Answered step by step

Verified Expert Solution

Question

1 Approved Answer

he comparative, unclassified statement of financial position for Ivanhoe Ltd. shows the following balances at December 31: Ivanhoe Ltd. Statement of Financial Position December 31

he comparative, unclassified statement of financial position for Ivanhoe Ltd. shows the following balances at December 31:

| Ivanhoe Ltd. Statement of Financial Position December 31 | ||||||

| Assets | 2018 | 2017 | ||||

| Cash | $ 16,000 | $ 38,000 | ||||

| Term deposits (maturing in 60 days) | 0 | 46,000 | ||||

| Accounts receivable | 77,000 | 40,000 | ||||

| Inventory | 104,000 | 68,000 | ||||

| Land | 187,000 | 234,000 | ||||

| Buildings | 908,000 | 529,000 | ||||

| Accumulated depreciationbuildings | (134,000 | ) | (188,000 | ) | ||

| Equipment | 96,000 | 67,000 | ||||

| Accumulated depreciationequipment | (39,000 | ) | (21,000 | ) | ||

| Total assets | $1,215,000 | $813,000 | ||||

| Liabilities and Shareholders Equity | ||||||

| Accounts payable | $ 27,000 | $ 74,000 | ||||

| Income tax payable | 4,000 | 6,000 | ||||

| Interest payable | 22,000 | 15,000 | ||||

| Bank loan payablecurrent portion | 50,000 | 42,000 | ||||

| Bank loan payablenon-current portion | 902,000 | 421,000 | ||||

| Common shares | 157,000 | 182,000 | ||||

| Retained earnings | 53,000 | 73,000 | ||||

| Total liabilities and shareholders equity | $1,215,000 | $813,000 | ||||

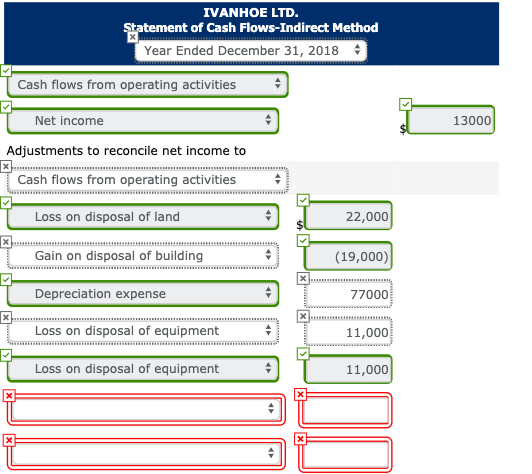

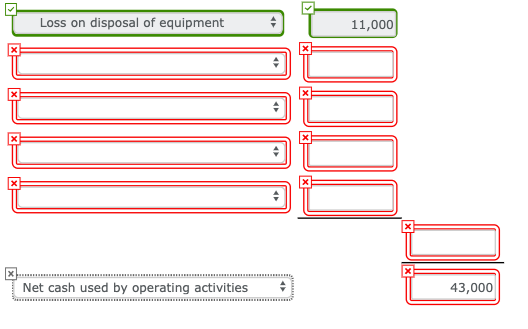

Additional information regarding 2018:

| 1. | Net income was $13,000. | |

| 2. | A loss of $22,000 was recorded on the disposal of a small parcel of land. No land was purchased during the year. | |

| 3. | A gain on the disposal of $19,000 was recorded when old building was sold for was sold for $40,000 cash. A new building was purchased for $500,000 and depreciation expense on buildings for the year was $46,000. | |

| 4. | Equipment costing $75,000 was purchased while a loss of $11,000 was recorded on equipment that originally cost $46,000 and was sold for $22,000. | |

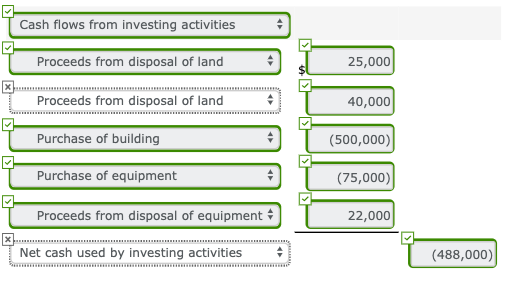

| 5. | The company received $514,000 from new bank loans during the year. | |

| 6. | Dividends were declared and paid during the year. | |

| 7. | No common shares were issued during the year but some were bought back and retired at the amount they were originally issued at. |

(a) Prepare the statement of cash flows using the indirect approach.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started