Answered step by step

Verified Expert Solution

Question

1 Approved Answer

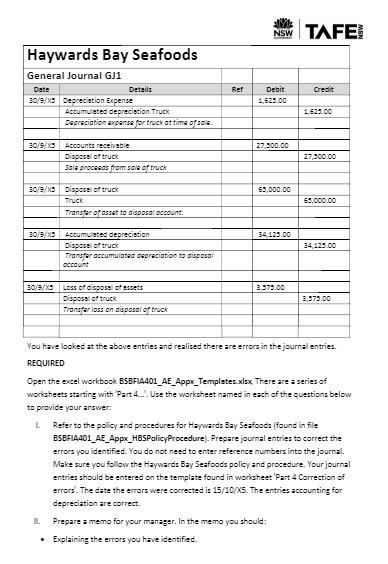

Haywards Bay Seafoods General Journal GJ1 Date 30/9/x3 Depreciation Expense 30/9/X5 Details Accumulated depreciation Truck Depreciation expense for truck at time of sole. 30/9/x5

Haywards Bay Seafoods General Journal GJ1 Date 30/9/x3 Depreciation Expense 30/9/X5 Details Accumulated depreciation Truck Depreciation expense for truck at time of sole. 30/9/x5 Accounts receivable Dispose of truck Sale proceeds from sale of truck 30/9/x3 Dispose of truck Truck Transfer of asset to disposal account. 30/9/X5 Accumulated depreciation Dispose of truck Transfer accumulated depreciation to disposal account Loss of disposal of assets Disposal of truck Transfer loss on disposal of truck Ref NSW TAFE Debit 1,625.00 27,500.00 65,000.00 34,125.00 3,575.00 Credit 1,625.00 IL Prepare a memo for your manager. In the memo you should: Explaining the errors you have identified. 27,500.00 65,000.00 34,125.00 3,575.00 You have looked at the above entries and realised there are errors in the journal entries. REQUIRED Open the excel workbook BSBFIA401_AE_Appx_Templates.xlsx There are a series of worksheets starting with Part 4.... Use the worksheet named in each of the questions below to provide your answer: L Refer to the policy and procedures for Haywards Bay Seafoods (found in file BSBFIA401_AE_Appx_HBSPolicyProcedure). Prepare journal entries to correct the errors you identified. You do not need to enter reference numbers into the journal. Make sure you follow the Haywards Bay Seafoods policy and procedure. Your journal entries should be entered on the template found in worksheet 'Part 4 Correction of errors. The date the errors were corrected is 15/10/X5. The entries accounting for depreciation are correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Memo To Managers Name From Your Name Date 1510XX Subject Correction of Errors in General Journal GJ1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started