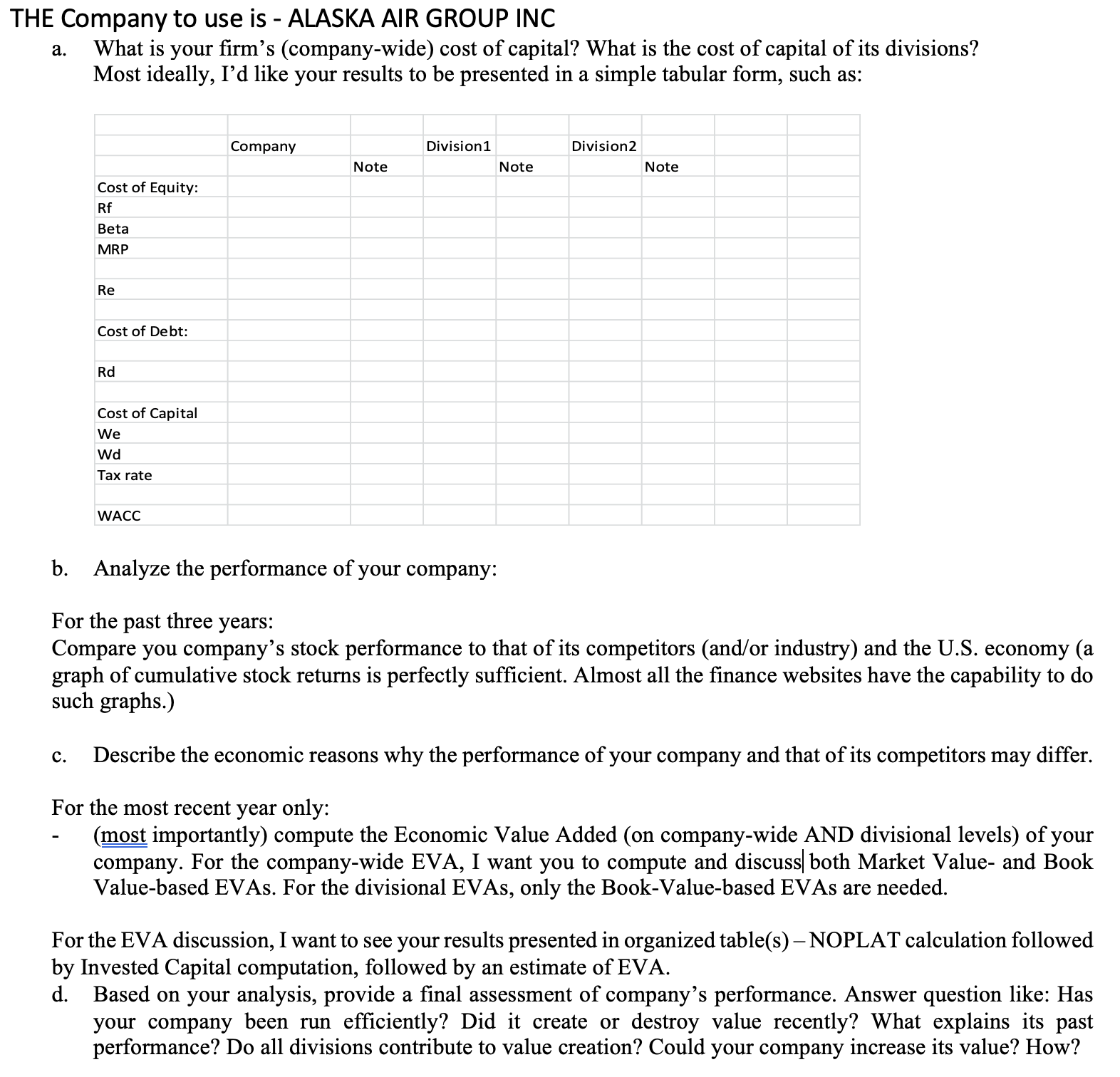

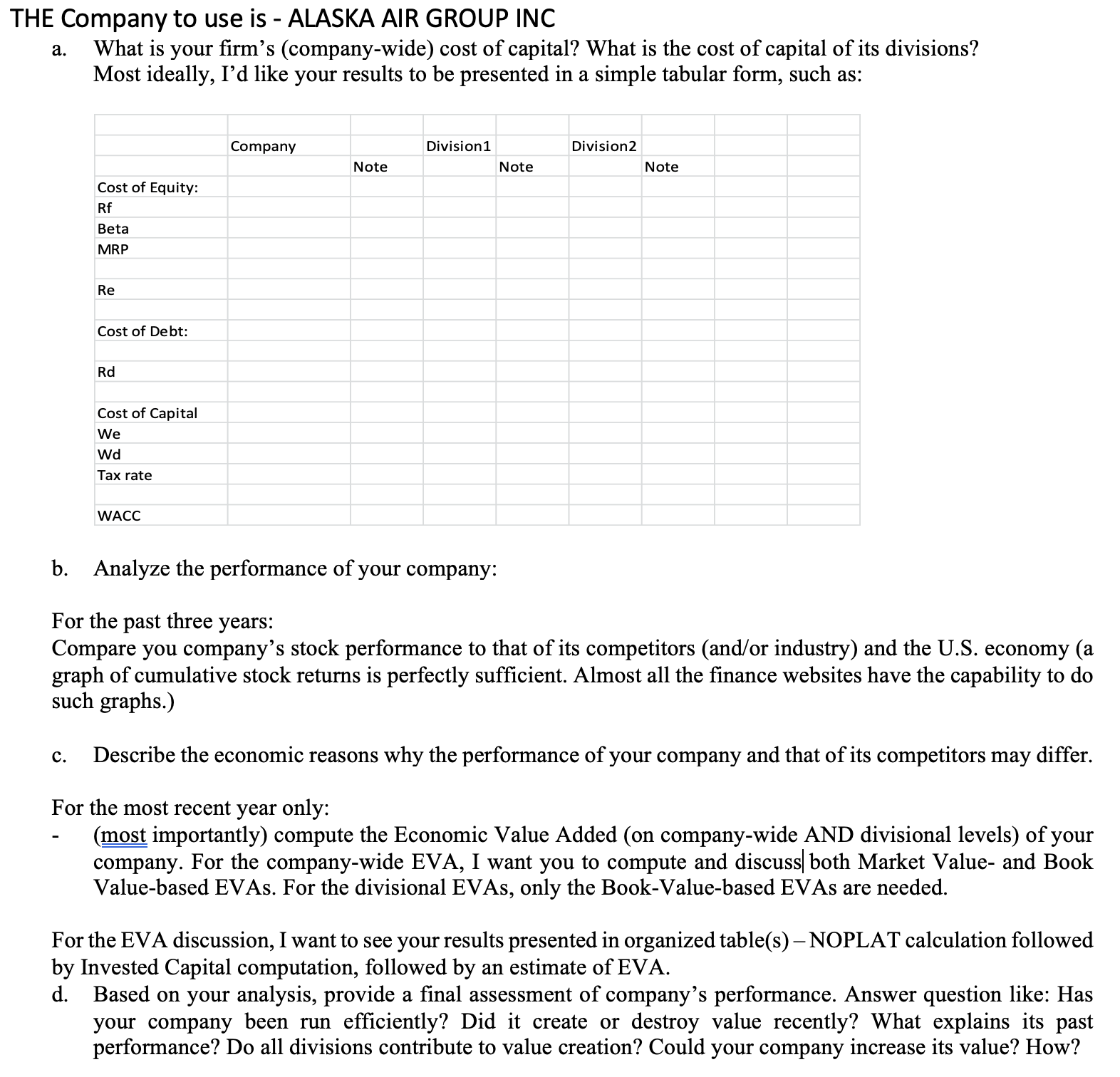

HE Company to use is - ALASKA AIR GROUP INC a. What is your firm's (company-wide) cost of capital? What is the cost of capital of its divisions? Most ideally, I'd like your results to be presented in a simple tabular form, such as: b. Analyze the performance of your company: For the past three years: Compare you company's stock performance to that of its competitors (and/or industry) and the U.S. economy (a graph of cumulative stock returns is perfectly sufficient. Almost all the finance websites have the capability to do such graphs.) c. Describe the economic reasons why the performance of your company and that of its competitors may differ. For the most recent year only: - (most importantly) compute the Economic Value Added (on company-wide AND divisional levels) of your company. For the company-wide EVA, I want you to compute and discuss both Market Value- and Book Value-based EVAs. For the divisional EVAs, only the Book-Value-based EVAs are needed. For the EVA discussion, I want to see your results presented in organized table(s) - NOPLAT calculation followed by Invested Capital computation, followed by an estimate of EVA. d. Based on your analysis, provide a final assessment of company's performance. Answer question like: Has your company been run efficiently? Did it create or destroy value recently? What explains its past performance? Do all divisions contribute to value creation? Could your company increase its value? How? HE Company to use is - ALASKA AIR GROUP INC a. What is your firm's (company-wide) cost of capital? What is the cost of capital of its divisions? Most ideally, I'd like your results to be presented in a simple tabular form, such as: b. Analyze the performance of your company: For the past three years: Compare you company's stock performance to that of its competitors (and/or industry) and the U.S. economy (a graph of cumulative stock returns is perfectly sufficient. Almost all the finance websites have the capability to do such graphs.) c. Describe the economic reasons why the performance of your company and that of its competitors may differ. For the most recent year only: - (most importantly) compute the Economic Value Added (on company-wide AND divisional levels) of your company. For the company-wide EVA, I want you to compute and discuss both Market Value- and Book Value-based EVAs. For the divisional EVAs, only the Book-Value-based EVAs are needed. For the EVA discussion, I want to see your results presented in organized table(s) - NOPLAT calculation followed by Invested Capital computation, followed by an estimate of EVA. d. Based on your analysis, provide a final assessment of company's performance. Answer question like: Has your company been run efficiently? Did it create or destroy value recently? What explains its past performance? Do all divisions contribute to value creation? Could your company increase its value? How