Answered step by step

Verified Expert Solution

Question

1 Approved Answer

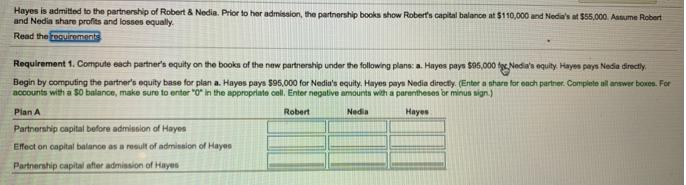

Hayes is admitted to the partnership of Robert & Nedia. Prior to her admission, the partnership books show Roberts capital balance at $110,000 and

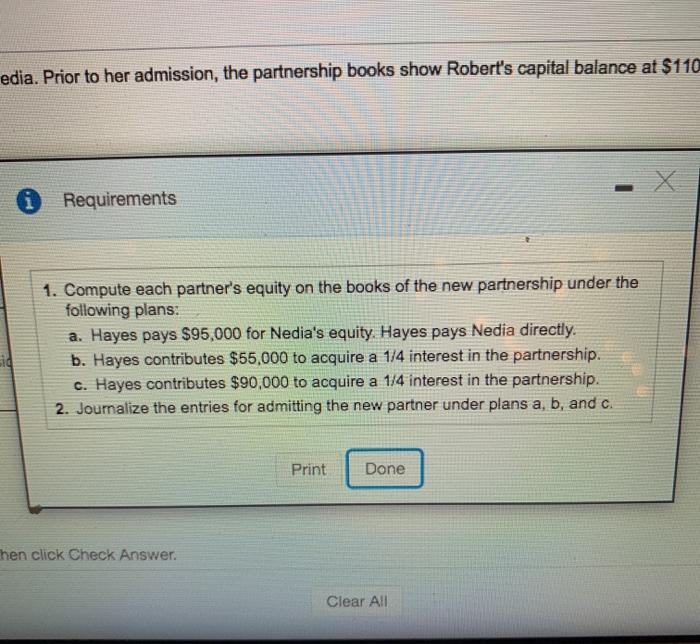

Hayes is admitted to the partnership of Robert & Nedia. Prior to her admission, the partnership books show Roberts capital balance at $110,000 and Nedia's at $55,000. Aaume Robert and Nedia share profits and losses equally. Read the Ensuirements Requirement 1. Compute each partner's equity on the books of the new partnership under the following plans: a. Hayes pays S06,000 fge Nedia's equity Hayes pays Nedia directly. Begin by computing the partner's equity base for plan a. Hayes pays $95,000 for Nedia's equity. Hayes pays Nedia directly (Enter a nhare for each partner. Complete al answer boxes. For accounts with a $0 balance, make sure to enter "0" in the appropriate cell. Enter negative amounts with a parentheses or minus sign.) Plan A Robert Nedia Hayes Partnership capital before admission of Hayes Effect on capital balance as a result of admission of Hayes Partnership capital after admission of Hayes edia. Prior to her admission, the partnership books show Robert's capital balance at $110 Requirements 1. Compute each partner's equity on the books of the new partnership under the following plans: a. Hayes pays $95,000 for Nedia's equity. Hayes pays Nedia directly. b. Hayes contributes $55,000 to acquire a 1/4 interest in the partnership. c. Hayes contributes $90,000 to acquire a 1/4 interest in the partnership. 2. Journalize the entries for admitting the new partner under plans a, b, and c. Print Done hen click Check Answer. Clear All

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Reauitement O Compute each partners eajuity on the books of the new partnership unde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started