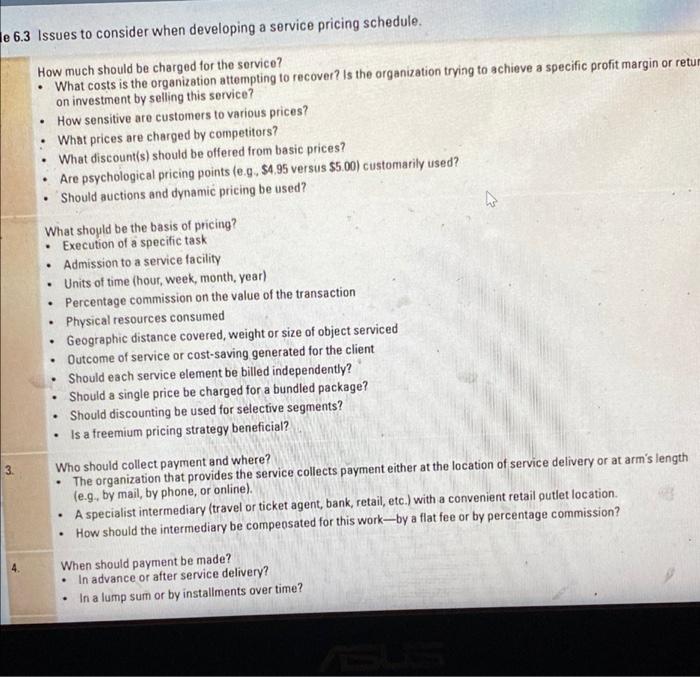

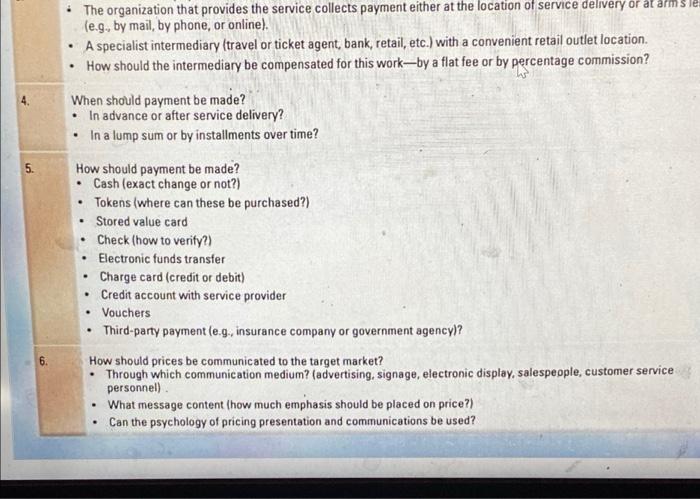

He 6.3 Issues to consider when developing a service pricing schedule. . How much should be charged for the service? What costs is the organization attempting to recover? Is the organization trying to achieve a specific profit margin or retur on investment by selling this service? How sensitive are customers to various prices? What prices are charged by competitors? What discount(s) should be offered from basic prices? Are psychological pricing points (eg, 54,95 versus $5.00) customarily used? Should auctions and dynamic pricing be used? What should be the basis of pricing? Execution of a specific task Admission to a service facility Units of time (hour, week, month, year) Percentage commission on the value of the transaction Physical resources consumed Geographic distance covered, weight or size of object serviced Outcome of service or cost-saving generated for the client Should each service element be billed independently? Should a single price be charged for a bundled package? Should discounting be used for selective segments? Is a freemium pricing strategy beneficial? Who should collect payment and where? The organization that provides the service collects payment either at the location of service delivery or at arm's length (e.g. by mail, by phone, or online) A specialist intermediary (travel or ticket agent, bank, retail, etc.) with a convenient retail outlet location How should the intermediary be compensated for this work-by a flat fee or by percentage commission? 3 . When should payment be made? In advance or after service delivery? In a lump sum or by installments over time? The organization that provides the service collects payment either at the location of service delivery or alarm s je (e.g., by mail, by phone, or online). A specialist intermediary (travel or ticket agent, bank, retail, etc.) with a convenient retail outlet location. How should the intermediary be compensated for this work-by a flat fee or by percentage commission? 5. When should payment be made? In advance or after service delivery? In a lump sum or by installments over time? How should payment be made? Cash (exact change or not?) Tokens (where can these be purchased?) Stored value card Check (how to verify?) Electronic funds transfer Charge card (credit or debit) Credit account with service provider Vouchers Third-party payment (e.g., insurance company or government agency)? How should prices be communicated to the target market? Through which communication medium? (advertising, signage, electronic display, salespeople, customer service personnel) What message content (how much emphasis should be placed on price?) Can the psychology of pricing presentation and communications be used? . 6. . He 6.3 Issues to consider when developing a service pricing schedule. . How much should be charged for the service? What costs is the organization attempting to recover? Is the organization trying to achieve a specific profit margin or retur on investment by selling this service? How sensitive are customers to various prices? What prices are charged by competitors? What discount(s) should be offered from basic prices? Are psychological pricing points (eg, 54,95 versus $5.00) customarily used? Should auctions and dynamic pricing be used? What should be the basis of pricing? Execution of a specific task Admission to a service facility Units of time (hour, week, month, year) Percentage commission on the value of the transaction Physical resources consumed Geographic distance covered, weight or size of object serviced Outcome of service or cost-saving generated for the client Should each service element be billed independently? Should a single price be charged for a bundled package? Should discounting be used for selective segments? Is a freemium pricing strategy beneficial? Who should collect payment and where? The organization that provides the service collects payment either at the location of service delivery or at arm's length (e.g. by mail, by phone, or online) A specialist intermediary (travel or ticket agent, bank, retail, etc.) with a convenient retail outlet location How should the intermediary be compensated for this work-by a flat fee or by percentage commission? 3 . When should payment be made? In advance or after service delivery? In a lump sum or by installments over time? The organization that provides the service collects payment either at the location of service delivery or alarm s je (e.g., by mail, by phone, or online). A specialist intermediary (travel or ticket agent, bank, retail, etc.) with a convenient retail outlet location. How should the intermediary be compensated for this work-by a flat fee or by percentage commission? 5. When should payment be made? In advance or after service delivery? In a lump sum or by installments over time? How should payment be made? Cash (exact change or not?) Tokens (where can these be purchased?) Stored value card Check (how to verify?) Electronic funds transfer Charge card (credit or debit) Credit account with service provider Vouchers Third-party payment (e.g., insurance company or government agency)? How should prices be communicated to the target market? Through which communication medium? (advertising, signage, electronic display, salespeople, customer service personnel) What message content (how much emphasis should be placed on price?) Can the psychology of pricing presentation and communications be used? . 6