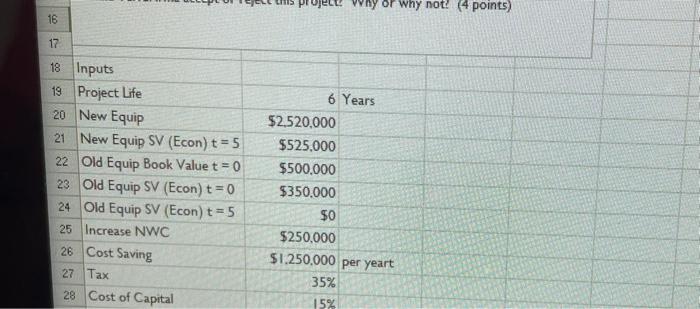

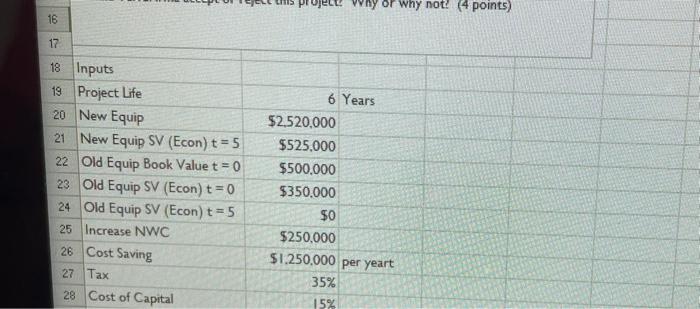

these should be clear now and better to read

5 Years $62,000 $75,000 $0 10 $280,000 $25,000 119.000 $80,000 per year Recovery Year 3-Year 5-Year 1 0.3333 0.2 2 0.4445 0.32 3 0.1481 0.192 4 0.0741 0.1152 5 0.1152 6 0.0576 7 8 7-Year 0.1429 0.2449 0.1749 0.1249 0.0893 0.0893 0.0832 0,0446 0.4 Inputs Projeot Life Old Equip SVI Old Equip BV It=0 1 Old Equip Tau SVI 5) 2 Old Equip Econ SV 5) 3 New Equip Cost 24 New Equip SV 51 25 Increase NWC 26 Op Cost Decrease 27 28 Taste 29 WACC 30 31 Yes 32 Dep Factors 33 34 Nov Equip 35 Old Equio 36 NWC 37 30 Sales Rev 39 Com 40 Dep|v ) 41 Deplod Chancen 0.15 + 0.4 Tax Rate WACC 0.15 Year DepFactors New Equip Old Equip NWC Sales Rev Cost Dep (New) Dep (Old) Change in Dep EBT Tan NI OCF SV New (AT) SV OldIATI Return NWC 2 FCF 55 Decision Why? 56 NPV 57 IRR 58 Payback 59 Overall Decision 60 Explain 61 62 Project hy or why not? (4 points) 16 17 18 Inputs 19 Project Life 20 New Equip 21 New Equip SV (Econ) t = 5 22 Old Equip Book Value t = 0 23 Old Equip SV (Econ) t=0 24 Old Equip SV (Econ) t = 5 25 Increase NWC 26 Cost Saving 27 Tax 28 Cost of Capital 6 Years $2,520,000 $525.000 $500.000 $350.000 $0 $250,000 $1,250,000 per yeart 35% 15% 16 17 6 Years 18 Inputs 19 Project Life 20 New Equip 21 New Equip SV (Econ) t = 5 22 Old Equip Book Value t = 23 Old Equip SV (Econ) t = 0 24 Old Equip SV (Econ) t = 5 25 Increase NWC 26 Cost Saving 27 Tax 28 Cost of Capital $2,520,000 $525,000 $500,000 $350,000 $0 $250,000 $1,250,000 per yeart 35% 15% 29 30 Year 31 Dep Factor 32 LO Paste BIU-- A. Clipboard Font 2 J16 B D 35% 15% A 27 Tax 28 Cost of Capital 29 30 Year 31 Dep Factor 32 33 New Equip 34 Old Equip 35 Increase NWC 36 37 Sales Rev 38 Cost Savings 39 Dep (New) 40 Dep (Old) 41 Change in Dep 42 EBT 43 Tax 44 NI 45 OCF AG Clipboard J16 B C 42 EBT 43 Tax 44 NI 45 OCF 46 47 SV (AT) 48 Return NWC 49 50 CF (Assets) 51 52 53 NPV Decision Why? 54 IRR 55 Payback 56 Overall Decision 57 58 5 Years $62,000 $75,000 $0 10 $280,000 $25,000 119.000 $80,000 per year Recovery Year 3-Year 5-Year 1 0.3333 0.2 2 0.4445 0.32 3 0.1481 0.192 4 0.0741 0.1152 5 0.1152 6 0.0576 7 8 7-Year 0.1429 0.2449 0.1749 0.1249 0.0893 0.0893 0.0832 0,0446 0.4 Inputs Projeot Life Old Equip SVI Old Equip BV It=0 1 Old Equip Tau SVI 5) 2 Old Equip Econ SV 5) 3 New Equip Cost 24 New Equip SV 51 25 Increase NWC 26 Op Cost Decrease 27 28 Taste 29 WACC 30 31 Yes 32 Dep Factors 33 34 Nov Equip 35 Old Equio 36 NWC 37 30 Sales Rev 39 Com 40 Dep|v ) 41 Deplod Chancen 0.15 + 0.4 Tax Rate WACC 0.15 Year DepFactors New Equip Old Equip NWC Sales Rev Cost Dep (New) Dep (Old) Change in Dep EBT Tan NI OCF SV New (AT) SV OldIATI Return NWC 2 FCF 55 Decision Why? 56 NPV 57 IRR 58 Payback 59 Overall Decision 60 Explain 61 62 Project hy or why not? (4 points) 16 17 18 Inputs 19 Project Life 20 New Equip 21 New Equip SV (Econ) t = 5 22 Old Equip Book Value t = 0 23 Old Equip SV (Econ) t=0 24 Old Equip SV (Econ) t = 5 25 Increase NWC 26 Cost Saving 27 Tax 28 Cost of Capital 6 Years $2,520,000 $525.000 $500.000 $350.000 $0 $250,000 $1,250,000 per yeart 35% 15% 16 17 6 Years 18 Inputs 19 Project Life 20 New Equip 21 New Equip SV (Econ) t = 5 22 Old Equip Book Value t = 23 Old Equip SV (Econ) t = 0 24 Old Equip SV (Econ) t = 5 25 Increase NWC 26 Cost Saving 27 Tax 28 Cost of Capital $2,520,000 $525,000 $500,000 $350,000 $0 $250,000 $1,250,000 per yeart 35% 15% 29 30 Year 31 Dep Factor 32 LO Paste BIU-- A. Clipboard Font 2 J16 B D 35% 15% A 27 Tax 28 Cost of Capital 29 30 Year 31 Dep Factor 32 33 New Equip 34 Old Equip 35 Increase NWC 36 37 Sales Rev 38 Cost Savings 39 Dep (New) 40 Dep (Old) 41 Change in Dep 42 EBT 43 Tax 44 NI 45 OCF AG Clipboard J16 B C 42 EBT 43 Tax 44 NI 45 OCF 46 47 SV (AT) 48 Return NWC 49 50 CF (Assets) 51 52 53 NPV Decision Why? 54 IRR 55 Payback 56 Overall Decision 57 58