Hawaiian Memories, Inc. (HMI) is a C corporation that was formed in 2012 in Maui. The company markets to tourists its specialty photography of the

Hawaiian Memories, Inc. (HMI) is a C corporation that was formed in 2012 in Maui. The company markets to tourists its specialty photography of the islands of Hawaii. The initial incorporators were Angie Lee and Bob Lin, a married couple, who now own 1,000 shares of voting common stock and 100 shares of preferred stock each. The company has eight employees who collectively own 500 shares of nonvoting stock. Most of the employees have worked for the company for several years. They purchase the stock when the company offers it at the end of each year. Two employees own 100 shares each; the other six own 50 shares each.

None of the HMI shareholders are related to each other by blood or marriage, except for Angie and Bob. All individual shareholders are native Hawaiians except for Inge; she is a Swedish citizen and has lived on Maui and worked for HMI for three years. Inge plans to move back to Sweden in one year and try to develop markets for HMI products there.

Another stockholder is the Plantation Sugar Partnership (PSP). PSP owns 500 nonvoting common shares; it supplies raw sugar in bulk to HMI. Bob Lin and his sister Katie each own 50% of PSP.

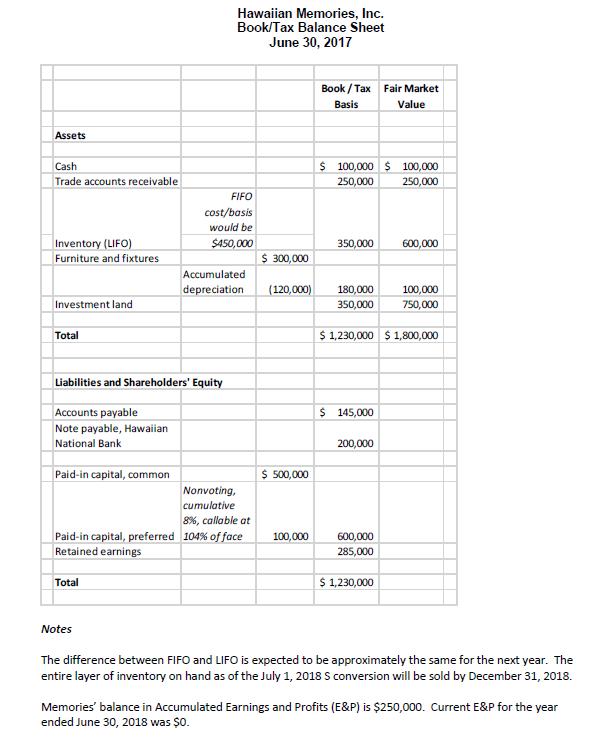

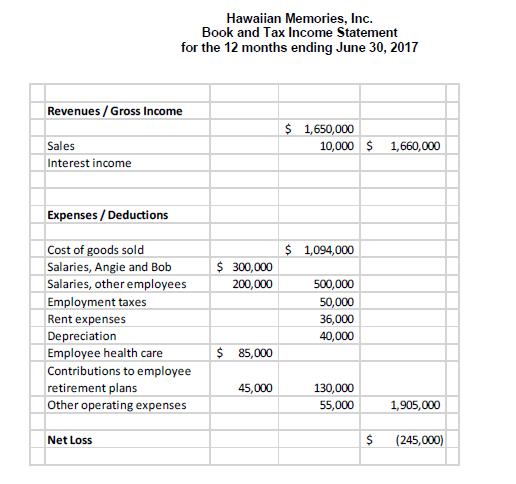

The corporation uses a June 30 year end. All of the HMI shareholders use calendar years. Financial statements for the year ended June 30, 2017 are attached. HMI does not expect that it will generate any significant increases in investment or passive activity income in the coming years.

This was the first year of corporate operating losses in some time. Bob and Angie expect one or two more years of losses and then steady increases in a positive amount of net income.

Bob lives in Hawaii and manages operations there. Angie moved to San Francisco in 2013 to develop mainland markets for their products. Both earn annual salaries of $150,000. The shareholders and all employees are provided accident and health insurance. The company contributes 10% of each employee's salary to a defined contribution 401(k) plan each year.

QUESTION.

Now instead assume the following: Memories elected S status, effective for the taxable year beginning July 1, 2018. HMI had wanted to keep its fiscal year, but it could not document significant seasonality.

So the first S tax return will be for six months, reflecting the new calendar tax year.

A C corporation return was filed for the fiscal year ending June 30, 2018. That return showed a zero taxable income for current year operations.

The balance sheet for June 30, 2018 only differs from the June 30, 2017 statement as presented by $40,000 additional depreciation deductions claimed. HMI plans to sell the investment land in 2019 to raise cash, because Bob and Angie feel that the appreciation potential in the land will have flattened by then. They expect the property to be worth about $800,000 in 2019.

Angie and Bob anticipate that there will be net tax losses from operations of $200,000 during the six-month period ending December 31, 2018. Projected operating losses for calendar tax year 2019 total $60,000, without consideration of the land sale.

Convey to HMI the tax effects of such a 2018 conversion to S status. Provide a restated HMI balance sheet as of June 30, 2018, and compute the passthrough to the shareholders for the 2019 HMI calendar year.

Hawaiian Memories, Inc. Book/Tax Balance Sheet June 30, 2017 Book / Tax Fair Market Basis Value Assets Cash $ 100,000 $ 100,000 Trade accounts receivable 250,000 250,000 FIFO cost/basis would be Inventory (LIFO) $450,000 350,000 600,000 Furniture and fixtures $ 300,000 Accumulated depreciation 100,000 750,000 (120,000) 180,000 350,000 Investment land Total $ 1,230,000 $ 1,800,000 Liabilities and Shareholders' Equity Accounts payable $ 145,000 Note payable, Hawaiian National Bank 200,000 Paid-in capital, common $ 500,000 Nonvoting, cumulative 8%, callable at Paid-in capital, preferred 104% of face 100,000 600,000 Retained earnings 285,000 $ 1,230,000 Total Notes The difference between FIFO and LIFO is expected to be approximately the same for the next year. The entire layer of inventory on hand as of the July 1, 2018 S conversion will be sold by December 31, 2018. Memories' balance in Accumulated Earnings and Profits (E&P) is $250,000. Current E&P for the year ended June 30, 2018 was $0.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution Under united States Federal income Tax Law C corporation refers to any Corporation that is taxed separately from its owners The business exis...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started