Question

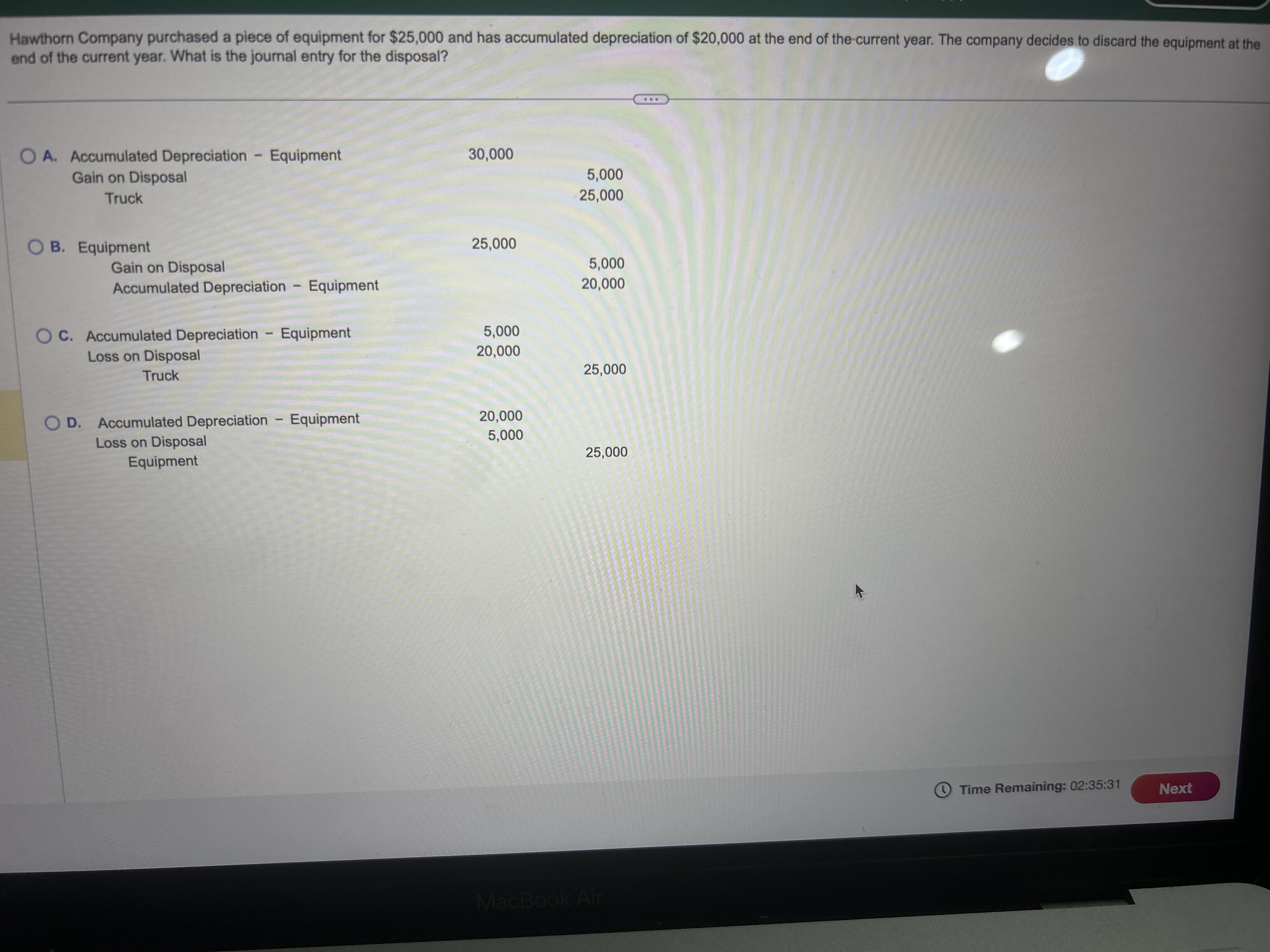

Hawthorn Company purchased a piece of equipment for $25,000 and has accumulated depreciation of $20,000 at the end of the current year. The company

Hawthorn Company purchased a piece of equipment for $25,000 and has accumulated depreciation of $20,000 at the end of the current year. The company decides to discard the equipment at the end of the current year. What is the journal entry for the disposal? OA. Accumulated Depreciation - Equipment Gain on Disposal Truck B. Equipment Gain on Disposal Accumulated Depreciation Equipment - OC. Accumulated Depreciation - Equipment Loss on Disposal Truck OD. Accumulated Depreciation - Equipment Loss on Disposal Equipment 30,000 25,000 5,000 20,000 20,000 5,000 5,000 25,000 5,000 20,000 25,000 25,000 MacBook Air TEO A Time Remaining: 02:35:31 Next

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the ab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Earl K. Stice, James D. Stice

18th edition

538479736, 978-1111534783, 1111534780, 978-0538479738

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App